FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hello,

I need help understanding how to solve this problem (attached). Can you please explain it to me?

Thank you,

Anita

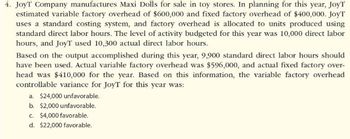

Transcribed Image Text:4. JoyT Company manufactures Maxi Dolls for sale in toy stores. In planning for this year, JoyT

estimated variable factory overhead of $600,000 and fixed factory overhead of $400,000. JoyT

uses a standard costing system, and factory overhead is allocated to units produced using

standard direct labor hours. The level of activity budgeted for this year was 10,000 direct labor

hours, and JoyT used 10,300 actual direct labor hours.

Based on the output accomplished during this year, 9,900 standard direct labor hours should

have been used. Actual variable factory overhead was $596,000, and actual fixed factory over-

head was $410,000 for the year. Based on this information, the variable factory overhead

controllable variance for JoyT for this year was:

a. $24,000 unfavorable.

b. $2,000 unfavorable.

c. $4,000 favorable.

d. $22,000 favorable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please help mearrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forward

- In the image you can look at the question . Is asking me to choose the correct answer below and fill in the answer box to complete your choice . How can I solve this type of question ?arrow_forwardsolve all of them. I mentioned in my question to solve all the partsarrow_forwardHello, the second half of this problem was not solved. Can you please provide explanation for part 4 and part 5 like you did for the other parts. Thanks so much.arrow_forward

- Hi, my name is Jennifer. I am having trouble with this same problem. But the sub-parts I need help with are C, D, and E. But more specifically, really just sub-parts D and E. The only parts I see being answered are sub-parts A, B, and C only in the 8 solutions posted. May I please receive help for the top sub-parts of C, D, and E ONLY, please? It would be much appreciated. Thank you. :) -- Jennifer Suttonarrow_forwardThe answer 417,974.94 was correct. Can you please help me solve without technology? Formulas used, etc. Thank you!arrow_forwardCan you please solve questions 5-15 of the problem above. Thank you.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education