FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

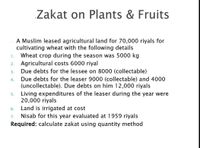

Transcribed Image Text:Zakat on Plants & Fruits

A Muslim leased agricultural land for 70,000 riyals for

cultivating wheat with the following details

Wheat crop during the season was 5000 kg

1.

2. Agricultural costs 6000 riyal

Due debts for the lessee on 8000 (collectable)

3.

Due debts for the leaser 9000 (collectable) and 4000

(uncollectable). Due debts on him 12,000 riyals

Living expenditures of the leaser during the year were

20,000 riyals

Land is irrigated at cost

Nisab for this year evaluated at 1959 riyals

Required: calculate zakat using quantity method

4.

5.

6.

7.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- (please answer, I will give you multiple upvote)arrow_forwardJustine Kofos purchased a house for $700,000 in Victoria for. The stamp duty payable is : Select one: a. $2,870 b. $44,870 c. $37,070 d. $26,990arrow_forwardSmith Farm Trust made a farmer a loan of $1,200 at 12% for three years compounded annually. Find the compound amount and the compound interest.arrow_forward

- Dick Hercher bought a home in Homewood, Illinois, for $230,000. He put down 20% and obtained a mortgage for 25 years at 8%. The total interest cost of the loan is: Multiple Choice $368,000 $327,372.80 $302,554 $242,042arrow_forward(16. A 28.5-acre parcel of land in Orange County sells for $4,100 per acre. What is the documen- real estate problem 16.) A 28.5-acre parcel of land in Orange Count sells for $4,100 per acre. What is the docume tary stamp tax on the deed? a. $409.15 b. $642.85 c. $817.95 d. $818.30arrow_forwardrented out a house at a monthly rent of Rs. 20,000. During the year incurred following expenses in respect of the house: Repair of house Rs. 15,000 Insurance premium 10,000 Property tax Rs. 6,000 Interest on loan from HBFC Rs. 12,000 Legal expenses Rs. 2,000 Required: Compute the amount that is chargeable to tax under the head "Income from Propertyarrow_forward

- Carmella purchased a refrigerator under a conditional sale contract that required 24 monthly payments of $70.26 with the first payment due on the purchase date. The interest rate on the outstanding balance was 15% compounded monthly. a. What was the purchase price of the refrigerator? (Do not round Intermedlate calculatlons and round your final answer to 2 declmal places.) Purchase price b. How much interest did Carmella pay during the entire contract? (Do not round Intermedlate calculatlons and round your final answer to 2 decimal places.) Interest paid 24 connectarrow_forwardSue Smith owns a 300 unit tax credit property. She received a total credit allocation covering 200 of her units and committed to the 20% @ 50% minimum set aside. To earn the maximum possible tax credit, how many units should Sue rent to residents with income no greater than 50% of the area median? O A. 60 units B. 100 units c. 200 units D. 300 unitsarrow_forwardComplete the journal entries for the following investing transactions. a. A farmer buys a tract of land for $50,000. b. A farmer leases a tractor that is worth $50,000 and will own the tractor at the end of the lease. c. A farmer builds a shed for $7,000. d. A farmer buys five cows for $6,000. e. A farmer sells a parcel of land to a local municipality for $36,000. The original cost of the land was $36,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education