Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

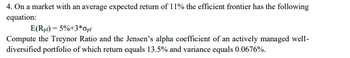

Transcribed Image Text:4. On a market with an average expected return of 11% the efficient frontier has the following

equation:

E(Rpf) = 5%+3*Opf

Compute the Treynor Ratio and the Jensen's alpha coefficient of an actively managed well-

diversified portfolio of which return equals 13.5% and variance equals 0.0676%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 5. There are three risky assets with rates of return r₁, 12, and r3, respectively. The covariance matrix and the expected rates of return are [0.4 0.2 0 = Σ 0.2 0.4 0.2 0 0.2 0.4 [0.04] 0.08 0.06 (a) Find the global minimum-variance portfolio. (b) For the required return z = 0.075, find (the weight of) the optimal portfolio with risky assets. For (c) and (d) only, assume there is an additional risk-free asset with return Tf 0.03. = (c) Find the tangent portfolio.arrow_forwardUse the following information: E[rXOM] = 15.6%, standard deviationyOM = 15.9% %3D E[IMSI=29.7%, standard deviationMS = 35.2% Correlation of returns: PXOM.MS = 0.139, r=10% If the optimal amount to invest in the first asset (w) is 0.43, what is the variance of the risky portfolio when w=0.43? (write in decimal format using 5 decimal places)arrow_forwardAssume we beleive a 1 factor APT model describes securities returns. Consider 2 assets with the following data Security A B Suppose the relevant variances are: Component Systematic Factor Expected Return 5.65% 9.06% € A EB Variance 10.0365 0.0387 0.039 Beta 0.5 1.6 1. The beta of an equally weighted portfolio is: Number 2. The the variance of an equally weighted portfolio is (answer exactly): Number 3. Compute the risk free rate : Numberarrow_forward

- Expected return (Kj)arrow_forwardThe market has three risky assets. The variance-covariance matrix of the risky assets are as follows: r1 r2 r3 r1 0.25 0 -0.2 r2 0 4 0.1 r3 -0.2 0.1 1 Assume the market portfolio is M = 0.2 ◦ r1 + 0.5 ◦ r2 + 0.3 ◦ r3. Further assume E(rM) = 0.08. (1) What is the variance of M?(2) What is the covariance of r2 and M?(3) What is β2?(4) If the rate of return of the risk-free asset is 0.02. Then what is the fair expected rate of return of security 2?(5) An investor wants to invest in a portfolio P = 0.4◦r1+0.6◦r3. What is its “fair” expected rate of return?arrow_forwardConsider a single-index model economy. The index portfolio M has E(RM ) = 6%, σM = 18%.An individual asset i has an estimate of βi = 1.1 and σ2ei = 0.0225 using the single index modelRi = αi + βiRM + ei. The forecast of asset i’s return is E(ri) = 12%. rf = 4%. a) According to asset i’s return forecast, calculate αi. (b) Calculate the optimal weight of combining asset i and the index portfolio M . (c) Calculate the Sharpe ratio of the index portfolio M and the portfolio optimally combiningasset i and the index portfolio M .arrow_forward

- Assume that the risk-free rate, RF, is currently 9% and that the market return, rm, is currently 16%. a. Calculate the market risk premium. b. Given the previous data, calculate the required return on asset A having a beta of 0.4 and asset B having a beta of 1.8.arrow_forwardc. Suppose the risk-free rate is 4.2 percent and the market portfolio has an expected return of 10.9 percent. The market portfolio has a variance of .0382. Portfolio Z has a correlation coefficient with the market of .28 and a variance of .3285. According to the capital asset pricing model, what is the expected return on Portfolio Z?arrow_forwardSuppose the CAPM is true. Consider two assets, X and Y, and the market M. Suppose cov(X,M) = .3, cov(Y,M) = .5. %3D (a) Is the expected return higher on X or Y? (b) Suppose var(M) = 1.5, what are the betas of X and Y? (c) Suppose the expected market return is 20% and the risk free rate is 5%, what is the expected returns of X and Y?. (d) Given your analysis in (a)-(c), what type of investor would prefer asset X to asset Y?arrow_forward

- Suppose the risk-free rate is 5%. The expected return and standard deviation of a risky asset are 10% and 20%, respectively. a. What is the slope of the capital allocation line (CAL) constructed using the risk-free asset and the risky asset? A. 0.30 B. 0.15 C. 0.25 D. 0.20 b. If an investor has a risk aversion coefficient of A=2, what is the optimal fraction of the money that she invests in the risky asset? A. 62.5% B. 42.5% C. 30% D. 20% c. If an investor invest 25% of her money in the risky asset, which is the investor’s risk aversion coefficient? a. 5 b. 1 c. 3 d. 4arrow_forwardSuppose you are given the following inputs for the Fama-Frech-3-Factor model. Required Return for Stock i: bi=0.8, kRF=8%, the market risk premium is 6%, ci=-0.6, the expected value for the size factor is 5%, di=-0.4, and the expected value for the book-to-market factor is 4%. Task: Estimate the required rate of return of this asset using the Capital asset pricing model and compare it with the Fama-French-3-factor model.arrow_forwardAsset X has an expected return of 10% and volatility of 10% . If its Sharpe Ratio is 0.60, what is the risk-free rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning