ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Answer all parts of the econ problem

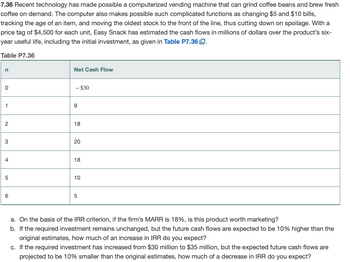

Transcribed Image Text:## 7.36 Overview

Recent technology has led to the development of a computerized vending machine capable of grinding coffee beans and brewing fresh coffee on demand. This machine offers advanced functions, including the ability to handle $5 and $10 bill changes, track item age, and prioritize older stock to minimize spoilage. With a unit price of $4,500, Easy Snack has projected cash flows (in millions of dollars) over the machine’s six-year lifespan, outlined below in Table P7.36.

### Table P7.36: Cash Flow Projections

| n | Net Cash Flow |

|----|----------------|

| 0 | −$30 |

| 1 | 9 |

| 2 | 18 |

| 3 | 20 |

| 4 | 18 |

| 5 | 10 |

| 6 | 5 |

### Analysis Questions

a. Based on the IRR criterion, if the firm’s Minimum Attractive Rate of Return (MARR) is 18%, should the product be marketed?

b. If the required investment remains unchanged, but future cash flows increase by 10% from original estimates, what is the expected increase in IRR?

c. If the required investment rises from $30 million to $35 million, but projected cash flows decrease by 10% from original estimates, what is the expected decrease in IRR?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A union leader states that: "The government should provide subsidies to unemployed workers throughout the duration of the COVID pandemic." Explain whether this a positive or a normative statement.arrow_forwardWhich of the following statements is normative? a. Printing too much money causes inflation b. Gas prices should be fair c. The employment rate should be lower d. People work harder if the wage is higherarrow_forwardState whether each entry below is positive or normative—explain your answer. Low-income people pay too much for housing. Imports from other countries are swamping US department storms. The number of US farms has decreased over the past 50 years. Toyota expands parts production in the US. The rural population in the US is declining.arrow_forward

- What is an intertemporal choice? What does it show on a budget constraint?arrow_forwardThe attainable production points on a production possibilities curve are?arrow_forwardEconomic models a) are precise replication of the real world b) answer virtually unlimited numbers of questions c) result in normative statments d) make assumptions to simplfy things in comparasionwith real worldarrow_forward

- Explain the difference between positive and normative economics Consider the following two statements. In each case, explain briefly your answer: a. A 5 percent fall in the unemployment rate will lead to a 2 percent increase in the inflation rate" b. "Pollution in developing countries is one of the biggest global environmental problems" Which of the these statements is an example of "positive" economics Which of these statements in an example of :normative "economicsarrow_forwardA) Define (in your own words, please do not use the book, or other online resources) and give a strong, unique, example for the following terms. Answers will be checked for originality. Economics: exports: imports: macroeconomics: microeconomics: model: scarcity:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education