FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

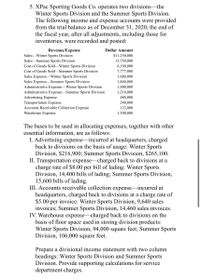

Transcribed Image Text:5. XPac Sporting Goods Co. operates two divisions-the

Winter Sports Division and the Summer Sports Division.

The following income and expense accounts were provided

from the trial balance as of December 31, 2020, the end of

the fiscal year, after all adjustments, including those for

inventories, were recorded and posted:

Revenue/Expense

Dollar Amount

Sales-Winter Sports Division

$11,250,000

Sales-Summer Sports Division

Cost of Goods Sold-Winter Sports Division

13,750,000

6,100,000

Cost of Goods Sold-Summer Sports Division

7,777,000

1,680,000

1,840,000

Sales ExpenseWinter Sports Division

Sales ExpenseSummer Sports Division

Administrative Expense-Winter Sports Division

Administrative Expense-Summer Sports Division

Advertising Expense

Transportation Expense

Accounts Receivable Collection Expense

Warehouse Expense

1,900,000

1,210,000

480,000

240,000

123,000

1,300,000

The bases to be used in allocating expenses, together with other

essential information, are as follows:

I. Advertising expense-incurred at headquarters, charged

back to divisions on the basis of usage: Winter Sports

Division, $216,900; Summer Sports Division, $265,100.

II. Transportation expense-charged back to divisions at a

charge rate of $8.00 per bill of lading: Winter Sports

Division, 14,400 bills of lading; Summer Sports Division,

15,600 bills of lading.

III. Accounts receivable collection expense-incurred at

headquarters, charged back to divisions at a charge rate of

$5.00

per

invoice: Winter Sports Division, 9,640 sales

invoices; Summer Sports Division, 14,460 sales invoices.

IV. Warehouse expense-charged back to divisions on the

basis of floor space used in storing division products:

Winter Sports Division, 94,000 square feet; Summer Sports

Division, 106,000 square feet.

Prepare a divisional income statement with two column

headings: Winter Sports Division and Summer Sports

Division. Provide supporting calculations for service

department charges.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Edge Co., a toy manufacturer, is in the process of preparing its financial statements for the year ended December 31, Year 8. Edge expects to issue its Year 8 financial statements on March 1, Year 9. For each item, two responses are required. Select from the option lists provided the appropriate adjustment amount, if any, and whether additional disclosure is required, either on the face of or in the notes for each financial statement below. Each choice may be used once, more than once, or not at all. If no adjustment is necessary, select "No entry required" in the Adjusted amount column and continue to the Additional disclosure required column. Show Transcribed Text 5. On January 30, Year 9, Edge issued $10 million bonds at a premium of $500,000. 6. On February 4, Year 8, the IRS assessed Edge an additional $400,000 for the Year 4 tax year. Edge's tax attorneys and tax accountants have stated that it is likely that the IRS will agree to a $100,000 settlement. C !!!!arrow_forwardINSTRUCTIONS: (1) Complete the adjustments section of the worksheet [WS]. Use the following information regarding unadjusted items. (a) On September 30, the firm received its utilities bill for the month of September amounting to P14,300. This remains to be unpaid at month-end. Record an adjustment for the utilities for the month of September. Accrued Expense (b) On September 21, the firm received a 6% 90-day note for money lent to Ling Ying Wei amounting to P400,000. The remainder of the amount pertains to a 12-month 9% promissory note received on May 1, 2021. Record an adjustment for the accrued interest from both notes for the month of September. Accrued Income (c) On September 30, an inventory of Warehouse Supplies and Office Supplies showed that items costing P127,000 and P12,000 were on hand respectively. Record an adjustment for the supplies used in September. Prepaid Expense (d) On July 1, 2021, the firm purchased a six-month insurance policy for P232,000. Record an…arrow_forwardUnder accrual basis accounting, expenses are recognized when incurred. The following transactions occurred in January:a. American Express paid its salespersons $3,500 in commissions related to December sales offinancial advisory services. Answer from American Express’s standpoint.b. On January 31, American Express determined that it will pay its salespersons $4,200 in commissions related to January sales. The payment will be made in early February. Answer fromAmerican Express’s standpoint.c. The city of Omaha hired Waste Management, Inc., to provide trash collection servicesbeginning January 1. The city paid $12 million for the entire year. Answer from the city’sstandpoint.d. The University of Florida paid $10,000 in advance for refundable airline tickets to fly thebaseball team to a tournament in California. The first game will be played in March. Answerfrom the university’s standpoint.e. A Houston Community College employee worked eight hours, at $15 per hour, on January 31;payday is…arrow_forward

- Stingers Inc. provides audited financial statements to its creditors and management receives a bonus partially based on revenues for the year An order for $61,500 was received from one of its regular customer on December 29, for products on hand. This order was shipped f.o.b. shipping point on January 9, 2021. The company made the following entry for 2020: Accounts Receivable 61,500 Sales Revenue 61,500 INSTRUCTIONS - DETERMINE HOW REVENUE SHOULD BE RECORDED UNDER EACH ALTERNATIVE a. Assume the company follows ASPE, provide a GAAP supported-case specific analysis. b. Assume the company follows IFRS, provide a GAAP supported-case specific analysis.arrow_forwardLove Company requires advance payments with special orders for machinery constructed to customer specifications.These advances are nonrefundable. Information for the current year is:Advances from customers – January 1 P1,320,000Advances received with orders 2,160,000Advances applied to orders shipped 1,920,000Advances applicable to orders cancelled 120,000In Love Company’s December 31 statement of financial position, what amount should be reported as current liability foradvances from customers?a. P1,440,000 b. P1,560,000 c. P1,680,000 d. P0arrow_forwardRequired: (a) Prepare journal entries to record the impairment loss of receivable in 2021 under Statement of Financial Position approach. (b) Prepare partial Statement of Financial Positions to show the accounts receivables at 31 December 2021.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education