FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

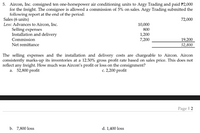

Transcribed Image Text:5. Aircon, Inc. consigned ten one-horsepower air conditioning units to Argy Trading and paid P2,000

for the freight. The consignee is allowed a commission of 5% on sales. Argy Trading submitted the

following report at the end of the period:

Sales (6 units)

Less: Advances to Aircon, Inc.

Selling expenses

Installation and delivery

Commission

72,000

10,000

800

1,200

7,200

19,200

52,800

Net remittance

The selling expenses and the installation and delivery costs are chargeable to Aircon. Aircon

consistently marks-up its inventories at a 12.50% gross profit rate based on sales price. This does not

reflect any freight. How much was Aircon's profit or loss on the consignment?

a. 52,800 profit

c. 2,200 profit

Page I 2

b. 7,800 loss

d. 1,400 loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Carla Vista Corporation shipped $20,100 of merchandise on consignment to Wildhorse Company. Carla Vista paid freight costs of $2,000. Wildhorse Company paid $510 for local advertising, which is reimbursable from Carla Vista. By year-end, 58% of the merchandise had been sold for $20,100. Wildhorse notified Carla Vista, retained a 10% commission, and remitted the cash due to Carla Vista. Prepare Carla Vista's journal entry when the cash is received. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)arrow_forwardMarkson and Sons leases a copy machine with terms that include a fixed fee each month of $500 plus a charge for each copy made. The company uses the high-low method to analyze costs and Markson paid $360 for 5,000 copies and $280 for 3,000 copies,arrow_forwardDinesh Bhaiarrow_forward

- Nonearrow_forwardNonearrow_forwardSteele Corp. purchases equipment for $23,000. Regarding the purchase, Steele recorded the following transactions: • Paid shipping of $800. • Paid installation fees of $1,600. • Pays annual maintenance cost of $220. • Received a 5% discount on $23,000 sales price. Determine the acquisition cost of the equipment. $fill in the blank 1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education