Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

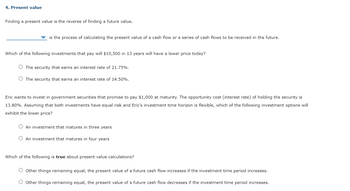

Transcribed Image Text:4. Present value

Finding a present value is the reverse of finding a future value.

is the process of calculating the present value of a cash flow or a series of cash flows to be received in the future.

Which of the following investments that pay will $10,500 in 13 years will have a lower price today?

O The security that earns an interest rate of 21.75%.

O The security that earns an interest rate of 14.50%.

Eric wants to invest in government securities that promise to pay $1,000 at maturity. The opportunity cost (interest rate) of holding the security is

13.80%. Assuming that both investments have equal risk and Eric's investment time horizon is flexible, which of the following investment options will

exhibit the lower price?

O An investment that matures in three years

An investment that matures in four years

Which of the following is true about present value calculations?

O Other things remaining equal, the present value of a future cash flow increases if the investment time period increases.

O Other things remaining equal, the present value of a future cash flow decreases if the investment time period increases.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Determine the present value P you must invest to have the future value A at simple interest rate r after time t. A = $19,000, r = 11.5%, t = 4 years The present value that must be invested to get $19,000 after 4 years at an interest rate of 11.5% is $. (Round up to the nearest cent.)arrow_forwardQuantitative Problem: You own a security with the cash flows shown below. 0 1 2 3 4 0 690 395 230 320 If you require an annual return of 12%, what is the present value of this cash flow stream? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward5. Present value To find the present value of a cash flow expected to be paid or received in the future, you will the future value cash flow by (1+1)N What is the value today of a $42, 000 cash flow expected to be received 17 years from now based on an annual interest rate of 7% ? $13,296 $10,637 $132, 670 $20, 609 Your broker called carfier today and offered you the opportunity to invest in a security. As a friend, he suggested that you compare the current, or present value, cost of the security and the discounted value of its expected future cash flows before deciding whether or not to invest. The decision rule that should be used to decide whether or not to invest should be. Everything else being equal, you should invest if the discounted value of the security's expected future cash flows is greater than or equal to the current cost of the security. Everything else being equal, you should invest if the current cost of the security is greater than the present value of the security's…arrow_forward

- 1. 1: Time Value of Money: Introduction A dollar in hand today is worth -Select- ✓a dollar to be received in the future because if you had it now you could invest that dollar and Select- interest. Of all the techniques used in finance, none is more important than the concept of time value of money (TVM), also called -Select- analysis. Time value analysis has many applications including retirement planning, stock and bond valuation, loan amortization and capital budgeting analysis. Time value of money uses the concept of compound interest rather than simple interest.arrow_forwardYou are considering investing in a security that will pay you RM1,000 in 'n' years. Required: How long do you have to invest if you start the investment of RM250 today with the appropriate discount rate of 10 percent quarterly? i. ii. Assume these securities sell for RM365, in return for which you receive RM1,000 in 30 years. What is the rate of return investors earn on this security if they buy it for RM365?arrow_forwardSuppose the term structure of risk-free interest rates is as shown here: a. Calculate the present value of an investment that pays $1,000 in 2 years and $4,000 in 5 years for certain. b. Calculate the present value of receiving $900 per year, with certainty, at the end of the next 5 years. To find the rates for the missing years in the table, linearly interpolate between the years for which you do know the rates. (For example, the rate in year 4 would be the average rate in year 3 and year 5.) c. Calculate the present value of receiving $2,700 per year, with certainty, for the next 20 years. Infer rates for the missing years using linear interpolation. (Hint: Use a spreadsheet.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) 2 years 3 years 5 years 7 years 1 year 2.06 2.44 2.64 3.22 3.74 Term Rate (EAR, %) Print Done 10 years 4.25 20 years 5.09 I X t cent.)arrow_forward

- Your friend offers you an investment opportunity. If you give him $1,200 today, his project will provide you with the following cash flows in Years 1-4: $100, $200, $600, $550. You required 10% return on investments of this risk level. Alternatively, you can invest your $1,200 in the money market fund at 4% today. Which of the two options is a better investment opportunity? Q4. There are two different ways to answers the question (both lead to the same conclusion). Show the complete formula (not the calculator shortcuts) with all the necessary terms that you would use to solve the problem as if you didn't have a financial calculator on hand. Q5. Circle the better investment opportunity: Friend's project / Money market fundarrow_forwardPlease help me with this problem. Thanksarrow_forward(Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: @ End of Year 1 W 5 2 3 4 12 5 s damaged 30 6 X 7 8 3 a. What is the present value of investment A at an annual discount rate of 21 percent? $(Round to the nearest cent.) b. What is the present value of investment B at an annual discount rate of 21 percent? $(Round to the nearest cent.) c. What is the present value of investment C at an annual discount rate of 21 percent? (Round to the nearest cent.) 80 F3 E A $11,000 11,000 11,000 11,000 11,000 D C $ 4 DDD DOD F4 R Investment B F 1 $11,000 11,000 11,000 11,000 % 5 V is FS T G A 6 C $16,000 B 48,000 MacBook Air F6 Y & 7 H 44 F7 U N * CO 8 J DII FA 1 ( M 9 K MOSISO 19 O 1 0 V I 4 F10 11 P > command 4 ● FII + B = { [ I Next F12 .. ? optionarrow_forward

- Suppose the risk - free interest rate is 4.2%.a. Having $200 today is equivalent to having what amount in one year?b. Having $200 in one year is equivalent to having what amount today?c. Which would you prefer, $200 today or $200 in one year? Does your answer depend on when you need the money? Why or why not?a. Having $200 today is equivalent to having what amount in one year?Having $200 today is equivalent to having Sin one year. (Round to the nearest cent.)arrow_forwardAn investor has two prototypes for invention, A and B, and needs the same amount of loan L for each. It is expected that either one of these prototypes will take a year to develop and will yield a reward of either RA or 0 for prototype A and either RB or 0 for prototype B. The probabilities of positive payoff are given by Prob(RA)=PA Prob (RB) =PB And these probabilities are known to the bank. The bank will only lend if the expected repayment at the end of the year generates a yield of i. If the prototype given a 0 reward, then the bank receive no repayment. Assuming risk neutrality on the part of the bank, explain why the repayments when either prototype is a success are given by (1+i) LPA, (1+i) LPB for A, B respectively. If the loan were granted, show that the expected payoff for the inventor after the bank has been repaid is given by PARA-(1+i) LPBRB-(1+i)L for A, B respectively. Under what conditions…arrow_forwardson.5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education