FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

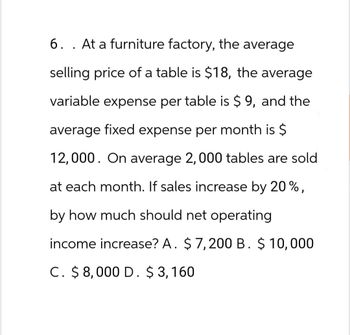

Transcribed Image Text:6. . At a furniture factory, the average

selling price of a table is $18, the average

variable expense per table is $ 9, and the

average fixed expense per month is $

12,000. On average 2, 000 tables are sold

at each month. If sales increase by 20%,

by how much should net operating

income increase? A. $ 7,200 B. $ 10,000

C. $8,000 D. $3,160

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- part f onlyarrow_forward2. An audio equipment manufacturer produced and sold 725 sound systems and made a net income of $50, 000 last year, with a total revenue of $1, 015, 000. The manufacturer's break-even volume is 600 units. a. Calculate the selling price of each sound system. b. Calculate the variable costs for each sound system. c. Calculate the fixed costs per year.arrow_forwardEdgerron Company is able to produce two products, G and B, with the same machine in its factory. The following information is available. Product G Product B $ 90 $ 120 Selling price per unit Variable costs per unit 30 72 Contribution margin per unit $ 60 $ 48 Machine hours to produce 1 unit 0.4 hours 1 hours Maximum unit sales per month 600 units 200 units The company presently operates the machine for a single eight-hour shift for 22 working days each month. Management is thinking about operating the machine for two shifts, which will increase its productivity by another eight hours per day for 22 days per month. This change would require $6,000 additional fixed costs per month. (Round hours per unit answers to 1 decimal place.) 1. Determine the contribution margin per machine hour that each product generates. Product B Product G $ Contribution margin per unit 48.00 Machine hours per unit 1.0 Contribution margin per machine hour 48.00 Product G Maximum number of units to be sold 600…arrow_forward

- If a company has fixed costs of $6.000 per month and their product that sells for $200 has a contribution margin ratio of 30%, how many units must they sell in order to break even? А. 100 В. 180 С. 200 D. 2,000arrow_forwardim.9arrow_forwardA company’s forecasted sales are $300,000 and its sales at break-even are $180,000. Its margin of safety in dollars is a. $180,000. c. $480,000. e. $300,000. b. $120,000. d. $60,000.arrow_forward

- A firm sell a single product for $6. Its variable cost per unit is $4 and fixed costs are $50. Ignoring income taxes, the amount of sales revenue needed for $20 profit is Select one: a. $210. b. $150. c. $35. d. $25.arrow_forward5. The Goldielocks company produces 3 products - Hot Product, Cold Product, Just Right Product. The variable expenses and sales price of all the products are given below: Just Right Prod. $50 Hot Prod. Cold Prod. Sale price per unit Variable exp per unit $ 200 $ 100 $ 100 $ 75 $25 The total fixed expenses of the company are $50,000 per month. For the coming month, Goldielocks expects the sale of the 3 products to be in the following ratio: Hot Product - 20% Cold Product - 30% Just Right Product - 50% Compute the following: Weighted-average contribution margin? How many total products must Goldielocks sell to break-even? How many of each product must Goldielocks sell to break-even? а. b. с. d. How much revenue will Goldielocks earn with this sales mix?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education