FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

typewritten for upvote

skip if you already did this otherwise downvote

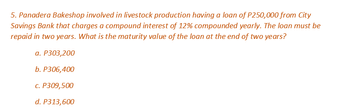

Transcribed Image Text:5. Panadera Bakeshop involved in livestock production having a loan of P250,000 from City

Savings Bank that charges a compound interest of 12% compounded yearly. The loan must be

repaid in two years. What is the maturity value of the loan at the end of two years?

a. P303,200

b. P306,400

c. P309,500

d. P313,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- AutoSave Normal 因 Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) v 11 - A^ A Aav A E E O Find - AaBbCcDc AaBbCcDc AABBCC AABBCCC AaB AABBCCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 2 3 4 Winter Company reported the following for the most recent month: Physical Units 700 Beginning work in process (60% complete) Units transferred in (started) during month Ending work in process 4,800 950 Materials are added at the end of the process and conversion costs are added evenly throughout the process. If equivalent whole units of production for conversion using the weighted average were 4,816, what percent complete was ending work in process at the end of the month? (Round to the nearest whole percent.) а. 20% b. 16%…arrow_forwardAutoSave Off File Home Module ThreeProblem Set Question3 ⚫ Saved to this PC Search Insert Page Layout Formulas Data Review View Automate Help ✗Cut Calibri 12 Α' Α' ab Wrap Text Text Copy ▾ Paste B I U ~A~ Merge & Center $ % 9 +0.00 Format Painter Clipboard √☑ Font Б Alignment √☑ Number Г A1 A B C D E F G H Accent3 Accent4 Accent5 Conditional Format as Formatting Accent6 Comma Comma [0] Table ▾ Styles Katherine Apuzzo KA Comments Share ☐☐ > AutoSum ✓ ĄT பப Fill Insert Delete Format Sort & Find & Add-ins > Clear Filter Select Cells Editing Analyze Data Add-ins J K L M N о P Q R S T U V W X Y ✓ ✓ ✓ fx Function: MAX; Formulas: Subtract; Divide; Cell Referencing 1 Function: MAX; Formulas: Subtract; Divide; Cell Referencing 2 3 BE5.7 - Using Excel to Determine Profitability Given a Constrained Reso 4 PROBLEM 5 Rachel wants to use her knitting skills to make a little extra money so she 6 can enjoy a theatre weekend with her besties. She's got the pattern down 7 for a hat, scarf, and mittens,…arrow_forwardne File Edit View History Bookmarks Profiles Tab Window Help M Inbox (2 x MACC101 x (4726) || X Account x| Account X WiConnec× M Question X Content c ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 7 Quiz i 7 7.58 points Ask Mc Graw Hill Saved QS 7-13 (Algo) Indicating journals used for posting LO P1, P2, P3, P4 The following T-accounts show postings of selected transactions. Indicate the journal used in recording each of these postings a through e. Cash Accounts Receivable Inventory Debit (d) 700 Credit (e) Debit 340 (b) 1,700 Credit (d) Debit Credit 700 (a) 1,520 (c) 1,040 Accounts Payable Sales Debit (e) 340 Credit (a) Debit 1,520 Credit (b) Cost of Goods Sold Credit Debit 1,700 (c) 1,040 Transaction a. b. C. d. e. Journal 12.020 ANE 18 tv Aarrow_forward

- Please answerarrow_forward%24 %23 AutoSave H UnitllILabAssignment Question8 Protected View O Search (Alt+Q) Off Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing :X v fx Function: SUM; Formula: Multiply, Subtract; Cell Referencing D E B. C. F. H. Function: SUM; Formula: Multiply, Subtract; Cell Referencing B Using Excel to Determine Dividends Paid to Common 4 and Preferred Stockholders Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to the Problem or work 5 PROBLEM 6 M. Bot Corporation has common stock and cumulative 7 preferred stock outstanding at December 31, 2022. No 8 dividends were declared in 2020 or 2021. area as indicated. What amount of dividends will common stockholders receive? Total dividend payment in 2022 $ 375,000 11 Preferred stock par value Annual…arrow_forwardAutoSave C. Home Insert Draw Page Layout Formulas Data Review X Times New Roman v 10 A A == Paste B I U v V A > Chapter 15 Build A Model.xlsx Automate General $%9 Read-Only Tell me Conditional Formatting Insert v Format as Table Delete v 00 20 .00 <-→0 Editing Cell Styles v Format View B C D E F G H I 0% 10% 20% 30% 40% 50% 60% 70% 80% 175 65 Xvfx A 66 67 68 69 Additional: using the (hypothetical) free cash flow stream below, calcuate and graph the NPVs (y-axis) against the various 70 Debt/Value Ratios (x-axis) in the space below (similar to Figure 15-8): 71 72 Time 73 FCF 74 0 1 2 3 4 5 -1200500 200000 350000 425000 350000 265000 Debt/Value WACC (from NPV (aka 75 Ratio above table) Firm Value) 76 0% 8.900% 77 10% 8.640% 78 20% 8.488% 79 30% 8.462% 80 40% 8.796% 81 50% 9.520% 82 60% 10.724% 83 70% 12.078% 84 85 86 $1.20 Build a Model + Ready Accessibility: Investigate MAY 6 44 Warrow_forward

