FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

![## Using Excel to Calculate Cost per Equivalent Unit

### Problem Statement

Funenstiens roasts peanuts and uses the FIFO method of process costing for their roasting process. Below is the information provided for this month's production:

- **Direct materials costs added to production:** $3,400

- **Conversion costs added to production:** $3,875

- **Direct materials costs in beginning inventory:** $600

- **Conversion costs in beginning inventory:** $800

### Equivalent Units Completed During the Month

- For Direct Materials: 4,600 units

- For Conversion Costs: 4,450 units

### Student Work Area

#### Task

1. **Input the required mathematical formulas** or functions using cell references to solve the problem.

#### Required Calculations

- **Total Costs to Account For:**

- **Direct Materials:** [Cell for calculation]

- **Conversion Costs:** [Cell for calculation]

- **Total:** [Cell for calculation]

- **Determine the Company's Cost per Equivalent Unit:**

- Calculate for both Direct Materials (DM) and Conversion Costs for the current month.

- **Cost per Equivalent Unit Formula:**

- Direct Materials: [Calculation based on input]

- Conversion Costs: [Calculation based on input]

This section encourages students to use Excel’s built-in functions to compute cost data efficiently, practicing real-world financial analysis skills using process costing principles.](https://content.bartleby.com/qna-images/question/2d5d8571-a566-48dd-93ba-2ac5e7bc1950/042cc7d5-49c7-4f5b-9323-2693cc7dfbbc/wcg8pu_thumbnail.jpeg)

Transcribed Image Text:## Using Excel to Calculate Cost per Equivalent Unit

### Problem Statement

Funenstiens roasts peanuts and uses the FIFO method of process costing for their roasting process. Below is the information provided for this month's production:

- **Direct materials costs added to production:** $3,400

- **Conversion costs added to production:** $3,875

- **Direct materials costs in beginning inventory:** $600

- **Conversion costs in beginning inventory:** $800

### Equivalent Units Completed During the Month

- For Direct Materials: 4,600 units

- For Conversion Costs: 4,450 units

### Student Work Area

#### Task

1. **Input the required mathematical formulas** or functions using cell references to solve the problem.

#### Required Calculations

- **Total Costs to Account For:**

- **Direct Materials:** [Cell for calculation]

- **Conversion Costs:** [Cell for calculation]

- **Total:** [Cell for calculation]

- **Determine the Company's Cost per Equivalent Unit:**

- Calculate for both Direct Materials (DM) and Conversion Costs for the current month.

- **Cost per Equivalent Unit Formula:**

- Direct Materials: [Calculation based on input]

- Conversion Costs: [Calculation based on input]

This section encourages students to use Excel’s built-in functions to compute cost data efficiently, practicing real-world financial analysis skills using process costing principles.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

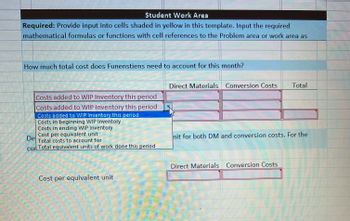

Follow-up Question

I am having problems understanding the answer can you check the picture and give me more information because it was wrong

Transcribed Image Text:Student Work Area

Required: Provide input into cells shaded in yellow in this template. Input the required

mathematical formulas or functions with cell references to the Problem area or work area as

How much total cost does Funenstiens need to account for this month?

Costs added to WIP Inventory this period

Costs added to WIP Inventory this period

Costs added to WIP Inventory this period

Costs in beginning WIP Inventory

Costs in ending WIP Inventory

Cost per equivalent unit

Total costs to account for

De

cur Total equivalent units of work done this period

45

Cost per equivalent unit

Direct Materials Conversion Costs Total

nit for both DM and conversion costs. For the

Direct Materials Conversion Costs

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I am having problems understanding the answer can you check the picture and give me more information because it was wrong

Transcribed Image Text:Student Work Area

Required: Provide input into cells shaded in yellow in this template. Input the required

mathematical formulas or functions with cell references to the Problem area or work area as

How much total cost does Funenstiens need to account for this month?

