FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

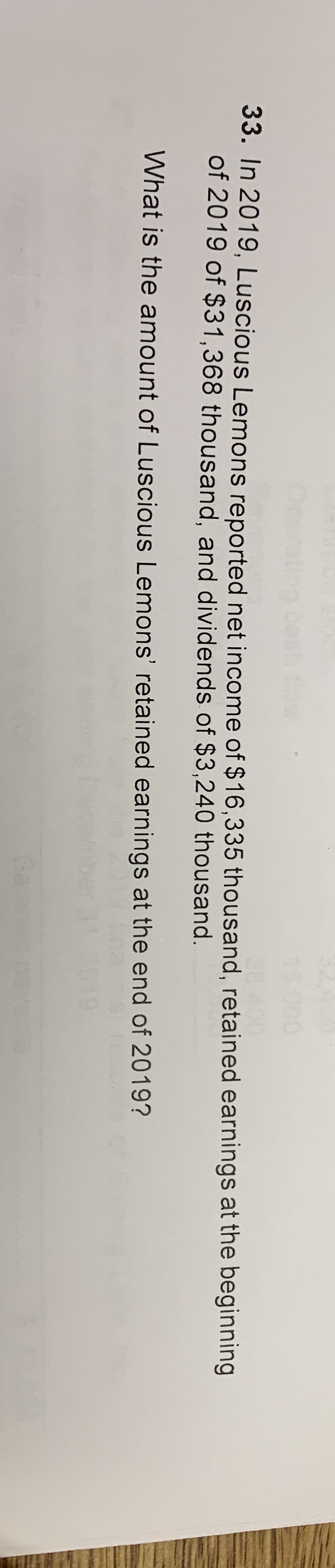

Transcribed Image Text:33. In 2019, Luscious Lemons reported net income of $16,335 thousand, retained earnings at the beginning

of 2019 of $31,368 thousand, and dividends of $3,240 thousand.

What is the amount of Luscious Lemons' retained earnings at the end of 2019?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- On 12/31/2020, Heaton Industries Inc. reported retained earnings of $575,000 on its balance sheet, and it reported that it had $172,500 of net income during the year. On its previous balance sheet, at 12/31/2019, the company had reported $555,000 of retained earnings. No shares were repurchased during 2020. How much in dividends did Heaton pay during 2020? Select the correct answer. a. $152,443 b. $152,328 c. $152,500 d. $152,385 e. $152,270arrow_forwardThe retained earnings of Volga plc at 1 March 2020 were £450,550. The retained earnings at 28 Febuary 2021 were £875,000. The pofit for the year is £581,450. What was the total dividend paid by Volga plc during the year?arrow_forwardThe 2019 financial statements for Growth Industries are presented below. INCOME STATEMENT, 2019 Sales $ 270,000 Costs 185,000 EBIT $ 85,000 Interest expense 17,000 Taxable income $ 68,000 Taxes (at 21%) 14,280 Net income $ 53,720 Dividends $ 21,488 Addition to retained earnings $ 32,232 BALANCE SHEET, YEAR-END, 2019 Assets Liabilities Current assets Current liabilities Cash $ 3,000 Accounts payable $ 10,000 Accounts receivable 8,000 Total current liabilities $ 10,000 Inventories 29,000 Long-term debt 170,000 Total current assets $ 40,000 Stockholders’ equity Net plant and equipment 210,000 Common stock plus additional paid-in capital 15,000 Retained earnings 55,000 Total assets $ 250,000 Total liabilities plus stockholders' equity $ 250,000 Sales and…arrow_forward

- Lowell reports retained earnings at the end of fiscal 2019 of $41115 and retained earnings at the end of fiscal 2018 of $35180. The company reported dividends of $5026. How much net income did the firm report in fiscal 2019? (Round your answer to zero decimal places and omit the "$" sign. Add a minus sign if needed. For example, if your answer is $1,000.2, type in "1000") 1arrow_forwardGrant Inc. reported retained earnings of $287,000 on its balance sheet on 12/31/2020, and it had $66,000 of net income during the year. The year before, on 12/31/2019, the company had reported $238,000 of retained earnings. No shares were issued or repurchased during 2020. How much dividends did the firm pay in 2020?arrow_forwardAt January 1, 2020, Crane Company reported retained earnings of $1,938,000. In 2020, Crane discovered that 2019 depreciation expense was understated by $387,600. In 2020, net income was $822,000 and dividends declared were $205,000. The tax rate is 20%. Prepare a 2020 retained earnings statement for Crane Company. CRANE COMPANY Retained Earnings Statementarrow_forward

- For the year ending December 31, 2022, Sheridan Inc. reports net income $147,000 and cash dividends $88,500. Determine the balance in retained earnings at December 31, assuming the balance in retained earnings on January 1, 2022, was $223,500. Balance in retained earnings %24arrow_forward1. During 2021, Target Corporation had: Revenue of $623,000 Cost of Goods Sold of $250,000 Operating expenses of $68,000 Interest expense of $4,000 Depreciation Expense of $13,000 During the year Target Corporation paid: 50% of net income in dividends 21% in corporate taxes a. Prepare a multi-step income statement on Sheet 1 of your spreadsheet. Include the dividend and additions to Retained Earnings below the income statement. b. Calculate Target's Operating Cash Flow beneath the Income Statement. 2. The following data refers to the 2021 year-end account balances for Target. However, the Retained Earnings balance is as of 12/31/2020. The accounts are listed in alphabetical order. $ Accounts Payable 25,000 Accounts Receivable 16,000 Accumulated Depreciation 175,000 Cash 44,000 Common Stock 120,000 Fixed Assets (gross) 390,000…arrow_forwardQuality Instruments had retained earnings of $320,000 at December 31, 2020. Net income for 2021 totaled $215,000, and dividends declared for 2021 were $95,000. How much retained earnings should Quality report at December 31, 2021? OA. $415,000 OB. $440,000 OC. $320,000 OD. $535,000arrow_forward

- Palmar Corporation has total assets and total liabilities of $82,000 and $40,000, respectively, at the end of 2020. Palmar's 2020 revenues were $120,000, and expenses were $106,000. Palmar also declared and paid dividends of $6,000 during the year. How much was Palmar's stockholders' equity at the beginning of 2020?arrow_forwardPlease Prepare The Income Statement !arrow_forwardDaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education