Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

I need help completing 4-7

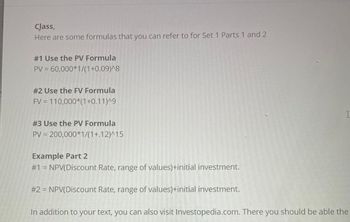

Transcribed Image Text:Class,

Here are some formulas that you can refer to for Set 1 Parts 1 and 2

#1 Use the PV Formula

PV = 60,000*1/(1+0.09)^8

#2 Use the FV Formula

FV = 110,000*(1+0.11)^9

#3 Use the PV Formula

PV = 200,000*1/(1+.12)^15

Example Part 2

#1 = NPV(Discount Rate, range of values)+initial investment.

#2 = NPV(Discount Rate, range of values)+initial investment.

I

In addition to your text, you can also visit Investopedia.com. There you should be able the

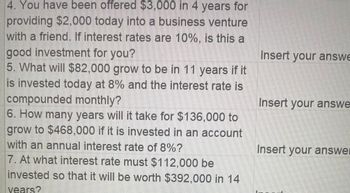

Transcribed Image Text:4. You have been offered $3,000 in 4 years for

providing $2,000 today into a business venture

with a friend. If interest rates are 10%, is this a

good investment for you?

5. What will $82,000 grow to be in 11 years if it

is invested today at 8% and the interest rate is

compounded monthly?

6. How many years will it take for $136,000 to

grow to $468,000 if it is invested in an account

with an annual interest rate of 8%?

7. At what interest rate must $112,000 be

invested so that it will be worth $392,000 in 14

vears?

Insert your answe

Insert your answe

Insert your answe

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- please help with parts a,b, and carrow_forwardAccounting Questionarrow_forwardeducation.wiley.com Ch 1: Ho... WP NWP AS... С Maria Q.. b Search.. The Acc... Cengag... financia... WileyPL... financia... BB Financi.. Accoun... X - Cha... e Ch 1: Homework Question 4 of 5 - / 20 View Policies Current Attempt in Progress Van Occupanther is the bookkeeper for Roscoe Company. Van has been trying to get the balance sheet of Roscoe Company to balance. Roscoe's balance sheet is as follows. ROSCOE COMPANY Balance Sheet December 31, 2022 Assets Liabilities Cash $ 9,400 Accounts payable $25,000 Supplies 7,100 Accounts receivable (19,500) Equipment 45,000 Common stock 40,000 Dividends 9,200 Retained earnings 25,200 Total assets $70,700 Total liabilities and stockholders' equity $70,700 Prepare a correct balance sheet. (List Assets in order of liquidity.) ROSCOE COMPANY Balance Sheet 田 IIarrow_forward

- ITS-The Political S A M7: Assignment No.1 10201Ox/aMzlzNzk 1NTQxNDg2/details ВА.. e Home | Edmodo O Spoliarium by Juan.. w You searched for Re.. W Operating Performa... 1 Otn.docxlo. Open with Activity No.: Topic : The Worksheet Problems The following are all the steps in the accounting cycle. List them they should be done. 1. the order in which Closing entries are journalized and posted to the ledger. - An unadjusted trial balance is prepared. - An optional end-of-period spreadsheet (worksheet) is prepared. -A post-closing trial balance is prepared. - Adjusting entries are journalized and posted to the ledger. - Transactions are analyzed and recorded in the journal. Adjustment data are assembled and analyzed. -Financial statements are prepared An adjusted trial balance is prepared Transactions are posted to the ledger 2. 7. 8. 6. 10 The balances for the accounts listed below appeared in the Adjusted Tral Balance columns of the work the Income Statement columns or iobtndicato ther cach…arrow_forwardNot a previously submitted question. Thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education