MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

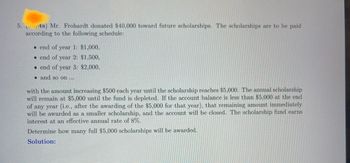

Transcribed Image Text:**5. (6 pts) Mr. Frohardt donated $40,000 toward future scholarships. The scholarships are to be paid according to the following schedule:**

- End of year 1: $1,000

- End of year 2: $1,500

- End of year 3: $2,000

- and so on...

**with the amount increasing $500 each year until the scholarship reaches $5,000.**

The annual scholarship will remain at $5,000 until the fund is depleted. If the account balance is less than $5,000 at the end of any year (i.e., after the awarding of the $5,000 for that year), that remaining amount immediately will be awarded as a smaller scholarship, and the account will be closed. The scholarship fund earns interest at an effective annual rate of 8%.

**Determine how many full $5,000 scholarships will be awarded.**

**Solution:**

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Similar questions

- A charity is building a home for a low-income family. The house will cost $85,000.00 to build. The family will make monthly payments of $250.00 until the loan is paid. (a) How long will it take for the family to pay off the loan?(b) What monthly payments would it take to pay off the loan if they were charged 6% interest and the length of the loan were the same as in part (a)?arrow_forwardIs the following problem a percent increase problem or a percent decrease problem? Pat earns $10 per hour. She will be getting a 5% pay raise next year. What will be her new hourly pay?arrow_forwardA patient’s insurance policy states:Annual deductible: $300.00Coinsurance: 70-30This year the patient has made payments totaling $533 to all providers. Today the patient has an office visit (fee: $80). The patient presents a credit card for payment of today’s bill. What is the amount that the patient should pay?arrow_forward

- Compute the total cost per year of the following pair of expenses. Then complete the sentence: On an annual basis, the first set of expenses is _______% of the second set of expenses. Vern buys fourlottery tickets each week at a cost of $5 each and spends $800 per year on his textbooks.arrow_forwardThree invoices for the amounts of $35,300, $27,000, and $40,600 were received on August 5, 2014, September 4, 2014, and September 27, 2014, respectively. If the payment terms are 3/7, 2/30, n/60, calculate the amount that must be paid on October 4, 2014 to settle all three invoices. Round to the nearest centarrow_forwardYou will be in graduate school for the next two years. You borrowed some money from the bank for your graduate education, which the bank has accepted to be paid after you graduate from school in three years. The bank has accepted to the following payment plan; from the beginning of Year 3 (25th month) to end of year 5 (60th month), pay $950 per month 25 and increase payment by 2% every month thereafter. How much money should you put aside each month (equal amount) for the first 24 months (during graduate school) such that you can pay the loan back after graduation? Use an APR of 12%, compounded monthly. Question 7 Part A.arrow_forward

- Consider each of the after-tax cash flows shown in the table below. Suppose that projects B and C are mutually exclusive. Suppose also that the required service period is eight years and that the company is considering leasing comparable equipment with an annual lease expense of $3,000, payable at the end of each year for the remaining years of the required service period. Which project is a better choice at 15%? Click the icon to view the cash flows for the projects. Click the icon to view the interest factors for discrete compounding when i=15% per year. The present worth of project B is $thousand. (Round to one decimal place.) More Info Capital Single Payment Compound Amount Factor (F/P, i, N) Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, i, N) Compound Amount Factor (F/A, i, N) 1.0000 More Info Recovery Factor (A/P, i, N) 1.1500 (P/A, i, N) 1.1500 1.0000 0.8696 1.3225 2.1500 0.4651 1.6257 0.6151 B с 1.5209 3.4725 0.2880 2.2832 0.4380 - $7,000 -$5,000 1.7490…arrow_forwardTaxable Income: A woman earned wages of $48,200, received $1200 in interest from a savings account, and contributed $2900 to a tax-deferred retirement plan. She also had deductions totaling $6580. She was entitled to a personal exemption of $4,050 a standard deduction Find her gross income, adjusted gross income, and taxable of $6,300. income. Her gross income is A b. Her adjusted gross income is c. Her taxable income is Desk 1 Z Oarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman