FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

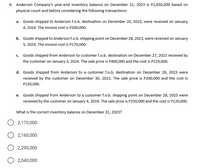

Transcribed Image Text:6. Anderson Company's year-end inventory balance on December 31, 2023 is P1,650,000 based on

physical count and before considering the following transactions:

a. Goods shipped to Anderson f.o.b. destination on December 20, 2023, were received on January

4, 2024. The invoice cost is P300,000.

b. Goods shipped to Anderson f.o.b. shipping point on December 28, 2023, were received on January

5, 2024. The invoice cost is P170,000.

c. Goods shipped from Anderson to customer f.o.b. destination on December 27, 2023 received by

the customer on January 3, 2024. The sale price is P400,000 and the cost is P220,000.

d. Goods shipped from Anderson to a customer f.o.b. destination on December 26, 2023 were

received by the customer on December 30, 2023. The sale price is P200,000 and the cost is

P130,000.

e. Goods shipped from Anderson to a customer f.o.b. shipping point on December 28, 2023 were

received by the customer on January 4, 2024. The sale price is P250,000 and the cost is P120,000.

What is the correct inventory balance on December 31, 2023?

2,170,000

2,160,000

O 2,290,000

2,040,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2021, Sanderson Variety Store adopted the dollar-value LIFO retail inventory method, Accounting records provided the following information: Beginning inventory Net purchases Net markups Net markdowns Net sales. Retail price index, end of year Cost $ 40,800 155,440 Retail $ 68,000 270,000 6,000 8,000 250,000 1.02 During 2022, purchases at cost and retail were $168,000 and $301,000, respectively. Net markups, net markdowns, and net sales for the year were $3,000, $4,000, and $280,000, respectively. The retail price index at the end of 2022 was 1.06. Estimate ending Inventory in 2022 using the dollar-value LIFO retail method. (Round your intermediate calculations to the nearest whole dollar.) Answer is complete but not entirely correct. Ending inventory S 50,451arrow_forwardOn January 1, 2021, Sanderson Variety Store adopted the dollar-value LIFO retail inventory method. Accounting records provided the following information: Beginning inventory Net purchases Net markups Net markdowns Net sales Retail price index, end of year Cost $50,400 201,840 During 2022, purchases at cost and retail were $248,655 and $452,100, respectively. Net markups, net markdowns, and net sales for the year were $3,000, $4,000, and $360,000, respectively. The retail price index at the end of 2022 was 1.06. Ending inventory Retail $ 84,000 350,000 10,000 12,000 327,000 1.04 Estimate ending inventory in 2022 using the dollar-value LIFO retail method. (Round your intermediate calculations to the nearest whole dollar. Round ratio calculation to the nearest whole percent.) $ 175,100arrow_forwardSunland Company's inventory on January 1, 2025, at cost and retail are $97,500 and $141,000, respectively. Sunland established its base year amounts on January 1, 2025. The current year price index was 1.20. Sunland also had the following information: Purchases Sales Mark-ups Mark-downs Cost $195,000 Retail $282,000 243,000 19,740 (11,280) Determine ending inventory using: (Round ratio to 2 decimal places, e.g. 75.35% and final answer to O decimal places, e.g. 5,275.) (a) LIFO retail. (b) Dollar Value LIFO. (a) Ending inventory under LIFO retail $ tA (b) Ending inventory under Dollar Value LIFO $arrow_forward

- The Rodelio Company conducted a physical count of inventory on December 31, 2023, with a cost of P3,370,000. The following items were included from the physical count: Goods held by Rodelio on consignment P420,000 Goods shipped by a vendor FOB Destination on December 31, 2023 and was received by Rodelio on January 5, 2024. 850,000 Goods purchased FOB Shipping Point was shipped by the supplier on December 31, 2023 and received by Rodelio on January 4, 2024. 770,000 Cost of goods shipped by Rodelio FOB Destination to a customer on December 31, 2023 and was received by the customer on January 2, 2024. 370,000 Cost of goods shipped by Rodelio FOB Shipping Point to a customer on December 31, 2023 and was received by the customer on January 5, 2024. 590,000 Cost of goods shipped by Rodelio to a customer on December 31, 2023 on an installments agreement (Rodelio Company believed that the collectability of the installment is reasonably assured) 340,000…arrow_forwardWildhorse Company's inventory of $1,188,700 at December 31, 2025, was based on a physical count of goods priced at cost and before any year-end adjustments relating to the following items. (a) (b) Goods shipped from a vendor f.o.b. shipping point on December 24, 2025, at an invoice cost of $64,330 to Wildhorse Company were received on January 4, 2026. The physical count included $31,420 of goods billed to Sakic Corp. f.o.b. shipping point on December 31, 2025. The carrier picked up these goods on January 3, 2026. What amount should Wildhorse report as inventory on its balance sheet? Inventory to be reported $ +Aarrow_forwardKmuarrow_forward

