Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

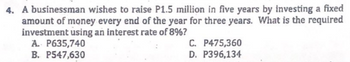

Transcribed Image Text:4. A businessman wishes to raise P1.5 million in five years by investing a fixed

amount of money every end of the year for three years. What is the required

investment using an interest rate of 8%?

A. P635,740

B. P547,630

C. P475,360

D. P396,134

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Double your money-Rule of 72. Approximately how long will it take to double your money if you get an annual return of 4.6%, 7.1%, or 10 4% on your investment? Approximately how long will it take to double your money if you get a 4.6% annual return on your investment? years (Round to two decimal places.)arrow_forward9 Suppose you invested $500 in a local credit union and: f(t) gives the future value of the investment in t years, if the APR is 2% and interest is compounded quarterly. • g(t) gives the future value of the investment in t years, if the APR is 2% and interest is compounded monthly. h(t) gives the future value of the investment in f years, if the APR is 2% and interest is compounded continuously. a. Write a function rule for f(t). For g(t). For h(t). Then describe how the rules are similar and how they are different. b. Based on your understanding of exponential growth, describe how the graphs of f(t), g(t), and h(t) are similar, and how they are different. c. On the same coordinate grid, use algebraic reasoning to sketch graphs of the three functions. .arrow_forwardGive only typing answer with explanation and conclusionarrow_forward

- How much would your investment be worth if you deposited $5,555.55 into a bank that paid simple interest of 4% for 10 years?arrow_forwardIf an investor intends to double $35,000 by investing in a bank that pays 6% interest per year, determine the time it would take to double the investment.arrow_forward3. Suppose that you have a savings plan that pays 2.5% compounded monthly. You make payments of $75 at the end of each month for 15 years, and then you make monthly payments of $110 for an additional 6 years. a) What is the value of the account at the end of 21 years? b) How much did you earn in interest during those 21 years? 4. Three years after buying 200 shares of XYZ stock for $25 per share, you sell the stock for $8,500. Find the total and annual return.arrow_forward

- You have $68,513 you want to invest. You are offered an investment plan that will pay you 4.58 percent per year for the first 20 years and 6.81 percent per year for the last 21 years. How much will you have (in $) at the end of the two periods? Answer to two decimals. < Previousarrow_forwardAssume that you can invest to earn a stated annual rate of return of 12 percent, but where interest is compounded semiannually. If you make 20 consecutive semiannual deposits of $500 each, with the first deposit being made today, what will your balance be at the end of Year 20? Group of answer choices $52,821.19 $57,900.83 $58,988.19 $62,527.47 $64,131.50arrow_forward2. Assume that you can invest to earn a stated annual rate of return of 12 percent, but where interest is compounded semiannually. If you make 20 consecutive semiannual deposits of $500 each, with the first deposit being made today, what will your balance be at the end of Year 20? $57,900.83 $58,988.19 O $52,821.19 O $64,131.50 O $62,527.47arrow_forward

- Provide step by step manula solution, formula, and diagram. An investor have a projected surplus income of P1000 per year which he plans to place in a bank which offers an interest of 18% per annum for time deposit over 5 years. Compute how much shall the investor collect at the end of 13 yearsarrow_forwardAssume you invest $15,000 today. How much will you have in six years at an interest rate of 9%? Future Value of $1: 8% 123456 1.080 1.166 1.260 1.360 1.469 1.587 OA. $23.805 OB. $25,155 OC. $26.580 OD. $23,085 9% 1.090 1.188 1.295 1.412 1.539 1.677 10% 1.100 1.210 1.331 1.464 1.611 1.772 MAKED ہےarrow_forwardAssume you can earn 9.4% per year on your investments. a. If you invest $170,000 for retirement at age 30, how much will you have 35 years later for retirement? b. If you wait until age 40 to invest the $170,000, how much will you have 25 years later for retirement? c. Why is the difference so large? a. If you invest $170,000 for retirement at age 30, how much will you have 35 years later for retirement? The future value is $ (Round to the nearest dollar)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education