ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

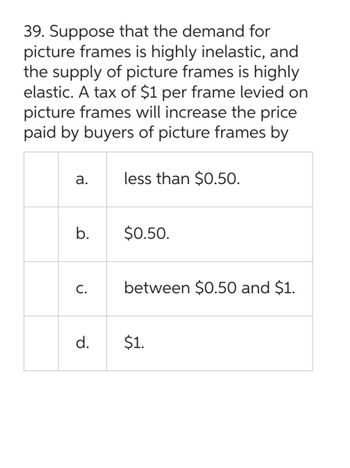

Transcribed Image Text:39. Suppose that the demand for

picture frames is highly inelastic, and

the supply of picture frames is highly

elastic. A tax of $1 per frame levied on

picture frames will increase the price

paid by buyers of picture frames by

a.

b.

C.

d.

less than $0.50.

$0.50.

between $0.50 and $1.

$1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 22 If the goal is to have the smallest deadweight loss, then a $1 tax should be imposed upon: a a market with highly elastic demand and highly elastic supply. b a market with highly inelastic demand and highly inelastic supply. c a market with highly elastic demand and unit elastic supply. d a market with unit elastic demand and unit elastic supply.arrow_forward6. The government decides to place a $6 unit tax on a product. The following elasticities are known: E, = - 1; E,= 2. By how much does the price paid by the demanders increase because of this tax?arrow_forwardSuppose that the Australian government imposes a sales tax on a product and both buyers and sellers share the burden of the If the price elasticity of demand for the product is perfectly inelastic. Which of the following is true? Select one: a. Sellers would pay more of the tax than buyers. b. Buyers would pay all of the tax. c. Buyers and sellers would share the tax burden equally. d. Sellers would pay all the tax.arrow_forward

- PRICE (Dollars per pack) 50 45 TAX REVENUE (Dollars) 40 35 30 25 400 360 320 At this tax amount, the equilibrium quantity of cigarettes is government collects $ in tax revenue. 280 240 0 Suppose the government imposes a $10-per-pack tax on suppliers. 200 160 120 0 5 80 40 Supply Now calculate the government's tax revenue if it sets a tax of $0, $10, $20, $25, $30, $40, or $50 per pack. (Hint: To find the equilibrium quantity after the tax, adjust the "Quantity" field until the Tax equals the value of the per-unit tax.) Using the data you generate, plot a Laffer curve by using the green points (triangle symbol) to plot total tax revenue at each of those tax levels. 0 Demand Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically. 10 15 20 25 30 35 40 45 50 QUANTITY (Packs) 5 True O False Graph Input Tool Market for Cigarettes Quantity (Packs) 10 15 20 25 30 TAX (Dollars per pack) Demand Price (Dollars per pack) Tax…arrow_forwardPrice 20 18 16 14 12 10 х $1.200 0 300 400 500 $2.000 S1 SO Quantity Assume that the market in the graph above is at an initial equilibrium price of $10 and an equilibrium quantity of 500 units. If the government decides to add a $4 per-unit tax on this good, it will be able to collect the following amount of tax revenue: Demand 1000arrow_forwardP $3.00 $2.66 $2.00 18. You are in the business of producing and selling hamburgers, French fries, pizza, and ice cream. The mayor of your city plans to impose a sales tax on one of these products. Based on the elasticities: j. k. Which of these goods would your customers least like to be taxed? Which of these goods would your customers prefer to be taxed? B S₁ So 130 150 bb bb Figure two: effect of excise tax on supply and demand QUESTION #19: a) TO OU a. b. C. b) a. b. C. Before the Tax: Price the Consumer Pays = Price the Producer Receives = Quantity = After the Tax, Price the Consumer Pays = Price the Producer Receives = Tax per unit = d. Quantity = e. Total Tax Revenue = f. Proportion of the Total Tax Consumers Pay = g. Proportion of the Total Tax Producers Pay = h. Who Pays the Burden of the Tax = i. DWL = ?arrow_forward

- 1. Find and graph the consumer, producer surplus, and total welfare: Demand is P = 30 - (1/2)Q Supply is P = 2Q 2. Graph and measure the deadweight loss when there is a price ceiling of P = $6. Demand is P = 21-2Q Supply is P = 3 + Qarrow_forward8. Suppose we want regular cars to be gradually replaced by electric cars. There are several kinds of government interventions that could be used to make this happen, or at least to push the car market to produce and sell more electric cars. Explain how a tax could be used for this purpose, and then explain how a subsidy could be used for this purpose.arrow_forward2. The elasticity of demand for guitars is -2.0, and the elasticity of supply is 3.0. How much will the price of guitars change with a per-unit tax of $2?arrow_forward

- The elasticity of demand for chocolate chip cookies is 0.6 and the elasticity of supply for these cookies is 1.9. If a tax is imposed on purchases of chocolate chip cookies, then the consumers would pay more of the tax. consumers would pay the entire tax because their demand is less elastic than the producers' supply. tax would be equally shared by the consumers and the producers. producers would pay more of the tax.arrow_forwardWhy must local governments pay attention to the types of products they tax. Describe in detail how the elasticity of these products impacts the expected revenue to be generated by these local Governmentsarrow_forwardDemand for a good is perfectly ELASTIC while supply is regularly shaped. Suppose the government taxes the good. Which of the following statements is true: A. The tax will create deadweight loss B. The tax will NOT create deadweight lossarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education