Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

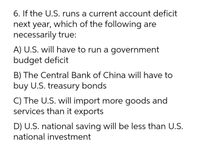

Transcribed Image Text:6. If the U.S. runs a current account deficit

next year, which of the following are

necessarily true:

A) U.S. will have to run a government

budget deficit

B) The Central Bank of China will have to

buy U.S. treasury bonds

C) The U.S. will import more goods and

services than it exports

D) U.S. national saving will be less than U.S.

national investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Question 8 What is the main source of the US fiscal imbalance and what are the painful choices we must face? The source of the US fiscal imbalance is [Select] Some painful choices arise because to meet its obligations, the federal government must consider [Select] income and or Social Security taxes, [ Select] Social Security benefits, [Select] federal government discretionary spending.arrow_forwardAnsarrow_forwardplease give me answer relatablearrow_forward

- According to the Taylor rule, the Fed should raise the federal funds target by O A. 1 B. 1.5 C. .5 D. 2 percentage points for each percentage point that inflation rises relative to the Fed's target.arrow_forwardA result of budget deficits is that governments have to borrow more, sometimes resulting in: a. Top of Form increasing interest costs. b. decreasing interest costs. C, increased foreign borrowing. d, crowding out the private sector for capital. All other things remaining the same, which one of the following events would directly increase the size of the UK's national debt? An increase in A. mortgage borrowing from UK banks. B. overseas lending to UK firms. C. the UK's current account deficit. D. the UK government's budget deficit.arrow_forwardChanges in Forward Premiums Assume that the Japanese yen’s forward rate currently exhibits a premium of 6 percent and that interest rate parity exists. If U.S. interest rates decrease, how must this premium change to maintain interest rate parity? Why might we expect the premium to change?arrow_forward

- Which of the following fact regarding federal budget balance in Canada is TRUE? Multiple Choice the largest budget deficits happened in 1992. there was budget surplus between 1985 to 1995 there was budget surplus between 1975 to 1985 the largest budget deficits happened in 1985. the largest budget surplus happened in 2019.arrow_forwardIdentify a reason why Social Security as it currently exists is unsustainable in the long run. The overall U.S. population is shrinking because of decreasing life expectancy, so soon there would not be enough taxpayers to fund A. the Social Security program. B. Income tax revenues that form the largest source of funds for Social Security programs are projected to decline in the long run. OC. Individual income that is subject to Social Security taxes is capped at about $117,000. D. Corporate income that is subject to Social Security taxes is capped at $1 million.arrow_forwardThe federal budget deficit has been growing over the past several years. What impact will this fiscal change have on the supply of Treasury bonds? A. Bond supply does not change B. Bond supply increases C. Bond supply declinesarrow_forward

- 29.World Central Banks Act as EU Growth Stalls The European Central Bank(ECB), along with its U.S., Japanese, Swiss, and British counterparts, announced they would inject extra U.S. dollar liquidity into banks facing a shortage of the U.S. dollars. European bank shares have plunged over the past weeks as their usual sources of U.S dollars. have dried up on concerns they might be hit by a Greek debt default, and the announcement sparked a strong bank and general stocks rally. Source: AFP, September 15,2011 How can group of central banks "inject extra U.S. dollar liquidity"? What will such an action do to the quantity of U. S dollars in Europe? 30.Banks in New Transylvania have a desired reserve ratio of 10 percent and no excess reserves. The currency drain ratio is 50 percent. Then the central bank increases the monetary base by $1,200 billion. a. How much do the banks lend in the first round of the money creation process? b. How much of the initial amount…arrow_forwardConsider the following table for a seven-year period: Year 1 2 3 4 5 6 7 U.S. Treasury Bills 3.45% 3.30 4.20 4.62 2.42 1.30 1.03 Returns Average real return Inflation -1.15% -2.29 -1.19 0.61 -6.43 -9.35 -1.30 What was the average real return for Treasury bills for this time period? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education