ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

TOPIC: Monetary policy and the problem of inflationary and recessionary gaps

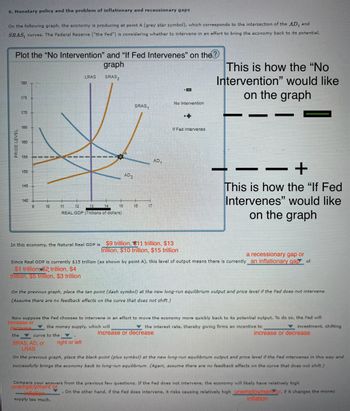

Transcribed Image Text:6. Monetary policy and the problem of inflationary and recessionary gaps

On the following graph, the economy is producing at point A (grey star symbol), which corresponds to the intersection of the AD, and

SRAS, curves. The Federal Reserve ("the Fed") is considering whether to intervene in an effort to bring the economy back to its potential.

Plot the "No Intervention" and "If Fed Intervenes" on the?

180

175

LRAS

graph

SRAS₂

This is how the "No

Intervention" would like

on the graph

PRICE LEVEL

170-

165

160

No Intervention

SRAS₁

A

155

AD₁

150

AD2

145

140

9

10

11

12

13

14

15

16

17

REAL GDP (Trillions of dollars)

++

If Fed Intervenes

This is how the "If Fed

Intervenes" would like

on the graph

In this economy, the Natural Real GDP is $9 trillion, 11 trillion, $13

trillion, $10 trillion, $15 trillion

a recessionary gap or

Since Real GDP is currently $15 trillion (as shown by point A), this level of output means there is currently an inflationary gap of

$1 trillion, $2 trillion, $4

trillion, $5 trillion, $3 trillion

On the previous graph, place the tan point (dash symbol) at the new long-run equilibrium output and price level if the Fed does not intervene.

(Assume there are no feedback effects on the curve that does not shift.)

Now suppose the Fed chooses to intervene in an effort to move the economy more quickly back to its potential output. To do so, the Fed will

increase or

decrease

the money supply, which will

the interest rate, thereby giving firms an incentive to

increase or decrease

investment, shifting

increase or decrease

the

curve to the

SRAS, AD, or

right or left

LRAS

On the previous graph, place the black point (plus symbol) at the new long-run equilibrium output and price level if the Fed intervenes in this way and

successfully brings the economy back to long-run equilibrium. (Again, assume there are no feedback effects on the curve that does not shift.)

Compare your answers from the previous few questions. If the Fed does not intervene, the economy will likely have relatively high

unemployment or

inflation

.

supply too much.

On the other hand, if the Fed does intervene, it risks causing relatively high unemploymen or, if it changes the money

inflation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If “inflation is always and everywhere a monetary phenomenon,” why did the huge expansions of central bank money by the Federal Reserve, the ECB, and the Bank of Japan between 2007 and 2018 not result in high inflation in those economies? The previously answered questions have a range of 2007-2015. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardIn order to manipulate the inflation rate in the United States, the Federal Reserve lowers the federal funds rate. What will occur as a result? Select all that apply.arrow_forwardSince the committee's meeting labor market conditions deteriorated and the available data indicate that consumer spending, business investment and industrial production have declined. Finiacial markets remain quite strained and credit conditions tight. identify the policy action is fiscal or monetary identify the policy is expansionary or contraction artarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education