FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

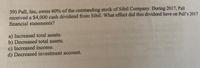

Transcribed Image Text:39) Pall, Inc, owns 40% of the outstanding stock of Sibil Company. During 2017, Pall

received a $4,000 cash dividend from Sibil. What effect did this dividend have on Pall's 2017

financial statements?

a) Increased total assets.

b) Decreased total assets.

c) Increased income.

d) Decreased investment account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with calculationarrow_forwardJanus Company had the following journal entry: Debit Credit Cash $30,000 Common Stock $30,000 From this entry, we can determine that Janus: a Purchased $30,000 of another company’s common stock b Repurchased $30,000 of their own common stock. c Issued $30,000 of their own common stock d urchased $30,000 of Investments.arrow_forwardB. Multiple Choice with Computation 1. Ribbon Company provided the following information during the current year: Dividend received 500,000 Dividend paid 1,000,000 Cash received from customers 9,000,000 Proceeds from issuing share capital 1,500,000 Interest received 200,000 Proceeds from sale of long term investments 2,000,000 Cash paid to suppliers and employees 6,000,000 Interest paid on long tem debt 400,000 Income taxes paid 300,000 Cash balance January 1 1,800,000 1a. What is the net cash provided by operating activities? a. 3,000,000 b. 3,300,000 c. 2,700,000 d. 2,000,000 1b. What is the net cash provided by investing activities? a. 2,500,000 b. 2,000,000 c. 2,200,000 d. -0- 1c.. What is the net cash provided by financing activities? a. 1,500,000 b. 1,000,000 c. 500,000 d. -0- 1d. What is the cash balance on December 31? a. 6,300,000 b. 5,500,000 c. 4,800,000 d. 7,300,000arrow_forward

- H2.arrow_forwardIf the preference shares are cumulative and fully participating, how much is the dividends to be allocated to ordinary shareholders? 2.If the preference shares of OTSO CORP are cumulative and participating only up to 15%, how much is the dividends to be allocated to ordinary shareholders?arrow_forwardReceived $17000 cash investment from the business owners and distributed 1000 shares of common stock to them with a market price of $17 per share? which accounts are affected in this transactions?arrow_forward

- X Corp has $200,000 of gross receipts from sales, $300,000 of operating expenses, and $150,000 of dividends received from a 10% owned corporation. What is X Corp's dividends-received deduction? 25,000arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardIf Pop Company exercises significant influence over Son Company and owns 40% of its common stock, then Pop Company: Would record 40% of the net income of Son Company as investment income each year. O Would increase its investment account when Son Company declares dividends. O All of these answer choices are correct. O Would record dividends received from Son Company as investment revenue.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education