- Haresharrow_forwardA physical inventory count showed ABC Company had inventorycosting $428,000 on hand at December 31, 2025. This amountdid not include the following:1. Inventory costing $39,000 that was shipped to acustomer FOB shipping point on December 30, 2025.The inventory was expected to be received by thecustomer on January 3, 2026.2. Inventory costing $17,000 that was shipped to acustomer FOB destination point on December 29, 2025.The inventory was expected to be received by thecustomer on January 6, 2026.3. Inventory costing $26,000 that ABC Company hadpurchased from one of its suppliers. The goodswere shipped to ABC Company on December 31, 2025.ABC Company expects to receive the inventory onJanuary 4, 2026. The shipping terms were FOBshipping point.Calculate the correct dollar amount of ending inventoryto be reported on ABC Company’s December 31, 2025 balancesheet.arrow_forwardThe adjusted trial balance of Wildhorse Co. shows these data pertaining to sales at the end of its fiscal year, October 31, 2022: Sales Revenue $904,100; Freight-Out $13,400; Sales Returns and Allowances $20,100; and Sales Discounts $15,500.Prepare the sales section of the income statement.arrow_forward

- The following data were taken from the income statements of Cullumber Company. 2022 2021 Sales revenue $6,420,000 $6,271,000 Beginning inventory 942,400 840,500 Purchases 4,836,000 4,691,000 Ending inventory 1,174,000 942,400 Compute the inventory turnover for each year. (Round answers to 1 decimal place, e.g. 12.5.) 2022 2021 Inventory turnover Enter inventory turnover in times rounded to 1 decimal place times Enter inventory turnover in times rounded to 1 decimal place times Compute days in inventory for each year. (Round answers to 0 decimal places, e.g. 124. Use 365 days for calculation.) 2022 2021 Days in inventory Enter days in inventory rounded to 0 decimal places days Enter days in inventory rounded to 0 decimal placesarrow_forwardThe following data are taken from the financial statements: Current Year Preceding Year Sales $3,600,000 $4,000,000 Cost of goods sold 2,000,000 2,700,000 Beginning inventory 372,000 352,000 Inventory, end of year 390,000 372,000 a. Determine for each year (1) the inventory turnover and (2) the number of days' sales in inventory. 1. The inventory turnover: (1f required, round your answers to one decimal place.) Current Year Preceding Year 2. The number of days' sales in inventory: Assume a 365-day year. (Round your intermediate calculation to whole number and final answers to two decimal places.) Current Year days Preceding Year days b. Comment on the favorable and unfavorable trends revealed by the data. v and the number of days' sales in inventory which are unfavorable trends Sales while gross profit The inventory turnoverarrow_forwardRaleigh Department Store uses the conventional retail method for the year ended December 31, 2022. Available information follows: a. The inventory at January 1, 2022, had a retail value of $49,000 and a cost of $34,380 based on the conventional retail method. b. Transactions during 2022 were as follows: Gross purchases Purchase returns Purchase discounts Sales Sales returns Employee discounts Freight-in Net markups Net markdowns Cost $ 323,040 6,300 5,400 Beginning inventory 28,500 Sales Sales returns Employee discounts Estimated ending inventory at retail Estimated ending inventory at cost Retail $530,000 14,000 Sales to employees are recorded net of discounts. c. The retail value of the December 31, 2023, inventory was $85,330, the cost-to-retail percentage for 2023 under the LIFO retail method was 69%, and the appropriate price index was 106% of the January 1, 2023, price level. d. The retail value of the December 31, 2024, inventory was $52,320, the cost-to-retail percentage for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education