FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:5

6

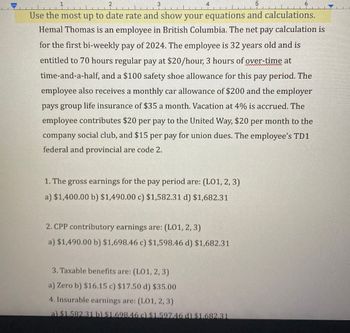

Use the most up to date rate and show your equations and calculations.

Hemal Thomas is an employee in British Columbia. The net pay calculation is

for the first bi-weekly pay of 2024. The employee is 32 years old and is

entitled to 70 hours regular pay at $20/hour, 3 hours of over-time at

time-and-a-half, and a $100 safety shoe allowance for this pay period. The

employee also receives a monthly car allowance of $200 and the employer

pays group life insurance of $35 a month. Vacation at 4% is accrued. The

employee contributes $20 per pay to the United Way, $20 per month to the

company social club, and $15 per pay for union dues. The employee's TD1

federal and provincial are code 2.

1. The gross earnings for the pay period are: (L01, 2, 3)

a) $1,400.00 b) $1,490.00 c) $1,582.31 d) $1,682.31

2. CPP contributory earnings are: (LO1, 2, 3)

a) $1,490.00 b) $1,698.46 c) $1,598.46 d) $1,682.31

3. Taxable benefits are: (LO1, 2, 3)

a) Zero b) $16.15 c) $17.50 d) $35.00

4. Insurable earnings are: (L01, 2, 3)

a) $1.582.31 b) $1.698.46 c) $1.597.46 d) $1.682.31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ! Required information [The following information applies to the questions displayed below.] Greer Utsey earned $49,200 in 2023 for a company in Kentucky. Greer is single with one dependent under 17 and is paid weekly. The FUTA rate in Kentucky for 2023 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in Appendix D. Manual payroll system is used and Box 2 is not checked. Required: Compute the following employee share of the taxes for the third weekly payroll of the year. Note: Do not round intermediate calculation. Round your final answers to 2 decimal places. Federal income tax withholding Social Security tax Medicare tax State income tax withholdingarrow_forward! Required information [The following information applies to the questions displayed below.] Greer Utsey earned $48,400 in 2022 for a company in Kentucky. Greer is single with one dependent under 17 and is paid weekly. The FUTA rate in Kentucky for 2022 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in Appendix D. Manual payroll system is used and Box 2 is not checked. Required: Compute the employer's share of the taxes for the third weekly payroll of the year. Note: Do not round intermediate calculation. Round your final answer to 2 decimal places. Answer is complete but not entirely correct. S S Federal income tax withholding Social Security tax Medicare tax FUTA tax SUTA tax State income tax withholding 60 S S GA 60 $ SA 930.77 57.68 X 13.49 5.58 50.22 X 187.52 Xarrow_forwardes ! Required information [The following information applies to the questions displayed below.] Greer Utsey earned $48,400 in 2022 for a company in Kentucky. Greer is single with one dependent under 17 and is paid weekly. The FUTA rate in Kentucky for 2022 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in Appendix D. Manual payroll system is used and Box 2 is not checked. Required: Compute the following employee share of the taxes for the third weekly payroll of the year. Note: Do not round intermediate calculation. Round your final answers to 2 decimal places. Federal income tax withholding Social Security tax Medicare tax State income tax withholding $ 13.49arrow_forward

- Lucille receives an annual salary of $37,500 based on a 37.5-hour workweek. What are her gross earnings for a two-week pay period in which she works 9 hours of overtime at 112112 times her regular rate of pay? (Assume there are exactly 52 weeks in a year. Round your answer to the nearest cent.)arrow_forwardEmployees that live in a state where the minimum wage is $7.40, their employer will pay them $fill in the blank f74d610d8fe6025_13 per hour.arrow_forwardCan I do a general journal entry on this scenario, if so how do i do it? Master Flow’s first employee, Emma Stone starts at the Company. She will be responsible for Warehouse Management. She will be paid $20 / Hour. Emma works 30 Hours / Pay Period (every two weeks). The pay period ends on 12-31-20. Emma’s Federal Tax Withholding is $50, based on her W4, and all other standard payroll taxes apply at their appropriate rates. She does not receive benefits and does not have any contributions of any type withheld from her pay.arrow_forward

- 1. The contribution limit for a Payroll Deduction IRA increases once an employee reaches _____ years of age. Answer: A. 40 B. 45 C. 50 D. 55 2. Carrie Rosenberg worked 44 hours the first week of the calendar year and earns regular wages of $18/hour. She is paid an overtime rate 1.5 times her regular wage rate, contributes 2% of her gross pay to a 401(k) plan, and contributes $40/week to a flexible spending account. Her Social Security tax for the week is $______ . 3. What types of wage garnishments are typically satisfied before others? Answer: A. Student loan payments and state/federal tax levies B. Alimony and child support payments C. Child support payments and federal tax levies D. State and federal tax leviesarrow_forwardDoris MacNeil works for Modem Furniture in Alberta and receives the following remuneration on her pay: Bi-weekly salary $1,364.85 Overtime 342.96 4% vacation pay on overtime 13.72 Group term life insurance non-cash taxable benefit 15.75 Taxable car allowance 75.00 What is Doris’ gross pensionable/taxable income for this pay? Show your calculationsarrow_forwardA8 please help.....arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education