ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

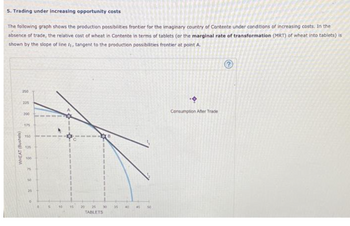

Transcribed Image Text:5. Trading under increasing opportunity costs

The following graph shows the production possibilities frontier for the imaginary country of Contente under conditions of increasing costs. In the

absence of trade, the relative cost of wheat in Contente in terms of tablets (or the marginal rate of transformation (MRT) of wheat into tablets) is

shown by the slope of line , tangent to the production possibilities frontier at point A.

WHEAT (Bushels)

250

200

175

150

125

100

S

25

0

10

15 20 25

30

TABLETS

35 40

45

10

..

Consumption After Trade

(?)

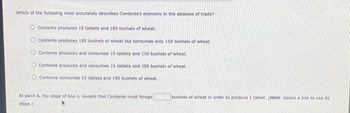

Transcribed Image Text:Which of the following most accurately describes Contente's economy in the absence of trade?

O Contente produces 15 tablets and 195 bushels of wheat.

O Contente produces 195 bushels of wheat but consumes only 150 bushels of wheat.

O Contente produces and consumes 15 tablets and 150 bushels of wheat.

O Contente produces and consumes 15 tablets and 195 bushels of wheat.

O Contente consumes 15 tablets and 195 bushels of wheat

At point A, the slope of line f, reveals that Contente must forego

slope.)

bushels of wheat in order to produce 1 tablet. (Hint: Select a line to see its

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 5. The price of trade Suppose that France and Switzerland both produce jeans and olives. France's opportunity cost of producing a crate of olives is 5 pairs of jeans while Switzerland's opportunity cost of producing a crate of olives is 10 pairs of jeans. By comparing the opportunity cost of producing olives in the two countries, you can tell that production of olives and has a comparative advantage in the production of jeans. has a comparative advantage in the Suppose that France and Switzerland consider trading olives and jeans with each other. France can gain from specialization and trade as long as it of jeans for each crate of olives it exports to Switzerland. Similarly, Switzerland can gain from trade as long as it receives more than of olives for each pair of jeans it exports to France. receives more than Based on your answer to the last question, which of the following prices of trade (that is, price of olives in terms of jeans) would allow both Switzerland and France to gain…arrow_forwardLENTILS (Millions of pounds) 80 70 8 60 50 40 30 20 10 + 0 0 PPF 10 Shenandoah 20 30 40 50 60 PEAS (Millions of pounds) 70 80 (?) LENTILS (Millions of pounds) 80 70 60 50 40 30 PPF 20 10 0 0 T 10 Denali 40 20 30 50 60 PEAS (Millions of pounds) 70 80 (?) Shenandoah has a comparative advantage in the production of , while Denali has a comparative advantage in the production of . Suppose that Shenandoah and Denali specialize in the production of the goods in which each has a comparative advantage. After specialization, the two countries can produce a total of peas. million pounds of lentils and million pounds of Suppose that Shenandoah and Denali agree to trade. Each country focuses its resources on producing only the good in which it has a comparative advantage. The countries decide to exchange 20 million pounds of peas for 20 million pounds of lentils. This ratio of goods is known as the price of trade between Shenandoah and Denali. The following graph shows the same PPF for Shenandoah…arrow_forward14arrow_forward

- Suppose that France and Germany both produce wine and cheese. The table below shows combinations of the goods that each country can produce in a day. France Germany Wine (Bottles) Cheese (Pounds) 16 Wine (Bottles) Cheese (Pounds) 12 8. 4. 25 20 15 2 3 3 4 10 4 Who has the comparative advantage in producing wine and who has the comparative advantage in producing cheese? O A. France has a comparative advantage producing wine and Germany has a comparative advantage producing cheese. O B. France has a comparative advantage producing wine and cheese. OC. Germany has a comparative advantage producing wine and cheese. -OD. Neither has a comparative advantage producing wine or cheese. OE. France has a comparative advantage producing cheese and Germany has a comparative advantage producing wine. Suppose that France is currently producing 1 bottle of wine and 12 pounds of cheese and Germany is currently producing 3 bottles of wine and 10 pounds of cheese. Then, assume instead that France and…arrow_forwardI need carrow_forwardCOFFEE (Millions of pounds) 48 42 36 30 24 18 12 6 0 PPF 1 Maldonia 36 30 POTATOES (Millions of pounds) 06 12 18 24 42 48 COFFEE (Millions of pounds) 48 42 36 30 24 18 12 6 0 PPF 1 0 6 Lamponia 18 42 12 24 30 36 POTATOES (Millions of pounds) 48 Consider the above two graphs which represent production possibilities. What are the comparative advantages? Maldonia has a comparative advantage in potatoes and Lamponia has a comparative advantage in coffee Maldonia has a comparative advantage in both goods O Lamponia has a comparative advantage in both goods O Maldonia has a comparative advantage in coffee adn Lamponia has a comparative advantage in potatoesarrow_forward

- Figure 2-9 Snow cones 240 0 Greenland 200 Popsicles Snow cones 270 0 Iceland O 100 popsicles & 130 snow cones; 100 popsicles & 140 snow scones O 100 popsicles & 140 snow cones; 100 popsicles & 100 snow scones O 140 popsicles & 120 snow cones; 100 popsicles & 130 snow scones none of the above. 180 Popsicles Figure 2-9 shows the production possibilities frontiers for Greenland and Iceland. Each country produces two goods, snow cones and popsicles. With the opening of international trade, the agreed price between Iceland and Greenland for popsicles is 1.3. Assume that the country which now imports popsicles (with int'l trade) decides that it will import 100 units of popsicles. The new consumption bundles/points after international trade for Greenland and Iceland, respectively, are?arrow_forwardNeed helparrow_forwardPlease explain whole parts on paper please!!arrow_forward

- Question 28 The table shows the maximum quantity of cars or motorcycles that can be produced by two countries, X and Y, using equal amounts of resources. Motorcycles Cars 10 60 20 80 Based on the data in the table, which of the following is true? A B D Country X Country Y E Country X has a comparative advantage in producing cars. Country Y has a comparative advantage in producing cars. Country X has an absolute advantage in producing cars. Country X has an absolute advantage in producing motorcycles. Country Y has a comparative advantage in producing motorcycles.arrow_forwardQuestion 1A. Define and explain the theory of comparative advantage (use an example ifnecessary).B. Discuss limitations of comparative advantage (Include in your answer at leastfive key limitations to this theory).C. Spencer Grant is a New York-based investor. He has been closely following hisinvestment in 100 shares of Vaniteux, a French firm that went public in Februaryof 2010. When he purchased his 100 shares at €17.25 per share, the euro wastrading at $1.360/€. Currently, the share is trading at €28.33 per share, and thedollar has fallen to $1.4170/€.a If Spencer sells his shares today, what percentage change in the share pricewould he receive?What is the percentage change in the value of euro versus the dollar overthis same period?What would be the total return Spencer would earn on his shares if he soldthem at these rates?arrow_forwardI need help with the last two questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education