FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

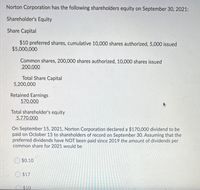

Transcribed Image Text:Norton Corporation has the following shareholders equity on September 30, 2021:

Shareholder's Equity

Share Capital

$10 preferred shares, cumulative 10,000 shares authorized, 5,000 issued

$5,000,000

Common shares, 200,000 shares authorized, 10,000 shares issued

200,000

Total Share Capital

5,200,000

Retained Earnings

570,000

Total shareholder's equity

5,770,000

On September 15, 2021, Norton Corporation declared a $170,000 dividend to be

paid on October 15 to shareholders of record on September 30. Assuming that the

preferred dividends have NOT been paid since 2019 the amount of dividends per

common share for 2021 would be

$0.10

O $17

$10

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What impact does Target's dividendend annoucement have on it's balance sheet? Target Corporation (NYSE:TGT) recently made a dividend annoucement.The announcement read:The board of directors of Target Coporation has declared a quarterly of 90 cents per common share. The dividend is payable December 10, 2021 to shareholders of record at the close of bussiness November 17, 2021. The 4th quater dividend will be the company's 217th consecutive dividend paid since October 1967 when the company became publicly held. Questions: 1. On which date will Target record a liability for the dividend? 2.On which date will Target pay the cash dividend? 3.On the date of declaration,what will the impact (increase,decrease,noeffect) on Target's:a)assets: b)liabilities; and c)stockholders' equity? 4. On the date of payement, what will be the impact (incease,decrease,no effect)on Target's:a)assets:b)liabilities: and c0 stockholdes" equity?arrow_forwardThe Shareholders’ Equity section of Green Corporation at December 31, 2019 showed the following: 8% cumulative Preference share capital, P 100 par, liquidating value P110 - P2,000,000; Ordinary Share Capital, P50 par - P2,500,000; Additional Paid In Capital - P 500,000; Retained Earnings - P 1,000,000. During the year, the company earned profit of P 500,000. Compute the book value per share for the Preference share assuming dividends are in arrears for 3 years including the current yearUsing data, Compute the book value per share for the Ordinary Share Capitalarrow_forwardAt 31 December 2019, B Plc had post-tax profits was $2,500,000 and had an issued share capital of $2,000,000 comprising 2,000,000 ordinary shares of 50p each and 1,000,000 $1 10% preference shares that are classified as equity. Assume that the post-tax profits for 2018 and 2019 were same at $ 2,500,000. The time-weighted number of shares was as follows: No. of Shares Shares (nominal value 50p) in issue at 01 January 2019 2,000,000 Shares issued for cash at market price on 30 September 2019 1,000,000 On 30 September 2019, B plc made a right issue of one share for every two shares (i.e one new share for every two shares held) at $3.25 per share. The following information is also given for B Plc as at 31 December 2019: Share option in existence 1,000,000 shares issuable in 2020 at $3.25 per share. An average market price per share of $4%; 1. Convertible 8% preference shares of $1 each totaling $2,000,000 convertible at one ordinary share for every five convertible preference shares. 2.…arrow_forward

- The following financial information is available for Blossom Ltd. as at December 31 (in thousands, except for per share amounts): 2021 2020 2019 Profit $1,721 $1,854 $2,317 Preferred share dividends (total) $73 $43 $30 Weighted average number of common shares 437 435 436 Dividends per common share $2.50 $2.25 $2.10 Market price per common share $43.00 $49.75 $56.25 (a)Calculate the earnings per share, price-earnings ratio, and payout ratio for the common shareholders for each of the three years. 2021 2020 2019 Earnings per share (Round answer to 2 decimal places, e.g. 5.25.) $enter Earnings per share in dollars rounded to 2 decimal places $enter Earnings per share in dollars rounded to 2 decimal places $enter Earnings per share in dollars rounded to 2 decimal places Price-earnings ratio (Round answer to 1 decimal place, e.g. 15.5.) enter Price-earnings ratio in times rounded to 1…arrow_forwardssarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education