FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

O 0:09:40 ook Giannitti Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. Data for the upcoming year appear below: Estimated machine-hours Estimated variable manufacturing overhead Estimated total fixed manufacturing overhead The predetermined overhead rate for the recently completed year was closest to: Multiple Choice $10.20 per machine-hour $15.02 per machine-hour $6.66 per machine-hour 72,200 $ 3.40 per machine-hour $ 838,800 1

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

Transcribed Image Text:O

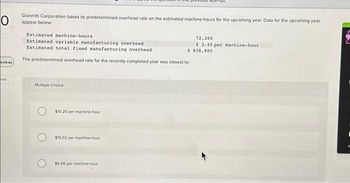

Giannitti Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. Data for the upcoming year

appear below:

0:09:40

ook

Estimated machine-hours

Estimated variable manufacturing overhead

Estimated total fixed manufacturing overhead

$

The predetermined overhead rate for the recently completed year was closest to:

Multiple Choice

$10.20 per machine-hour

$15.02 per machine-hour

empe

$6.66 per machine-hour

72,200

$ 3.40 per machine-hour.

838,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4. UFC Inc. applies factory overhead as follows: Department Per Machine HourFabricating P10Spreading P20Packaging P30Actual machine hours are:Fabricating – 2,000 hoursSpreading – 1,500 hoursPackaging – 3,000 hoursThe following additional data are provided:a. The actual factory overhead expense for the period is P100,000b. The ending balances of the inventories and cost of goods sold after the application of overhead are asfollows: Raw materials 200,000Work in process 100,000Finished goods 400,000Cost of goods sold 500,000 c. The over/(under) applied overhead during the period is considered material if at least 30% of actualfactory overhead, What is the adjusted cost of goods sold after closing the under/over application of factory overhead?A. 460,000B. 480,000C. 540,000D. 483,333arrow_forwardExercise #1 The following information is estimated by Blue Sea Ltd’s accountant for the upcoming financial year: Sales revenue 3,480,000 Machine hours 54,000 Direct labour hours 81,000 Direct labour rate $22.00 Manufacturing overhead 1,326,000 Required: Calculate the predetermined overhead rates assuming that the cost driver is: Direct labour hours Direct labour costs Machine hoursarrow_forward15arrow_forward

- Saved The following date Is for a company that uses a job-order costing system: Estimated direct labor hours Estimated manufacturing overhead costs Actual direct labor hours Actual manufacturing overhead costs 12,000 $39,000 11,000 S37,000 Overhead Is applied based on direct labor-hours. What Is the predetermined overhead rate? Multiple Cholce $3.08 per direct labor-hour $3.25 per direct labor-hour $3.36 per direct labor-hour $3.55 per direct labor-hourarrow_forwardPlease do not give solution in image format thankuarrow_forward14arrow_forward

- esc QUESTION 10 Shoes Wisely, Inc. allocates overhead using machine hours as the allocation base. The following information was estimated at the beginning of the year: Estimated Manufacturing Overhead $68,000 Estimated Machine Hours 18,000 Actual overhead totaled $72,000. During the year, the company produced 8,500 units of product using 14,000 machine hours and 60,000 direct labor hours. How much manufacturing overhead was allcoated to the product during the year? Round your answer to whole dollars. Click Save and Submit to save and submit. Click Save All Answers to save all answers. 1 Q A D 8 2 W S # 3 X E D $ 4 CE R C % от оро 5 F MacBook Pro T 6 V G ✓ lo 7 Y H B 00 * 8 с J O Narrow_forwardPredetermined Overhead Rate Calculation: Estimated Annual Overhead: $720,000 Estimated Annual Direct Labor Hours: 24,000 Predetermined Overhead Rate: [To be calculated] Overhead Applied to Jobs during the Period: Overhead Applied: [To be calculated] Total Cost of Jobs 102 and 103 at the End of the Period: Job 102: [To be calculated] Job 103: [To be calculated] Cost of Jobs on the Balance Sheet: Job 102: [Specify location on the balance sheet] Job 103: [Specify location on the balance sheet] Journal Entries in the 'T' Accounts (Ledger Accounts Tab): [List the journal entries and their corresponding accounts] Ending Balances in All Accounts (Ledger Accounts Tab): [List the ending balances of each account] Over- or Underapplied Overhead Calculation (Ledger Accounts Tab): Over- or Underapplied Overhead: [To be calculated] Journal Entry to Dispose of Overhead Balance (Ledger Accounts Tab): [Provide the journal entry to dispose of the overhead balance]…arrow_forwardA company expected its annual overhead costs to be $813200 and machine hours to equal 107000 hours. Actual overhead was $749000, and actual machine hours totalled 98000 hours. How much overhead was over or underapplied? $4200 underapplied O $68400 underapplied O $69000 over-applied O $64400 underappliedarrow_forward

- A 19arrow_forwardQUESTION 7 Shoes Wisely, Inc. allocates overhead using machine hours as the allocation base. The following information was estimated at the beginning of the year: Estimated Manufacturing Overhead $83,000 Estimated Machine Hours 13,000 Actual overhead totaled $72,000. During the year, the company produced 8,500 units of product using 14,000 machine hours and 60,000 direct labor hours. How much manufacturing overhead was allcoated to the product during the year? Round your answer to whole dollars.arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education