FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

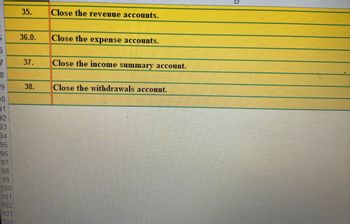

Transcribed Image Text:35.

Close the revenue accounts.

36.0.

37.

Close the expense accounts.

Close the income summary account.

Close the withdrawals account.

7

8

9

38.

90

91

92

93

94

95

96

197

98

199

100

101

102

103

104

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 7. Which of the following statements is NOT TRUE about charge cards? A. American Express is one examples of charge card provider B. Charge card has a pre-set spending limits C. Charge card must be paid in full every month D. Cash advance is not available through charge cardarrow_forwardPlease do not give image format I need help with what to put on the credit side of the accounts receivable. I was using a different question for reference and it came up as incorrect?arrow_forwardWe'd help with EB14arrow_forward

- please answer do not image.arrow_forwardbackground info: Green checkmark means that entry is correct, red is wrong. There is only supposed to be a total of 19 entries. look at 1 picture with the complete journal and adjust to fit the allowance method to go into the second table with green and red corrections. The first entry....you are removing the account so you have to remove the allowance and related receivable (2 parts) The second entry...you want to record the cash received, the removal of the allowance and related receivable (3 parts) The third entry...recording a credit sales (2 parts) The fourth entry...setting up receivable and the allowance (2 parts) The fifth entry...record collection of a previously recorded credit sale (2 parts) The sixth entry...record collection of a previously recorded credit sale (2 parts) The seventh entry...adjusting the allowance by reducing the allowance and reducing 5 customer receivable accounts (6 parts) 1. Finalize the journal entries shown on the Fan-Tastic Sports Gear Inc. panel…arrow_forwardWhen writing off a customer's account using the allowance method: A. Bad Debts Expense is increased with a debit B. The customer's account is decreased with a debit C. The Allowance for Bad Debts account is decreased with a debit D. Bad Debts Expense is increased with a creditarrow_forward

- ABC Company has the following T Account at the end of the year: Post to T-Acct (aka Ledger) Asset Cash Liability + C/ stock - Dividend + Acct Payable Commonstah Dividend Revenue 30,000 1,000 500 Common stah Dividend Service Revenue 30,000 480 Expense Rent expense 41000 500 15,000 4,000 5,000 15,000 480 Travel expense 1,000 Insurance expense 5,000arrow_forward8. ABC Cleaning Company paid off the $280 they owe to XYZ Corp, check #104. • Which accounts are affected? Is it an increase or decrease to the account? Where will the debit and credit be reported? Okay Youarrow_forward78.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education