FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

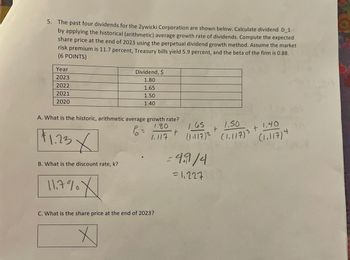

Transcribed Image Text:5. The past four dividends for the Zywicki Corporation are shown below. Calculate dividend D_1

by applying the historical (arithmetic) average growth rate of dividends. Compute the expected

share price at the end of 2023 using the perpetual dividend growth method. Assume the market

risk premium is 11.7 percent, Treasury bills yield 5.9 percent, and the beta of the firm is 0.88.

(6 POINTS)

Dividend, $

Year

2023

2022

2021

2020

1.80

1.65

1.50

1.40

A. What is the historic, arithmetic average growth rate?

$1.23 X

B. What is the discount rate, k?

11.7% X

P =

1.80

t

+

1.117

1.65

(1.117) 2 (1,117)³

1.50

3

3+1.40

(1.11714

=4.9/4

=1.227

C. What is the share price at the end of 2023?

Х

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Detroit irons last dividend was$3.00. the company's growth is expected to remain at a constant 5 percent for the foreseeable future. if investors demand a 13 percent return what is the firm's current stock price? Show formula and work. A.52.50 B.45.00 C.42.86 D.39.38 E.37.50arrow_forwardUse the Dividend Discount Model to determine the expected annual growth rate of the dividend for ELO stock. The firm is expected to pay an annual divided of $3.07 per share in one year. ELO shares are currently trading for $27.81 on the NYSE, and the expected annual rate of return for ELO shares is 16.58%. Answer as a % to 2 decimal places (e.g., 12.34% as 12.34). Answer:arrow_forwardUse Excel for this question: A company announced that it will pay a $2.00 dividend, a $2.50 dividend, and a $3.70 dividend in years 1, 2, and 3, respectively. A year 3, the dividends are expected to grow at 6% every year. What is the price of this stock today, given an 7% rate of return? O $327.23 O $342.34 O $311.46 O $389.76arrow_forward

- B4) see picturearrow_forwardThe current price of stock A is $40. The expected dividend for the next year is $2. The dividend is expected to grow at a constant growth rate in the future. The required return of stock A is 15%. Using constant-growth dividend model, the implied dividend growth rate is _______. A. 10% B. 5% C. 15% D. 0%arrow_forwardNonearrow_forward

- Use the dividend discount model to value a share of Toyota’s stock (ticker symbol: TM) as of December 31, 2021. In your application of this model, use the data provided on the most recent Toyota Value Line report to estimate the necessary dividend payment and the firm’s equity beta. Assume, that the expected growth rate of dividends in perpetuity (g) ranges from 2.5% to 3.5%/year.arrow_forwardUse the Constant Dividend Growth Model to determine the expected annual growth rate of the dividend for ELO stock. The firm is expected to pay an annual divided of $8.9 per share in one year. ELO shares are currently trading for $144.48 on the NYSE, and the expected annual rate of return for ELO shares is 12.86%. Answer as a % to 2 decimal places (e.g., 12.34% as 12.34).arrow_forwardUse the historical dividend data below to calculate the constant growth rate, estimate the price of O'Brien Ltds’ common stock knowing that the investor has an 19% required rate of return. 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 $0.41 $0.48 $0.56 $0.65 $0.75 $0.88 $0.99 $1.10 $1.13 $1.39 Question 10Answer a. g= 17.50% and Price (P0) = $56.43 b. g= 14.04% and Price (P0) = $31.49 c. g= 27.4% and Price (P0) = $300.81 d. g= 14.53% and Price (P0) = $35.60arrow_forward

- 1. XYZ Corporation is currently paying a dividend of $1.5 per share and is expected to increase this dividend by 10% per year for the next two year. After this, dividends are expected to grow at a stable rate of 4% annually. If the required rate of return on the stock is 8%, what is the current value of a share? A. $40.00 B. $42.25 C. $47.19 D. $43.62 2. JW Corporation is expected to pay a dividend of $1.80 per share next year. After that, dividends are expected to grow by 3% annually indefinitely. The current stock price is $30.00. If your required rate of return is 10%, should you purchase the stock today? Why or why not? A. No; The stock has a present value of $31.50 per share. B. Yes; The stock has a present value of $31.50 per share. C. No; The stock has a present value of $25.71 per share. D. Yes; The stock has a present value of $25.71 per share. E. No; The stock has a present value of $36.00 per share.arrow_forwardBarrow_forwardProcter and Gamble (PG) paid an annual dividend of $2.79 in 2018. You expect PG to increase its dividends by 7.9% per year for the next five years (through 2023), and thereafter by 2.7% per year. If the appropriate equity cost of capital for Procter and Gamble is 8.9% per year, use the dividend-discount model to estimate its value per share at the end of 2018.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education