- LutoSave 日 Off UnitlILabAssignment_Question1 O Search (Alt-Q) Protected View Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing fx Formula: Multiply, Subtract; Cell Referencing A D E F G H. K Formula: Multiply, Subtract; Cell Referencing Using Excel to Record Stock Entries Student Work Area PROBLEM Required: Provide input into cells shaded in yellow in this template. Select account names from the drop-down lists. Use cell references to the data area. Use mathematical formulas to calculate any amounts not given. On May 10, Jack Corporation issues common stock for cash. Shares of stock issued Par value per share 2,000 24 %24 10.00 Amount at which stock issued 18.00 Journalize the issuance of the stock. 10 11 Date Debit Credit 12 May 10 13 14 15 16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 32 33 Enter Answer Ready 24arrow_forwardin text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!!!!!!!arrow_forwardList Paragraph For the... badiya aldujaili BA AutoSave ff Search EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut - A^ A° Aav A E - E - E E E O Find - Calibri (Body) 11 AaBbCcDc AaBbCcDc AaBbC AABBCCC AaB AAB6CCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А I Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em... A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 1. 2 4 5 6. 7 If Busby Corporation's variable cost ratio is 0.75, targeted after tax net income is $27,580 (tax rate of 20%), and targeted sales volume in dollars is $219,000 then Busby's total fixed costs are: a. $27,170 b. $71,380 c. $20,275 d. $136,670 e. $129,775 f. $26,350 g. $54,750 Page 3 of 3 331 words English (United States) Focusם 160% 8:28 PM O Type here to search ENG 2/11/2021 (凸) . I . I ..?. . . E • . . L. . . t .. I ..arrow_forward

- Please solve in Excel with explanation computation for each steps answer in text formarrow_forwardAutoSave a Ch13Homework_Question5 OFF Home Insert Draw Page Layout Formulas Data Review View Tell me A Share Comments A^ A KA Insert v Liberation Sans 12 22 Wrap Text v Custom Delete v В I U A $ v % 9 .00 Conditional Format Cell Find & Select Analyze Data Paste Merge & Center v Sort & Sensitivity 00 Formatting as Table Styles Format v Filter С32 fx K L 0 P A В C D E G H J M N R S U V W X Formula: Divide; Cell Referencing 1 2 3 Using Excel to Perform Vertical Analysis PROBLEM Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to this work area. 4 5 Data from the comparative balance sheets of Rollaird Company is 6 presented here. 7 December 31, December 31, Using these data from the comparative balance sheets of Rollaird Company, perform vertical analysis. 8. 9. 2022 2021 Accounts receivable (net) $ 460,000 $ 780,000 400,000 650,000 10 11 Inventory December 31, 2022 December 31, 2021 12 Total assets…arrow_forwardFile Home Insert Page Layout Formulas Data Review View Automate Help Analytic Solver Comments Share Paste Clipboard E9 A B Arial BIU 10 - Α' Α' A Font Alignment Б Insert Σ General Delete $-% 08-08 Number Conditional Format as Cell Formatting Table Styles Styles Format Sort & Find & Filter Select Sensitivity Add-ins Analyze Data Cells Editing Sensitivity Add-ins Show ToolPak Commands Group D E F G H M N 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Problems 1. Build a data table to explore potential total savings based on annual contributions from $2,000 to $10,000 in $2,000 increments, using interest rates from 3.0% to 8.0% in 1.0% increments. Use 30 years as the term. Retirement Savings Four-for-Four Doubles Calculator Credit Score 100% Ready Accessibility: Good to goarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education