FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

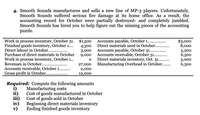

Transcribed Image Text:4. Smooth Sounds manufactures and sells a new line of MP-3 players. Unfortunately,

Smooth Sounds suffered serious fire damage at its home office. As a result, the

accounting record for October were partially destroyed- and completely jumbled.

Smooth Sounds has hired you to help figure out the missing pieces of the accounting

puzzle.

Work in process inventory, October 31.

Finished goods inventory, October 1...

Direct labour in October...

Purchase of direct materials in October

$1,500

Accounts payable, October 1..

Direct materials used in October.

Accounts payable, October 31..

Accounts receivable, October 31....

Direct materials inventory, Oct. 31....

Manufacturing Overhead in October..

$3,000

8,000

4,300

3,000

9,000

5,200

6,500

Work in process inventory, October 1...

Revenues in October....

Accounts receivable, October 1.. .

Gross profit in October...

3,000

27,000

6,300

2,000

12,000

Required: Compute the following amounts

i)

ii)

iii)

iv)

v)

Manufacturing costs

Cost of goods manufactured in October

Cost of goods sold in October

Beginning direct materials inventory

Ending finished goods inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please don't give images in solution thankuarrow_forwardRon Howard recently took over as the controller of Johnson Brothers Manufacturing. Last month, the previous controller left the company with little notice and left the accounting records in disarray. Ron needs the ending inventory balances to report first-quarter numbers. For the previous month (March 2017) Ron was able to piece together the following information:Direct materials purchased $120,000 Work-in-process inventory, 3/1/2017 $ 35,000 Direct materials inventory, 3/1/2017 $ 12,500 Finished-goods inventory, 3/1/2017 $160,000 Conversion costs $330,000 Total manufacturing costs added during the period $420,000 Cost of goods manufactured 4 times direct materials used Gross margin as a percentage of revenues 20% Revenues $518,750 Calculate the cost of: 1. Finished-goods inventory, 3/31/2017 2. Work-in-process inventory, 3/31/2017 3. Direct materials inventory, 3/31/2017arrow_forward1. Fortune, Ltd. produces reproductions of antique residential moldings a plant located in Indang Cavite. August 1, the start of the company's fiscal year, inventory account balances were as follows: Raw materials Work in process Finished goods P10,000 4,000 8,000 During the year, the following transactions were completed: Raw materials purchased on account, P160,000. • Raw materials requisitioned for use in production, P140,000 (materials costing P120,000 were chargeable directly to jobs, the remaining materials were indirect). Costs for employee services were incurred as follows: Direct labor Indirect labor P90,000 60,000 20,000 50,000 Sales commissions Administrative salaries • Prepaid insurance expired during the year, P18,000 (13,000 of this amount related to factory operations, and the remainder related to selling and administrative activities). • Utity costs incurred in the factory, P10,000. • Advertising costs incurred, P15,000 Depreciation recorded on equipment, P25,000.…arrow_forward

- 22.arrow_forwardHello, I need some assistance with required question 3 at bottom of the first document. I'm having trouble with the Schedule of Cost of Goods Sold. I attached the Journal Entry I did if it helps.arrow_forwardAlert for not submit AI generated answer. I need unique and correct answer. Don't try to copy from anywhere. Do not give answer in image formet and hand writingarrow_forward

- Please do not give solution in image formatarrow_forwardOn November 30, 2022, there was a fire in the factory of Able Manufacturing Limited, where you work as the controller. The work in process inventory was completely destroyed, but both the materials and finished goods inventories were undamaged. Able uses normal job-order costing and its fiscal year end is December 31. Selected information for the periods ended October 31, 2022, and November 30, 2022, follows: October 31, 2022 November 30, 2022 Supplies (including both direct and indirect materials) $ 79,250 $ 73,250 Work in process inventory 58,875 ? Finished goods inventory 60,000 63,000 Cost of goods sold (year to date) 576,000 656,000 Accounts payable (relates to materials purchased only) 17,960 53,540 Manufacturing overhead incurred (year to date) 129,500 163,300 Manufacturing overhead applied 128,700 ? Other information for November 2022: Cash payments to…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education