Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

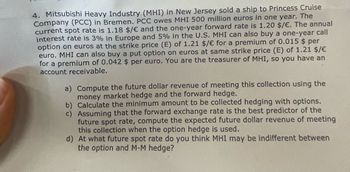

Transcribed Image Text:4. Mitsubishi Heavy Industry (MHI) in New Jersey sold a ship to Princess Cruise

Company (PCC) in Bremen. PCC owes MHI 500 million euros in one year. The

current spot rate is 1.18 $/€ and the one-year forward rate is 1.20 $/€. The annual

interest rate is 3% in Europe and 5% in the U.S. MHI can also buy a one-year call

option on euros at the strike price (E) of 1.21 $/ € for a premium of 0.015 $ per

euro. MHI can also buy a put option on euros at same strike price (E) of 1.21 $/€

for a premium of 0.042 $ per euro. You are the treasurer of MHI, so you have an

account receivable.

a) Compute the future dollar revenue of meeting this collection using the

money market hedge and the forward hedge.

b) Calculate the minimum amount to be collected hedging with options.

c) Assuming that the forward exchange rate is the best predictor of the

future spot rate, compute the expected future dollar revenue of meeting

this collection when the option hedge is used.

d) At what future spot rate do you think MHI may be indifferent between

the option and M-M hedge?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Conceptual introduction

VIEW Step 2: Calculation for Future Dollar Revenue via Money Market Hedge and Forward Hedge

VIEW Step 3: Calculation for Minimum Amount to be Collected Hedging with Options

VIEW Step 4: Calculation for Expected Future Dollar Revenue Using Option Hedge

VIEW Step 5: Calculation for Indifference Point Between Option and Forward Hedge

VIEW Solution

VIEW Step by stepSolved in 6 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- OneUSF, a U.S. MNC based in Florida, is considering making a fixed direct investment in Italy. The Italian government has offered OneUSF a concessionary loan of €2,700,000 at a rate of 3 percent per annum. The current spot rate is $1.36/€1.00 and the expected inflation rate is 4% in the U.S. and 2% in Italy. The normal borrowing rate is 7 percent in dollars and 6 percent in euros. The loan schedule calls for the principal to be repaid in three equal annual installments. The marginal corporate tax rate in Italy and the U.S. is 35%. What is the present value of the benefit of the concessionary loan? (Please keep 2 digits in decimals to get the right answer) $117,160 None of the above with the $10,000 of the correct answer $51,360 $1,165,209 $1,310,116arrow_forwardBoeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed €19 million which is payable in one year. The current EUR/USD rate is 1.0651 and the one-year forward rate is 1.0898. The annual interest rate is 4.9% in the U.S. and 2.7% in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure. It is considering to hedge borrowing euros from Credit Lyonnaise against the euro receivable. How much will they receive in one year? (USD, no cents) The answer is 20,670,407 I cannot figure out how. Thanks!arrow_forwardUse the following information for the next 8 questions. UCD (U.S. based MNC) will receive 250,000 euros in one year. The spot exchange rate today is $1.20 per euro. It observes that1. The one-year interest rate for euros is 8%, and the one-year interest rate for U.S. dollars is 3%.2. In the option market, there is one-year call option or put option available. Both options have the same exercise price of $1.18 per euro, and a premium of $0.02 per euro.3. In the forward market, the one-year forward rate exhibits a 5% discount from the current spot exchange rate. 4 If UCD decides to use options contracts to hedge its receivables, UCD shallarrow_forward

- TNB has a 10-year, ¥50 million loan outstanding with a Japanese bank. The Yen loanhas a 2.5% annual interest rate. The loan was taken 5 years ago and so has 5 more yearsto go. Daibochi, a Japanese plastics maker with operations in Malaysia has justnegotiated a RM 5 million, 5-year loan with Maybank at 7.5% annual interest. Bothcompanies are worried about the foreign exchange exposure. Design a currency swapthat will enable both companies to manage exchange rate risk. (Assume debt servicingwill be on 6-monthly basis, the spot Yen/Ringgit rate is 10 Yen/Ringgit).arrow_forwardManshukharrow_forwardY2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education