FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

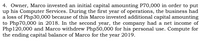

Transcribed Image Text:4. Owner, Marco invested an initial capital amounting P70,000 in order to put

up his Computer Services. During the first year of operations, the business had

a loss of Php30,000 because of this Marco invested additional capital amounting

to Php70,000 in 2018. In the second year, the company had a net income of

Php120,000 and Marco withdrew Php50,000 for his personal use. Compute for

the ending capital balance of Marco for the year 2019.

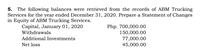

Transcribed Image Text:5. The following balances were retrieved from the records of ABM Trucking

Services for the year ended December 31, 2020. Prepare a Statement of Changes

in Equity of ABM Trucking Services.

Capital, January 01, 2020

Withdrawals

Php. 700,000.00

150,000.00

77,000.00

45,000.00

Additional Investments

Net loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Levi Ackerman decided to resign from his current job and start his own café. He is investing $50,000 of his own money and took out a business loan worth $100,000. Levi handed in his resignation in May 2021, purchased and fully paid for an established café costing $109,000 in June 2021, and plans to open shop on 1 July 2021. Additional information: • Annual depreciation for the non-current assets taken over from the previous owner totals $18,000. Additional equipment costing $5,000 were purchased and paid for in June. These equipment are depreciated on a straight-line basis and have an expected useful life of ten years with no residual value. Assume that monthly payment for the loan is $780, of which $240 relates to interest payment and the remainder relates to principal repayment. One month's credit is received from inventory suppliers and Levi will utilise this payment term, paying the amounts owed one day before it is due. Inventories costing $4,000 are acquired in June 2021.…arrow_forwardJohn Mason is the owner and president of Digital Imagery and More Ltd., a company in the multimedia industry. The revenue of the business is about $ 20 million a year. In the past few years, John has spent the following: Swimming pool built at his home: $40 000 Renovations to his cottage: $7500 • Landscaping around his home: $4000 Although each of these expenditures was of a personal nature, Mason requested that invoices for the charges be sent to his company, Digital Imagery and More Ltd. All of the expenditures were recorded in the books of the company in various expense accounts. a. As his accountant, what will you advise John to do? In your answer, be sure to include accounting principles and CPA Code of Conduct reference.arrow_forwardMzanzi (Pty) Ltd was established June 1, 2016, by two students majoring in education. The twoentrepreneurs provided entertainment for children’s birthday parties to supplement their collegecareer. The following transactions occurred during the first month of operations:June 1: Received contribution of R6,000 from each of the two principal owners of the new businessin exchange for ordinary shares in the business.June 1: Purchased lighting equipment for R300 on an open account. The company has 30 days topay for the equipment.June 5: Registered as a vendor with the city and paid the R25 monthly fee.June 9: Purchased an event tent to set up at parties for R2,400 cash.June 10: Purchased R100 in miscellaneous supplies on account. The company has 30 days to payfor the supplies.June 15: Paid a R75 bill from local printer for advertisement signs.June 17: Customers paid for services with cash of R1,500.June 24: Billed the local park district R800 entertainment provided to a summer camp.The park…arrow_forward

- The business was put up from a cash of ₱200,000, the initial capital of the owner. Then, ₱40,000 of the cash was used to purchase an equipment to be used in business. The purchase of equipment resulted in a liability of ₱20,000. How much are the total assets of the business THE ANSWER SHOULD BE 140,000 PESOSarrow_forwardJada Company had the below transactions during the year. If all transactions were recorded properly, what amount did Jada capitalize for the year, and what amount did Jada expense for the year? Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for extraordinary repairsarrow_forwardLegend Sdn Bhd purchased a machine costing RM 160,000. The machine was then sold to Elite Sdn Bhd on 31/07/2021 at a price of RM154,000. Both companies are under the control of Neuro Sdn Bhd and the accounting period for both companies are as follows: Legend closes its account on 31/12 Elite closes its account on 31/8 Required : Compute Capital allowances for both companyarrow_forward

- Owner, Juan invested an initial capital amounting P50,000 in order to put up his Clean company. During the first year of operations (2016), the company had a loss of P25,000. Because of this, Juan invested additional capital amounting to P50,000 in 2017. In the second year (2017), the company had a net income of P100,000 and Juan withdrew P10,000 for personal use. Prepare the Statement of Changes in Equity for the year 2017.arrow_forwardDuring the year, Tulip had the following transactions: Long-term loss on the sale of business use equipment $7,000 Long-term loss on the sale of personal use camper 6,000 Long-term gain on the sale of personal use boat 3,000 Short-term loss on the sale of stock investment 4,000 Long-term loss on the sale of land investment 5,000 Before the transactions, Tulip's AGI was $100,000. Determine Tulip's new AGI, the rate the income will be taxed, and any carryovers.arrow_forwardRomantic Company owns a fleet of motor vehicles. In 2020, one of the cars which was acquired at a cost of Php. 1,400,000 was allowed as service vehicle by one of its officials. During the year, its book value amounted to Php. 1,150,000. How much was the FBT due thereon? * A. Php. 75,385.00 B. Php. 18,823.00 C. Php. 17,767.00 D. Php. 88,235.00 Based on the data in no. 7 above, suppose Romantic Company is just leasing the car that is being used partly for personal and for business purposes and is paying an annual rental of Php. 120,000. The annual fringe benefit tax isarrow_forward

- Mr Cruz, procured a tract of timber for P65,000. The worth of the land was established tobe P17,000 and the worth of the 23,500 trees was P45,000. During the first year ofoperation, they cut down 4,500 trees. What was the depletion allowance that year?arrow_forwardPedro Reyes purchased a delivery vehicle on January 1, 2016 amounting to PHP250,000. It is estimated that the vehicle will be useful for 10years. The vehicle can be sold for PHP10,000 at the end of its useful life. If the accounting period being reported by Pedro is one (1) year from January - December 2016, how much is the depreciation expense? a. Php240,000 b. Php24,000 c. Php20,000 d. Php2,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education