FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

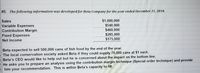

Transcribed Image Text:#5. The following information was developed for Beta Company for the year ended December 31, 2018.

$1,000,000

$540,000

$460,000

$285,000

$175,000

Sales

Variable Expenses

Contribution Margin

Fixed Expenses

Net Income

Beta expected to sell 500,000 cans of fish food by the end of the year.

The local conservation society asked Beta if they could supply 70,000 cans at $1 each.

S Beta's CEO would like to help out but he is concerned about the impact on the bottom line.

7 He asks you to prepare an analysis using the contribution margin technique (Special order technique) and provide

Bhim your recommendation. This is within Beta's capacity to fill.

Transcribed Image Text:Without Special Order

Special Order

70,000 Units

1

With Special Order

500,000 Units

Per Unit

2 Sales

Variable Expenses

Contribution Margin

Fixed Expenses

6 Operating Income

570,000

3.

4

8

% Increase in Net Income

10

11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume Rajan Manufacturing Ltd makes sports vest for local soccer, baseball, basketball, and other sports teams. Rajan, the owner, purchases the vests and prints graphics on the vests for each team. The graphics were designed several years ago, so design costs are no longer incurred. On average, Rajan sells 1,000 vests each month. Typical monthly financial data is shown below: Per Unit Total Monthly Data at 1,000 Vests Sales revenue $20 $20 000 Variable costs: Direct materials $8 $8 000 Direct labour 2 2 000 Manufacturing overhead 3 13 3 000 13 000 Contribution margin $ 7 $ 7 000 Fixed costs (rent, salaries, etc.) 4 000 Profit $ 3 000 The monthly information provided relates to the company’s routine monthly operations. A representative of the local university recently approached Rajan to ask about a one-time special order. The university will be hosting a state-wide soccer event and is willing to pay Rajan’s Manufacturing $17 per shirt to make 200 custom vests for…arrow_forwardpp. Subject :- Accountingarrow_forwardPlease help me. Thankyou.arrow_forward

- Using this information below, answer the following question: What is the Net Income required? Total sales amount to $2,000,000 Food generates 75% of total sales Food cost is $500,000 Beverages generated sales of $300,000 with a CMR of 0.85 The gift store generated the remaining sales at a cost of 30% Tax rate is 27% Annual fixed costs total $1,500,000 Group of answer choices $1,080,000 $1,010,000 $1,000,000 $1,090,000arrow_forwardAssume that you desire to operate a food truck business. You have five food trucks. Some trucks will need more repairs than others. Based on online research and discussions with other food truck owners, you determine that in a given year the following possibilities are likely. The probability of few repairs is 20% and the estimated cost is $2,500 The probability of moderate repairs is 60% with an estimated cost of $5,000 The probability of extensive repairs is 20% with an estimated cost of $25,000. What is the average expected cash flow out for repairs, based on these probabilities? Type your answer without commas or decimal places or dollar signs.arrow_forwardSuppose you are the human resource manager for a cellular phone company with 700 employees. Top management has asked you to implement three additional fringe benefits that were negotiated with employee representatives and agreed upon by a majority of the employees. These include group term life insurance, a group legal services plan, and a wellness center. The life insurance is estimated to cost $390 per employee per quarter. The legal plan will cost $468 semiannually per employee. The company will contribute 40% to the life insurance premium and 75% to the cost of the legal services plan. The employees will pay the balance through payroll deductions from their biweekly paychecks. In addition, they will be charged 1 4 % of their gross earnings per paycheck for maintaining the wellness center. The company will pay the initial cost of $600,000 to build the center. This expense will be spread over 5 years. (a) What total amount should be deducted per paycheck for these new…arrow_forward

- Assume Rajan Manufacturing Ltd makes sports vest for local soccer, baseball, basketball, and other sports teams. Rajan, the owner, purchases the vests and prints graphics on the vests for each team. The graphics were designed several years ago, so design costs are no longer incurred. On average, Rajan sells 1,000 vests each month. Typical monthly financial data is shown below: Per Unit Total Monthly Data at 1,000 Vests Sales revenue $20 $20 000 Variable costs: Direct materials $8 $8 000 Direct labour 2 2 000 Manufacturing overhead 3 13 3 000 13 000 Contribution margin $ 7 $ 7 000 Fixed costs (rent, salaries, etc.) 4 000 Profit $ 3 000 The monthly information provided relates to the company’s routine monthly operations. A representative of the local university recently approached Rajan to ask about a one-time special…arrow_forwardIf Anna Cullumber, the company’s president, is successful in increasing sales revenue by 5%, by what percent will the company’s operating income increase?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education