Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

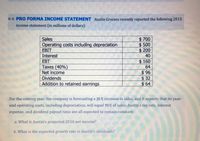

Transcribed Image Text:6-4. PRO FORMA INCOME STATEMENT Austin Grocers recently reported the following 2015

income statement (in millions of dollars):

$ 700

$500

$200

40

Sales

Operating costs including depreciation

ЕBIT

Interest

$160

64

EBT

Taxes (40%)

Net income

$96

$ 32

$ 64

Dividends

Addition to retained earnings

For the coming year, the company is forecasting a 25% increase in sales, and it expects that its year-

end operating costs, including depreciation, will equal 70% of sales. Austin's tax rate, interest

expense, and dividend payout ratio are all expected to remain constant.

a. What is Austin's projected 2016 net income?

b. What is the expected growth rate in Austin's dividends?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- For 2017, the firm is forecasting a 40% increase in sales and that its year end operating costs will decline to 60% of sales. Tax rate, interest expense and dividend payout ratio are expected to remain constant. Required:What is the projected 2017 net income?arrow_forwardplease answer the following questionarrow_forwardLast year, Garrison Manufacturing sold 500 000 units at $4 each. Sales volume is expected to increase by 15% in the upcoming year, and sales price is expected to decrease by 5% in the upcoming year. The expected sales revenue for the upcoming year is: A. $2 255 000 B. $2 185 000 C. $2 645 000 D. $2 000 000arrow_forward

- Last year company A introduced a new product and sold 25,900 units at $97.00 per unit. The product variable expense $67.00 per unit with a fixed price expense of $835,500 per year. a. What is the product's net income or loss last year? b. What is the product break-even point in unit sales and dollar sales? c. Assume the company has conducted a market study that estimates it can increase sales by 5,000 units for each $2.00 reduction in its selling price. If the company would only consider increments of $2.00(e.g. $68,$66, etc) What is the maximum annual profit that can be earned on this product? What sales volume and selling price per unit generate the maximum profit? d. What would be the break-even point in unit sales and dollar sales using the selling price that was determined in the required letter c above? Thank you,arrow_forwardCompany B’s income statement for this year is shown below. Assume that the company’s sales will increase by 10% but fixed expenses remain the same next year. By what percentage will net operating income increase? Sales $100 Variable expenses 30 Contribution Margin 70 Fixed expenses 35 Net operating income $35 a)20% b)10% c)40% d)30%arrow_forwardba.1arrow_forward

- The following tables summarizes the 2019 income statement and end-year balance sheet of Drake’s Bowling Alleys. Drake’s financial manager forecasts a 10% increase in sales and costs in 2020. The ratio of sales to average assets is expected to remain at 0.40. Interest is forecasted at 5% of debt at the start of the year. INCOME STATEMENT, 2019 (Figures in $ thousands) Sales $ 1,120 (40% of average assets)a Costs 840 (75% of sales) Interest 26 (5% of debt at start of year)b Pretax profit $ 254 Tax 101 (40% of pretax profit) Net income $ 152 a Assets at the end of 2018 were $2,700,000. b Debt at the end of 2018 was $530,000. BALANCE SHEET, YEAR-END (Figures in $ thousands) Assets $ 2,900 Debt $ 530 Equity 2,370 Total $ 2,900 $ 2,900 a. What is the implied level of assets at the end of 2020? (Do not round your intermediate calculations. Enter your answer in thousands.) b. If the…arrow_forwardProvide correct solutionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education