Costs added to WIP Inventory this period

Costs added to WIP Inventory this period

Costs added to WIP Inventory this period

Costs in beginning WIP Inventory

Costs in ending WIP Inventory

Cost per equivalent unit

Total costs to account for

De

cur Total equivalent units of work done this period

45

Cost per equivalent unit

Direct Materials Conversion Costs Total

nit for both DM and conversion costs. For the

Direct Materials Conversion Costs

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Part B: Assuming Wildhorse uses the FIFO method of process costing, complete Step 4 to determine its cost per equivalent unit for both DM and conversion costs. (Round cost per equivalent unit answers to 2 decimal places, e.g. 15.25.) DM Conversion Costs Total equivalent units of work done this period (FIFO) 29,000 26,000 STEP 4 Calculate Cost Per Equivalent Unit DM Conversion Cost select an item Correct answer $enter a dollar amount Correct answer $enter a dollar amount Correct answer select an item Correct answer enter a number of unitsCorrect answer enter a number of unitsCorrect answer select a closing name Correct answer $enter a dollar amount rounded to 2 decimal places $enter a dollar amount rounded to 2…arrow_forwardJay Please give me correct answer with explanationarrow_forward8arrow_forward

- 6 Compute the conversion cost per equivalent unit for the Production department using the weighted-average method. Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Production cost information for the Production department follows. Beginning work in process Direct materials. Conversion Costs added this period Direct materials Conversion $ 93,500 107,000 Units 18,000 90,000 108,000 30,000 $ 253,000 291,160 $ 200,500 $544,160 Direct Materials Percent Complete 100% 100% Conversion Percent Complete 40% 60%arrow_forwardNonearrow_forwardA 1 Original Data: 2 3 4 5 6 7 8 9 10 11 12 Part 1 13 14 15 16 Estimated MOH Estimated DLHS 28 29 B Selling price per unit Direct materials per unit Direct labour per unit Direct labour-hours per unit Estimated annual productio POR: 17 18 Sales 19 Less product costs 20 21 22 23 Total product costs 24 Product margin Direct materials Direct labour Manufacturing overhead 25 Units produced and sold: 26 Product margin per unit 27 $1,350,000 112,500 High Grade $212.50 $83.50 $30.00 1.00 75,000 High Grade D Professional $387.00 $212.00 $45.00 1.50 25,000 per DLHs Professional Totalarrow_forward

- Bowie Inc., a manufacturer of earnings, has accumulated the following cost information for products A and B: Production volume Engineering costs incurred Engineering costs per batch Batch size Total direct manufacturing labor hours Direct manufacturing labor hours/unit A $2.67 $4.00 $1.60 B $2.14 $3.00 500 $1.50 $2,000 $800 200 750 1.5 B 1,000 Assuming activity-based costing (ABC) is used, what is the engineering cost per unit for products A and B? $3,000 $1,500 500 1,400 Total $5,000 2,150arrow_forwardsaarrow_forward1- Chapter 1 Assignment i 1 of 15 € a 19 2 Total manufacturing overhead cost Manufacturing overhead per unit 4# Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Okay 3 4 Y A Saved 11. If 8,000 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per unit basis? (Round your "per unit" answer to 2 decimal places.) & LO 5 * Help 6 Save & Exit 7 Average Cost per Unit $7.00 $4.50 $ 1.40 $ 4.00 $4.00 $ 2.10 $ 1.10 $ 0.55 You Check my work 8 Submit 9 } 11 0 darrow_forward

- 5 Vista Company reports the following information. Direct materials Direct labor Variable overhead Fixed overhead Units produced Compute its product cost per unit under absorption costing. Multiple Choice $76.00. $152.00. $171.00. $ 44 per unit 64 per unit $ 44 per unit $ 380,000 per year 20,000 units < Prarrow_forwardPR 17-2A Cost of Production Report Obj. 2, 4 Hana Coffee Company roasts and packs coffee beans. The process begins by placing coffee beans into the Roasting Department. From the Roasting Department, coffee beans are then transferred to the Packing Department. The following is a partial work in process account of the Roasting Department at July 31: ACCOUNT Work in Process-Roasting Department Date July Item 1 Bal., 30,000 units, 10% completed 31 Direct materials, 155,000 units 31 Direct labor 31 Factory overhead 31 Goods transferred, 149,000 units 31 Bal.,? units, 45% completed Instructions Answer Check Figure: Conversion cost per equivalent unit, $0.76 Debit Credit 620,000 90,000 33,272 PICTIO ? ACCOUNT NO. Balance Debit Credit 121,800 741,800 831,800 865,072 1. Prepare a cost of production report, and identify the missing amounts for Work in Process -Roasting Department. ? 2. Assuming that the July 1 work in process inventory includes $119,400 of direct materials, determine the…arrow_forwardPeriod Ccb Home | bartl... of 15 ! 2 Required information [The following information applies to the questions displayed below.] my.post.edu... X 9- Unit 1 - C... Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Total fixed manufacturing cost Okay 3 9. If 8,000 units are produced, what is the total amount of fixed manufacturing cost incurred to support this level of production? 4 5 G what is the h... Init 1 - C... CO 6 7 Average Cost per Unit $ 7.00 $ 4.50 $ 1.40 $ 4.00 $ 4.00 $ 2.10 $ 1.10 $ 0.55 You 8 9 0 ct dearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education