FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

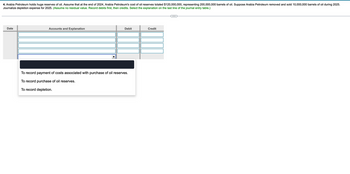

Transcribed Image Text:4. Arabia Petroleum holds huge reserves of oil. Assume that at the end of 2024, Arabia Petroleum's cost of oil reserves totaled $120,000,000, representing 200,000,000 barrels of oil. Suppose Arabia Petroleum removed and sold 10,000,000 barrels of oil during 2025.

Journalize depletion expense for 2025. (Assume no residual value. Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Date

Accounts and Explanation

Debit

Credit

To record payment of costs associated with purchase of oil reserves.

To record purchase of oil reserves.

To record depletion.

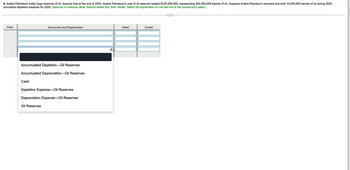

Transcribed Image Text:4. Arabia Petroleum holds huge reserves of oil. Assume that at the end of 2024, Arabia Petroleum's cost of oil reserves totaled $120,000,000, representing 200,000,000 barrels of oil. Suppose Arabia Petroleum removed and sold 10,000,000 barrels of oil during 2025.

Journalize depletion expense for 2025. (Assume no residual value. Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Date

Accounts and Explanation

Accumulated Depletion-Oil Reserves

Accumulated Depreciation-Oil Reserves

Cash

Depletion Expense-Oil Reserves

Depreciation Expense-Oil Reserves

Oil Reserves

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A firm has fixed assets at the end of 2022 of $40,000. At the beginning of 2022, it's fixed assets were $35,000. During the year, the firm recorded $2000 in depreciation. How much was recorded for the firm's CAPEX? Hint #1: CAPEX = end FA - beg FA + dep Hint #2: Be careful with beginning and endingarrow_forwardPlease explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?arrow_forwardam.107.arrow_forward

- 1. On July 1, 2024, The Exploration Company, invests $1.3 million in a mine that is estimated to have 800,000 tonnes of ore. The company estimates that the property will be sold for $100,000 when production at the mine has ended. During the last six months of 2024, 100,000 tonnes of ore are mined and sold. The Exploration Company has a December 31 fiscal year end. a) Record the 2024 depletion. b) Show how the mine and any related accounts are reported on the December 31, 2024, income statement and balance sheet. Apply the Accounting Concepts.arrow_forwardLouisiana Oil Company (LOC) paid $3,000,000 for an oil reserve estimated to hold 50,000 barrels of oil. Oil production is expected to be 10,000 barrels in year 1, 30,000 barrels in year 2, and 10,000 barrels in year 3. LOC expects to begin selling barrels from its oil inventory in year 2. Required: Assuming these estimates are accurate, determine the book value of oil reserves at the end of year 1.arrow_forwardB. If Flint prepares financial statements in accordance with ASPE, what is the recoverable amount of the equipment at November 30, 2023? Recoverable amount $arrow_forward

- H1.arrow_forwardIn singapore pinku Ltd sold a machine in the year ended 30 September 2023 for $23,000. This machine was purchased for S$60,000 in the year ended 30 September 2021 and it was depreciated over 5 years though CA was claimed under S19(1) over 3 years. What is the balancing adjustment for the above sale? A. Balancing Charge of $3,000B. Balancing Charge of $13,000C. BalancingAllowanceof$3,000 D. Balancing Allowance of $13,000arrow_forwardOn Pina's multiple - step income statement for 2023, income from continuing operations is: Select answer from the options below a) $17395. b) $24850. c)$40400. d) $17780.arrow_forward

- During 2018, Libby Oil and Gas Company completed the last well from its drilling and production platform off the coast of Texas. Unrecovered costs not including decommissioning costs on December 31, 2018, were $25 million, including $5 million in acquisition costs and $20 million in drilling and development costs. Total proved developed reserves were estimated to be 600,000 barrels as of the January 1, 2018. Production during 2018 was 30,000 barrels. At the end of the life of the reservoir, decommissioning costs are estimated to be $14 million, and salvage value is estimated to be $1 million. Required: compute DD&A for 2018.arrow_forwardFind the depletion expense for the year 2020. Ignore the answers in choices , those are wrong. Show all your workings.arrow_forwardH1. Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education