Microeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN: 9781305506893

Author: James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I need helph with questions 4.10 and 4.11 with some explanation

answers for both questions are provided

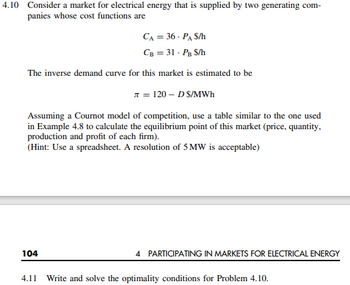

Transcribed Image Text:4.10 Consider a market for electrical energy that is supplied by two generating com-

panies whose cost functions are

CA = 36 - PA $/h

CB = 31 - PB S/h

The inverse demand curve for this market is estimated to be

л=120-DS/MWh

Assuming a Cournot model of competition, use a table similar to the one used

in Example 4.8 to calculate the equilibrium point of this market (price, quantity,

production and profit of each firm).

(Hint: Use a spreadsheet. A resolution of 5 MW is acceptable)

104

4.11

4 PARTICIPATING IN MARKETS FOR ELECTRICAL ENERGY

Write and solve the optimality conditions for Problem 4.10.

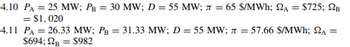

Transcribed Image Text:4.10 PA = 25 MW; PB = 30 MW; D = 55 MW; л = 65 $/MWh; NA = $725; B

= $1,020

4.11 PA = 26.33 MW; PB = 31.33 MW; D = 55 MW; л = 57.66 $/MWh; 2A =

$694; B = $982

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- May and Raj me the only two growers who provide organically grown corn to a local grocery store. They know that if they cooperated and produced less corn, they could raise the price of the com. If they work independently, they will each earn 100. If they decide to work together and both lower their output, they call each earn 150. If one person lowers output and the other does not, the person who lowers output will earn $1 and the other person will capture the entire market and will earn 200. Table 10.6 represents the choices available to Mary and Raj. What is the best choice for Raj if he is sole that Mary will cooperate? If Mary thinks Raj will cheat, what should Mary do and why? What is the prisoners dilemma result? What is the preferred choice if they could ensure cooperation? A = Work independently; B = Cooperate and Lower Output. (Each results entry lists Rajs earnings first, and Marys earnings second.)arrow_forwardA firm in a perfectly competitive industry has patented a newprocess for making widgets. The new process lowers the firm’saverage cost, meaning that this firm alone (although still aprice taker) can earn real economic profits in the long run. a. If the market price is $20 per widget and the firm’s marginalcost is given by MC=0.4q , where q is the dailywidget production for the firm, how many widgets willthe firm produce? b. Suppose a government study has found that the firm’snew process is polluting the air and estimates the socialmarginal cost of widget production by this firm to be. If the market price is still $20, what is thesocially optimal level of production for the firm? Whatshould be the rate of a government-imposed excise tax tobring about this optimal level of production? c. Graph your results.arrow_forwardAjax Cleaning Products is a medium-sized firm operating in an industry dominated by one large firm—Tile King. Ajax produces a multiheaded tunnel wall scrubber that is similar to a model produced by Tile King. Ajax decides to charge the same price as Tile King to avoid the possibility of a price war. The pnce charged by Tile King is $20,000. Ajax has the following short-run cost curve: TC=800,0005,000Q+100Q2 Compute the marginal cost curve for Ajax. Given Ajaxs pricing strategy, what is the marginal venue function for Ajax? Compute the profit-maximizing level of output for Ajax. Compute Ajaxs total dollar profits.arrow_forward

- Return to Figure 9.2. Suppose P0 is 10 and P1 is 11. Suppose a new firm with the same LRAC curve as the incumbent tries to bleak into the market by selling 4,000 units of output. Estimate from the graph what the new firms average cost of producing output would be. If the incumbent continues. to produce 6,000 units, how much output would the two films supply to the market? Estimate what would happen to the market price as a result of the supply of both the incumbent firm and the new entrant. Approximately how much profit would each firm earn? Figure 9.2 Economics of Scale and Natural Monoployarrow_forwardSome years ago. two intercity bus companies, Greyhound Lines, Inc. and Trailways Transportation System, wanted to merge. One possible definition of the market for this case was the market for intercity bus service. Another possible definition was the market for intercity transportation, including personal cars, car rentals, passenger trains, and commuter air flights.' Which definition do you think the bus companies preferred, and why?arrow_forwardWould you rather have efficiency or variety? That is, one opportunity cost of the variety of products we have is that each product costs more per unit than if there were only one kind of product of a given type, like shoes. Perhaps a better question is, What is the right amount of variety? Can there be too many varieties of shoes, for example?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax