FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

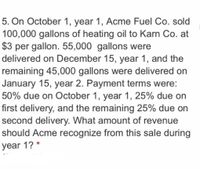

Transcribed Image Text:5. On October 1, year 1, Acme Fuel Co. sold

100,000 gallons of heating oil to Karn Co. at

$3 per gallon. 55,000 gallons were

delivered on December 15, year 1, and the

remaining 45,000 gallons were delivered on

January 15, year 2. Payment terms were:

50% due on October 1, year 1, 25% due on

first delivery, and the remaining 25% due on

second delivery. What amount of revenue

should Acme recognize from this sale during

year 1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Osgood Appliance Centre is advertising refrigerators for six monthly payments of $199, including a payment on the date of purchase. What cash price should Osgood accept if it would otherwise sell the conditional sale agreement to a finance company to yield 18% compounded monthly? A)$1150.75 B) 1242.50 C )1352.02 D) 1298.78 E) 1045.87arrow_forwardPina Colada Corp. purchased a delivery van with a $55000 list price. The company was given a $4200 cash discount by the dealer and paid $3100 sales tax. Annual insurance on the van is $1200. As a result of the purchase, by how much will Pina Colada Corp. increase its van account? $53800. $55000. $50800. $53900.arrow_forwardone received a loan of $51,000.00 at 3.50% compounded quarterly to purchase machinery for its factory. Calculate the time period of the loan if the total amount of interest paid was $17,582.10.arrow_forward

- Belk Co. sells extended service contracts on automobiles for cash. The service contracts are for a one-year, two-year, or three-year period. Cash receipts from customers are credited to Unearned Service Contract Revenue and this account had a balance of $450,000 at Dec. 31, 20A1 before year-end adjustment. Service contract costs are charged as incurred to the Service Contract Expense account, which had a balance of $100,000 at Dec. 31, 20A1. Outstanding service contracts at Dec. 31, 20A1 expire as follows:During 20A2: $90,000During 20A3: $160,000During 20A4: $70,000What amount should be reported as Unearned Service Contract Revenue in Belk's Dec. 31, 20A1 balance sheet? Group of answer choices $ 0 $220,000 $320,000 $130,000arrow_forwardKinston Industries issued $4,000,000 in commercial paper which matures in six months and received $3,876,000. Calculate the effective annual rate that Kinston is paying.arrow_forwardStratus Inc. purchased equipment for $18,500 and received an invoice with terms 4/10, 3/30, n/45. If Stratus Inc. decided to pay the full price on the 15th day of the invoice date, how much must it pay?arrow_forward

- Memanarrow_forwardA construction company takes a loan of $1,322,000 to cover the cost of a new grader. If the interest rate is 7.95% APR, and payments are made monthly for five years, what percentage of the outstanding principal does the company pay in interest each month? A. 0.76% B. 6.63% C. 0.61% D. 0.71% E. 0.66%arrow_forwardor each of the separate revenue contract scenarios 1 through 5, (a) measure the transaction price and (b) determine whether the transaction price is fixed, variable, or some combination of both. 1. Loyola Inc. sells $70,000 of inventory during the year to customers for $140,000. Loyola Inc. accepts returns up to 3 months after the date of purchase. Loyola estimates returns to be 6% of sales. a. Transaction price Answer b. Variable consideration Answer Fixed consideration Answer 2. Nakoma Corp. sells product offering a retroactive volume discount on certain cumulative sales volumes as follows: 0 to 500 units cost $10 each; 501 to 1,000 units cost $9 each; 1,001 units and beyond cost $8 each. For Nakoma’s largest customer, Nakoma estimates the likelihood of cumulative purchases for the year as follows: 15% for 400 units, 50% for 800 units, and 35% for 1,200 units. The revenue contract stipulates that the price per unit of product will be adjusted retroactively once…arrow_forward

- Required information [The following information applies to the questions displayed below.] Foster Supplies is a wholesaler of hair supplies. Foster Supplies uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $34,917). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $390). c. Sold merchandise (costing $9,595) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $310) after year-end from sales made during the year. $ 62,080 420 20,200 10,100 194 430arrow_forward1arrow_forwardIV. A new sound system is being installed at Club Falcon. The invoice, dated June 9, shows the total cost of the equipment as $16,480. Shipping charges amount to $516, and insurance is $81.20. Terms of sale are 2/10 prox. If the invoice is paid on July 9, what is the net amount due?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education