Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Please show your work.

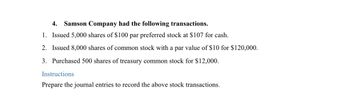

Transcribed Image Text:4. Samson Company had the following transactions.

1. Issued 5,000 shares of $100 par preferred stock at $107 for cash.

2. Issued 8,000 shares of common stock with a par value of $10 for $120,000.

3. Purchased 500 shares of treasury common stock for $12,000.

Instructions

Prepare the journal entries to record the above stock transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Prepare general journal entries for the following transactions of GOTE Company: (a) Received subscriptions for 10,000 shares of 2 par common stock for 80,000. (b) Received payment of 30,000 on the stock subscription in transaction (a). (c) Received the balance in full for the stock subscription in transaction (a) and issued the stock. (d) Purchased 1,000 shares of its own 2 par common stock for 7.50 a share. (e) Sold 500 shares of the stock on transaction (d) for 8.50 a share.arrow_forwardThe following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the current fiscal year: During the year, the corporation completed a number of transactions affecting the stockholders equity. They are summarized as follows: a. Issued 500,000 shares of common stock at 8, receiving cash. b. Issued 10,000 shares of preferred 1% stock at 60. c. Purchased 50,000 shares of treasury common for 7 per share. d. Sold 20,000 shares of treasury common for 9 per share. e. Sold 5,000 shares of treasury common for 6 per share. f. Declared cash dividends of 0.50 per share on preferred stock and 0.08 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.arrow_forwardPrepare the stockholders equity section of the balance sheet based on the following account balances: Common stock, 2 par, 60,000 shares 120,000 Preferred stock, 10 par, 5%, 4,000 shares 40,000 Common stock subscribed, 2 par, 3,000 shares 6,000 Retained earnings 17,000 The answers to the Self-Study Test Questions are at the end of the chapter (pages 811812).arrow_forward

- Vaughn Company had the following transactions. 1. 2. Issued 4,600 shares of common stock with a stated value of $10 for $131,000. Issued 2,200 shares of $100 par preferred stock at $110 for cash. Prepare the journal entries to record the above stock transactions. (List all debit entries before automatically indented when the amount is entered. Do not indent manually.)arrow_forwardPrepare the journal entry to record Zende Company's issuance of 65,000 shares of $4 par value common stock assuming the shares sell for: a. $4 cash per share. b. $5 cash per share. View transaction list Journal entry worksheet Record the issuance of 65,000 shares of $4 par value common stock assuming the shares sell for $4 cash per share. 2 Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardSheridan Company had these transactions pertaining to stock investments: Feb. 1 Purchased 1,130 shares of BJ common stock (2% of outstanding shares) for $7,910. July 1 Received cash dividends of $2 per share on BJ common stock. Sept. 1 Dec. Sold 480 shares of BJ common stock for $5,550. 1 Received cash dividends of $1 per share on BJ common stock. (a) Journalize the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Creditarrow_forward

- Prepare the journal entry to record Zende Company's issuance of 79,000 shares of $8 par value common stock assuming the shares sell for: a. $8 cash per share. b. $9 cash per share. View transaction list Journal entry worksheetarrow_forwardPrepare the journal entry to record Zende Company's issuance of 84,000 shares of $8 par value common stock assuming the shares sell for: a. $8 cash per share. b. $9 cash per share. View transaction list Journal entry worksheet 1 Record the issuance of 84,000 shares of $8 par value common stock assuming the shares sell for $8 cash per share. 2 Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journal Saved >arrow_forwardWildhorse Restaurant Supply Company had the following transactions: 1. Issued 5,100 shares of $100 par preferred stock at $107 per share for cash. 2. Issued 8,100 shares of common stock with a par value of $10 per share for $121,500. 3. Purchased 510 shares of treasury common stock for a total of $12,240. Prepare the journal entries to record the above stock transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amount in the relevant debit OR credit box. Entering zero in ALL boxes will result in the question being marked incorrect. List all debit entries before credit entries.) No. Account Titles and Explanation Debit Credit 1. Cash Preferred Stock Paid-in Capital in Excess of Par-Preferred Stock 2. Cash Common Stock Paid-in Capital in Excess of Par-Common Stock 3. Treasury Stock Cash 546700 121500 12240 510000 36700 81000 40500 12240arrow_forward

- Based on the following information, prepare journal entries for Windgate Corporation. Mar. 7 Issued 10,000 shares of $5 par common stock for $53,000 cash. 16 Issued 6,000 shares of $5 par common stock for $33,000 cash. 23 Issued 4,000 shares of $12 par, 7% preferred stock for $53,000 cash. 29 Issued 5,000 shares of $4 par common stock for land with a fair market value of $28,000.arrow_forwardBlossom Company had these transactions during the current period. June 12 Issued 82,000 shares of $1 par value common stock for cash of $307,500. July 11 Issued 3,700 shares of $101 par value preferred stock for cash at $105 per share. Nov. 28 Purchased 2,450 shares of treasury stock for $8,800. Prepare the journal entries for the Blossom Company transactions shown above.arrow_forwardBlossom Company had these transactions during the current period. June 12 Issued 83,500 shares of $1 par value common stock for cash of $313,125. July 11 Issued 2,800 shares of $101 par value preferred stock for cash at $106 per share. Nov. 28 Purchased 3,350 shares of treasury stock for $8,450. Prepare the journal entries for the Blossom Company transactions shown above. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning