ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

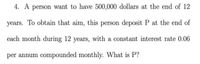

Transcribed Image Text:4. A person want to have 500,000 dollars at the end of 12

years. To obtain that aim, this person deposit P at the end of

each month during 12 years, with a constant interest rate 0.06

per annum compounded monthly. What is P?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Helen borrows $1000. To repay the amount she makes 12 equal monthly payment of $93.12 1- determine the monthly interest rate 2- the nominal rate 3- the effective annual rate 4- the continous ratearrow_forward2arrow_forwardIn how many years will an amount be doubled if the interest rate is 6%?arrow_forward

- 5. Liezel deposited 500,0000 cash a gift to her brother but her brother has to wait until the amount doubled. When will her brother withdraws the amount if the bank gives an interest of 10% compounded quarterly?arrow_forward19. Ma. Nochna Pula borrowed $10,000 at 6% annual compound interest. She agreed to repay the loan with five equal annual payments at end of each year. How much is the annual payment? $2,737.96 b. G $2,373.96 $2,773.96 a. $2,337.96arrow_forwardHow much would you have to deposit now. so that you can withdraw of $10000 starting at the end of year 5 , and subsequent Withdrawals will decrease a rate of of 10% semiannual year over the previous year's until at the end of year 8 , if the interest rate is 676. compounded semi-annually? Note: Draw the cosh flow diagram and use interest rate with five decimal places. Box your final answer and upload the picture of your solution.arrow_forward

- Suppose you deposited $200 at the end of every year for seven years in an account that earned 6% annual effevtive interest. At the end of seven years, how much would the account be worth?arrow_forward1. How much must you deposit each year to have $20,000 at the end of 15 years with money worth 7%?arrow_forward2. A sum of $1,000 is deposited at time "0" at an interest rate of 5½%, compounded quarterly. What is this money worth in five years? Choose your final answer from below while still showing your work. A. $1314 B. $1307 C. $1252 D. $1186arrow_forward

- 1. Mary buys a 20 year annuity immediate for $100,000 subject to 6% effective annual interest rate. The first payment is one year from the time of purchase. Mary reinvests each of the 20 payments, as soon as she received them at the end of each year, into a fund that earns 8% interest on deposits. What is the accumulated amount in Mary's fund right after the 20th annuity payment has been deposited into the fund?arrow_forward27. How much do eight ₱ 64,055 quarterly payments amount at present, if the interest rate is 2 compounded quarterly?arrow_forwardWhat type of interest is the capital invested in a transaction is principal and at any time after the investment of the principal, the sum of the principal and the interest due is future amount?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education