FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

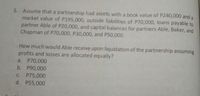

Transcribed Image Text:5. Assume that a partnership had assets with a book value of P240,000 and a

market value of P195,000, outside liabilities of P70,000, loans payable to

partner Able of P20,000, and capital balances for partners Able, Baker, and

Chapman of P70,000, P30,000, and P50,000.

How much would Able receive upon liquidation of the partnership assuming

profits and losses are allocated equally?

a. P70,000

b. P90,000

C. P75,000

d. P55,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3. A and B agreed to form a partnership. A contributed P40,000 cash while B contributed equipment with fair value of P100,000. However due to the expertise that A will be bringing to the partnership, the partners agreed that they should initially have an equal interest in the partnership capital. Requirement: Provide the journal entry to record the initial investments of the partners. Option 1 Clear selectionarrow_forwardThe partnership which is being liquidated by installment method has a final cash balance of P100,000 after selling all the non-cash assets. The Profit and Loss ratio is 5:3:2. Partners' capital accounts are as follow: A, Capital - P70,000; B, Capital - P40,000; C, Capital - (P10,000). C is already insolvent. What is the distribution of cash to all the partners? a.) A - P33,333 B - P33,333 C - P33,333 b.) A - P50,000; B - P30,000; C - P20,000 c.) A - P50,000; B - P50,000; C - None d.) A - P63,750 B - P36,250 C - None SHOW COMPLETE SOLUTIONarrow_forwardIf the total cash available for distribution to the partners as settlement of their claims in the partnership was P278,000, for how much were the non-cash assets sold?arrow_forward

- A and B formed a partnership and agreed to divide initial capital equally even if A contributed P100,000 and B contributed P84,000 in identifiable assets. Under the bonus approach to adjust the capital accounts, what amount should be debited to B's unidentifiable assets?arrow_forwardT2 would like to purchase a partnership interest from T1. At the time of the purchase, T1's outside basis in the partnership interest is $20,000, which includes $3,000 of liabilities of the partnership allocable to T1. Determine T2's initial outside basis in the partnership interest if he acquires it from T1 for $27,500 in cash. Type your answer...arrow_forward8. Dunn and Grey are partners with capital account balances of $60,000 and $90,000, respectively. They agree to admit Zorn as a partner with a one-third interest in capital and profits, for an investment of $100,000, after revaluing the assets of Dunn and Grey. Goodwill to the original partners should be a. $0 b. $33,333 c. $50,000 d. $66,667arrow_forward

- Show the computationarrow_forwardA and B formed a 60:40 capital interest in AB Partnership with the following contribution: A B Land P1,000,000 - Building - P 800,000 Mortgage - 50,000 They agreed that the land will be valued at P1,500,000 and the mortgage will be assumed by the partnership. Part of the agreement also provided that the building already reflects its fair value. Assuming A is the base, how much should B contribute or (withdraw) to be in accordance with their capital interest? 133,333250,000200,000(P83,333) Assuming B is the base, how much should A contribute or (withdraw) to be in accordance with their capital interest?(P300,000)(P375,000)200,000125,000arrow_forwardFor Industry H, determine each partner's share of income assuming the partners agree to share income by giving a $67,700 per year salary allowance to Price, a $126,100 per year salary allowance to Waterhouse, a $113,700 per year salary allowance to Coopers, a 15% interest on their initial capital investments, and the remaining balance shared equally. (Enter all allowances as positive values. Enter losses as negative values.) Important! Be sure to click the correct Industry at the top of the dashboard. Net income (loss) Salary allowances Balance of income (loss) Interest allowances Balance of income (loss) Balance allocated equally Balance of income (loss) Shares of each partner Initial partnership investments Net income Allocation of Partnership Income Price Total net income Total 0 Waterhouse $ $ PRICE, WATERHOUSE, AND COOPERS Statement of Partners' Equity For Year Ended December 31 Price Coopers 0 0 Waterhouse 0 0 0 $ For Industry H, prepare a statement of partners' equity for the…arrow_forward

- Which of the following would be classified as disproportionate distributions? Assume A and B each own 50% interests in the AB Partnership, the partnership owns hot assets, and the partners remain partners in AB partnership. Question 18 options: a. Partner A receives $6,000 cash and Partner B receives a capital asset valued at $6,000. b. Partner A received $6,000 cash and Partner B receives inventory items valued at $6,000 (basis $3,500). c. Both partners receive unrealized accounts receivables with a basis of $0 and a value of $6,000. d. Items a. and c. represent disproportionate distributions e. Items b. and c. represent disproportionate distributions.arrow_forward2. Hammer and Nail formed a partnership. Hammer contributed equipment with original cost of P370,000 and fair value of P300,000 while Nail contributed cash of P180,000. Hammer and Nail agreed to have a 60:40 interest in the partnership and that their initial capital credits should reflect this fact. A partner's capital account should be increased accordingly by way of additional cash investment. Which of the partners should make an additional investment and by how much? a. Hammer, P20,000 b. Nail, P20,000 c. Hammer, P70,000 d. Nail, P70,000arrow_forward4. Under partnershiparrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education