FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Given the following information for Jane Brown, lawyer, calculate the value of J. Brown, Capital as of

December 31, 2022. Please create a

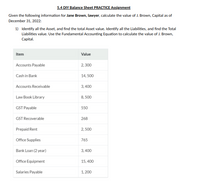

Transcribed Image Text:5.4 DIY Balance Sheet PRACTICE Assignment

Given the following information for Jane Brown, lawyer, calculate the value of J. Brown, Capital as of

December 31, 2022:

1) Identify all the Asset, and find the total Asset value. Identify all the Liabilities, and find the Total

Liabilities value. Use the Fundamental Accounting Equation to calculate the value of J. Brown,

Capital.

Item

Value

Accounts Payable

2, 300

Cash in Bank

14, 500

Accounts Receivable

3,400

Law Book Library

8, 500

GST Payable

550

GST Recoverable

268

Prepaid Rent

2, 500

Office Supplies

765

Bank Loan (2 year)

3, 400

Office Equipment

15, 400

Salaries Payable

1, 200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ted Coverdale and Jim Kulak set up a new limited liability company on May 16, 2020. Ted contributes a warehouse and land worth a combined $1,098,000. Market value of the warehouse is $264,000. Jim contributes $893,000 in cash. Write the journal entry to record the contributions to the LLC.arrow_forwardCurrent Attempt in Progress For Pharoah Co., beginning capital balances on January 1, 2022, are Nancy Payne $23,300 and Ann Dody $22,500. During the year, drawings were Payne $7,600 and Dody $5,700. Net income was $31,800, and the partners share income equally. (a) (b) Prepare the owners' equity section of the balance sheet at December 31, 2022. eTextbook and Media PHAROAH CO. Partial Balance Sheet December 31, 2022arrow_forwardScenario 1: Alex and Jamie decide to start a consulting firm named "Strategic Advisors." Alex contributes$40,000 in cash, and Jamie contributes $60,000 worth of equipment. They agree to share profits andlosses equally.1) What are the initial journal entries to record the formation of Strategic Advisors?2) How would the capital accounts of Alex and Jamie look after these entriesarrow_forward

- Array intends to allocate her savings into various types of financial investments. She has $184,100 to invest in stocks, bonds, and mutual funds according to her chosen 10 2 10 ratio 779 investment? Round your answers to the nearest dollar. Stocks: $ Bonds: $ respectively. How much should she invest in each type of Mutual Funds: $arrow_forwardPlease show their ending capital balances. Thank youarrow_forwardPrepare closing entries. (Use Operating Expenses for Expenses) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order displayed in the problem statement.) Date Account Titles and Explanation Oct. 31 Sales Revenue Oct. 31 Oct. 31 Income Summary (To close revenue account) Income Summary Depreciation Expense Salaries and Wages Expense (To close expense accounts) Income Summary Retained Earnings (To transfer net income/(loss)) Oct. 31 Retained Earnings Cash Dividends (To close cash dividends to retained earnings) Debit 462500 383740 78760 1400 Credit 462500 3900 379840 78760 1400arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education