ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

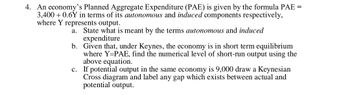

Transcribed Image Text:4. An economy's Planned Aggregate Expenditure (PAE) is given by the formula PAE =

3,400 +0.6Y in terms of its autonomous and induced components respectively,

where Y represents output.

a. State what is meant by the terms autonomous and induced

expenditure

b.

Given that, under Keynes, the economy is in short term equilibrium

where Y-PAE, find the numerical level of short-run output using the

above equation.

c. If potential output in the same economy is 9,000 draw a Keynesian

Cross diagram and label any gap which exists between actual and

potential output.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A. Suppose you are given the following fixed-price Keynesian model: C=280 + 0.9Y. I-200 G=100 X3D200 M= 100 + 0.1Y. T= 100 a. Find the aggregate expenditure function. b. Find the equilibrium level of real GDP. C. What is the spending multiolier in this model? Tax multiplier? d. Show that leakages injections at equilibrium. e. If taxes increase by $100, what is the new equilibrium level of GDP? E. Show your answers to b) and e) graphically.arrow_forwardThe Keynesian cross 45 degree line represents: Every point where aggregate expenditure is equal to real GDP O The points where aggregate expenditure is greater than real GDP The points where Keynes believed that aggregate expenditure should be O The points where aggregate expenditure is less than real GDParrow_forwardi need the answer quicklyarrow_forward

- Use the following consumption function data to anwser the question bellow: Real disposable income consumption savings aMpc MPSarrow_forward2. For simplicity, we normally treat aggregate tax payments (T) as determined by politics or other factors unrelated to output. However, suppose that aggregate tax payments are proportional to income. That is, T=t·Y, where tis the marginal tax rate and is between o and 1. a. How, if at all, would this change in our assumptions affect the Keynesian cross diagram? b. Would this change increase, decrease, or have no impact on the multiplier effect, or is it not possible to tell? (That is, how would the effect of a given vertical shift of the planned expenditure line compare with what it was before?)arrow_forwardWhich of the following sets of variable changes will all cause the IS Curve to shift to the right? A. A decrease in autonomous consumption, a decrease in government spending and an increase in financial friction. B. An increase in autonomous consumption, an increase in government spending and a decrease in financial friction. OC. An increase in autonomous consumption, a decrease in government spending and an increase in financial friction. D. A decrease in autonomous consumption, an increase in government spending and an increase in financial friction.arrow_forward

- The graph gives an economy's AE curve when the economy is in long-run equilibrium. Equilibrium expenditure is $12 trillion. Draw a new AE curve that shows the effect of an increase in investment. Label it AE₁. Draw a point at the new equilibrium expenditure. Label it B. Draw another AE curve that shows equilibrium expenditure in the short run. Label it AE2. Draw a point at the short-run equilibrium. Label it C. Finally, draw the AE curve when the economy returns to long-run equilibrium. Label it AE3. 16- 14- 12- 10- Aggregate expenditure (trillions of 2012 dollars) 10 A 45 degree line AEO 15 11 12 13 14 Real GDP (trillions of 2012 dollars) >>> Draw only the objects specified in the question. 16arrow_forwardNew help with D, E, F, Garrow_forwardd. Now G assumes its original value of G = 800. Congress decreases the tax rate from (1/2) to (1/4). i) Use a model to sketch the effect of the decrease in the tax rate when the price level is held constant. ii) What is the new marginal propensity to consume? iii) Calculate the new equilibrium level of income.arrow_forward

- Hi I need the second half to this problem thank youarrow_forwardConsider the following planned aggregate expenditure function: AEp=1000+0.8Y 1. Calculate the income-expenditure equilibrim real GDP, Y*, for this economy. Illustrate the equilibrium real GDP on a diagram below. Label the equilibrium point E. 2. Explain how an increase in uncertainty due to the collapse of multiple banks in the economy affects consumption and firm investment spending. Also explain what effect these changes would have on AEp and Y*. Show the effect on your diagram in part 1. 3. Suppose following the events above consumption and investment spending change by 220. By how much would Y* change eventually? Calculate and explain. 4. If the federal government wants to get the economy back at producing Y* you found in part 1 by adjusting its purchases of goods and services (G) by how much would it have to change G? (Hint: use the multiplier to calculate).arrow_forward1. How do changes in the real interest rate affect the IBL and current and future consumption? 2. How do binding borrowing constraints affect the IBL and current and future consumption? 3. On what assumptions did Keynes base his theory of consumption? How does his theory relate to intertemporal choice?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education