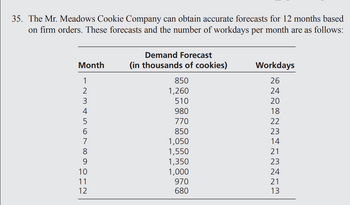

Replace the March demand forecast 510 by C.

During a 46-day period when there were 120 workers, the firm produced 1,700,000 cookies. Assume that there are 100 workers employed, and C cookies in inventory at the beginning of month 1 (January). Further assume that the inventory carrying cost cI = $0.10/cookie/month, employee hiring cost cH = $100/work, and cost of firing one worker cF = $200/worker. It is required that the inventory level at the end of month 12 (December) is 2C.

use the Constant workforce plan (level strategy): Find the minimum constant workforce needed to meet all monthly demands (i.e, back order not allowed). Computer the total cost including employee hiring or firing cost (which occurs only at the beginning of month 1), and inventory carrying cost.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- If a company has excess capacity, it is contemplating whether a special order should be accepted. The order will not impact regular sales. If the company accepts the special order, what will occur? O Both fixed and variable costs will increase. Net income will increase if the special sales price per unit exceeds the unit variable costs. There are no incremental revenues. Incremental costs will not be affected.arrow_forwardIf actual period demand varies from the forecast by more than 3MAD, this indicates: there is 3% chance that the forecast is wrong. there is a 98% chance that the forecast is wrong. there is a 97% chance that the forecast is wrong. there is a 3% chance that the forecast is correct Moving to the next question prevents changes to this answer:arrow_forwardStep 3: Assess the Evidence (Calculate the test statistic for the observed sample mean. Sketch the T-distribution and identify the position of the observed test statistic. Shade the area that represents the P-value. Use the test statistic to find the P-value.)arrow_forward

- A surfboard manufacturer lost $500,000 last year during a recession. Total revenue was $5,000,000 and total variable costs were 40% of sales. The production facility ran at 50% capacity. The production manager wants to know the following: a. What is the percent capacity required to break even? b. When the economy recovers this year, if the plant runs at 100% capacity what net income could the company realize? c. There is a possibility that sales could be so strong this year that the plant may be required to run at 120% capacity by offering a lot of overtime to its production workers. This would result in total variable costs rising by 35%. On a strictly financial basis, should the production manager plan to exceed capacity or should he advise top management to freeze production at 100% capacity? Justify your answer. Answer Solution- 9a. 58.3% 9b. $2,500,000 9c. $3,100,000arrow_forward5 Imagine that a company sells portable walkie-talkie radios to construction crews. The batteries for these radios last for an average of 55 hours. The purchasing manager for this company receives a brochure in the mail that advertises a new brand of batteries. This new brand of batteries is cheaper than the brand that the company currently uses. However, the purchasing manager is concerned that the cheaper batteries may have a shorter average battery life than the current brand. (Note: The number of hours that batteries last is called their battery life.) The pricing manager installs 40 randomly selected batteries of the cheaper brand in the company's walkie-talkie radios. He finds that the mean battery life for the sample is 52 hours, with a standard deviation of 10 hours. He wants to perform a statistical test at the 1% level of significance to determine whether the cheaper batteries have a shorter average battery life span than the average life span of the brand of batteries the…arrow_forwardCompute the NPV statistic for Project Y if the appropriate cost of capital is 12 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Project Y Time: 1 2 3 4 Cash flow: -$8,000 $3,350 $4,180 $1,520 $300arrow_forward

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,