Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Use following info

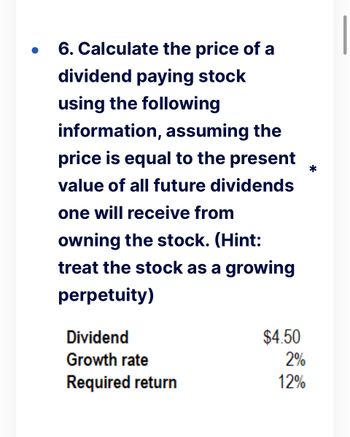

Transcribed Image Text:6. Calculate the price of a

dividend paying stock

using the following

information, assuming the

price is equal to the present

value of all future dividends

one will receive from

owning the stock. (Hint:

treat the stock as a growing

perpetuity)

Dividend

$4.50

Growth rate

2%

Required return

12%

*

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculation of dividends pricearrow_forwardPlCalculate dividend price..arrow_forward(3) According to the Dividend-Discount Model Equation, the price of the stock today (Po) is equal to the present value of all of the expected future dividends (e.g., Divi, Div..., Divx) investors will receive, along with the cash flow from the sale of the stock (i.e., Ps) in year N (see, the following Equation). Div Div ₂ + L + 1+FE (1+E)² Po = + PN Div N (1+re)^ *(1+r)^ List three practical challenges (i.e., limitations) when using the Equation to calculate stock price (Po) in practice.arrow_forward

- An investor expects a14% return on a $ 50 stock that pays a dividend of $ 2.50. Was is the implied capital gain rate on the price appreciation?arrow_forwardThe following table shows the expected dividend payments and required rate of return of Globex Corp. Clearly explain the assumptions, if any, you are using to solve below question(s). 2021 2023 20244 2022 $4 Yeara 2025 20264 20274 ket Dividend $ 0.40 0.44 0.48 $ 0.53 $ 0.59 $ 0.61 $ 0.63 12%e i. Calculate value of Globex Corp share in 2021. ww mmarrow_forwardThe cost of equity and dividends are known to the picture.calculate the value of Ve, according to the multi-period dividend discount modelarrow_forward

- Estimate its cost of common equity, Maxell and Associcates recently hired you. Obtain the following data, D0=$0.90, P0= $27.50, gl=7% constant. Based on the dividend grwoth model, What is the cost of common for reinvested earnings? (10.50%,9.29%,10.08%,9.68%,10.92%)arrow_forwardMost recent dividend (D0) paid $5.16, if anticipated growth of 4.8 % is expected to be constant into the future, what is the fair value of the stock if the required return (rs) = 13.8 percent? Answer to two decimal places.arrow_forwardPlease helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education