ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

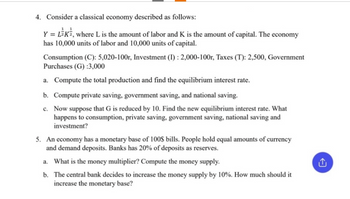

Transcribed Image Text:4. Consider a classical economy described as follows:

Y = LEK, where L is the amount of labor and K is the amount of capital. The economy

has 10,000 units of labor and 10,000 units of capital.

Consumption (C): 5,020-100r, Investment (I): 2,000-100r, Taxes (T): 2,500, Government

Purchases (G) :3,000

a. Compute the total production and find the equilibrium interest rate.

b. Compute private saving, government saving, and national saving.

c. Now suppose that G is reduced by 10. Find the new equilibrium interest rate. What

happens to consumption, private saving, government saving, national saving and

investment?

5. An economy has a monetary base of 100$ bills. People hold equal amounts of currency

and demand deposits. Banks has 20% of deposits as reserves.

a. What is the money multiplier? Compute the money supply.

b. The central bank decides to increase the money supply by 10%. How much should it

increase the monetary base?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Use the Simple Classical Macroeconomic Model to answer this question. Suppose the tax cut has not been enough to stimulate sufficient job growth. The government passes infrastructure improvement legislation to increase government spending from $3,000 to $4,000. What is the affect on GDP from the combined changes (Taxes and Spending) in government policies? a. 53,000 b. 60,000 c. 26,500 d. 33,000arrow_forward12. Suppose an economy represented by the graph below started with K = 25, so it was in a steady state, but then disaster struck and most of the capital was destroyed. (Assume that no people were hurt so the labor force is the same size.) dK 25 K After the disaster would we expect the economy to grow or shrink? a. grow, I> dK b. grow, I dK d. shrink, I< dKarrow_forwardPlease answer the following question. Thanks! Consider a classical economy described as follows: ? = ?^(1/2)?^(1/2) , where L is the amount of labor and K is the amount of capital. The economy has 10,000 units of labor and 10,000 units of capital. Consumption (C): 5,020-100r, Investment (I) : 2,000-100r, Taxes (T): 2,500, Government Purchases (G) :3,000arrow_forward

- NEW QUESTION Consider the investment function of the IS model. Suppose that in the long-run 20% of GDP is spent on investment. Moreover, a one percentage-point increase of the real interest rate reduces the share of investment in GDP by one percentage point. Suppose that at some time t the real interest rate is equal to -1% while the rate of return of physical capital (think of it as the marginal product of capital) is 3%. What is the share of investment in GDP at time t?arrow_forwardHi pleasearrow_forwardSuppose the government must increase taxes in order to increase spending. Now assume Congress wants to increase spending on education without decreasing spending somewhere else. For each variable state if it will INCREASE, DECREASE or REMAIN UNCHANGED. In at least one complete sentence state WHY this change will occur. Be specific. Private Saving (Sp): Consumption: (C) Government Saving (Sg) Total Saving: (S) Real Interest Rates: (r) Investment: (I)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education