FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

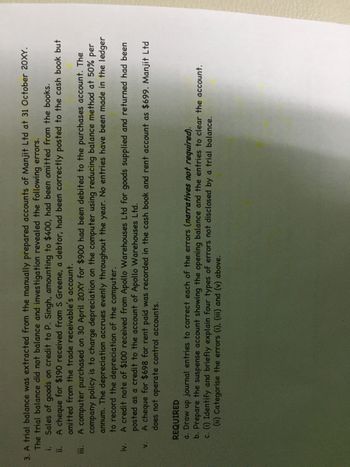

Transcribed Image Text:3. A trial balance was extracted from the manually prepared accounts of Manjit Ltd at 31 October 20XY.

The trial balance did not balance and investigation revealed the following errors.

i.

Sales of goods on credit to P. Singh, amounting to $400, had been omitted from the books.

ii.

A cheque for $190 received from S Greene, a debtor, had been correctly posted to the cash book but

omitted from the trade receivable's account.

A computer purchased on 30 April 20XY for $900 had been debited to the purchases account. The

company policy is to charge depreciation on the computer using reducing balance method at 50% per

annum. The depreciation accrues evenly throughout the year. No entries have been made in the ledger

to record the depreciation of the computer.

iv.

A credit note of $100 received from Apollo Warehouses Ltd for goods supplied and returned had been

posted as a credit to the account of Apollo Warehouses Ltd.

A cheque for $698 for rent paid was recorded in the cash book and rent account as $699. Manjit Ltd

does not operate control accounts.

V.

REQUIRED

a. Draw up journal entries to correct each of the errors (narratives not required).

b. Prepare the suspense account showing the opening balance and the entries to clear the account.

c. (i) Identify and briefly explain four types of errors not disclosed by a trial balance.

(ii) Categorise the errors (i), (iii) and (v) above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous month's balance. PreviousBalance AnnualPercentageRate (APR) MonthlyPeriodicRate(as a %) FinanceCharge(in $) Purchasesand CashAdvances PaymentsandCredits NewBalance(in $) $45.00 12% % $ $176.20 $55.00 $arrow_forwardAt what amount will accounts receivable for Anderson Company be reported on the balance sheet if the gross receivable balance is $52,000 and the allowance for doubtful accounts is estimated at 4% of gross receivables? Select one: A. $28,200 B. $49,920 C. $52,960 D. $47,000arrow_forwardsarrow_forward

- The following information is available for Market, Incorporated and Supply, Incorporated at December 31. Accounts Market, Incorporated Supply, Incorporated Accounts receivable $59,800 $77,800 Allowance for doubtful accounts 2,548 2,956 Sales revenue 616,960 907,100 Required What is the accounts receivable turnover for each of the companies? What is the average days to collect the receivables? Assuming both companies use the percent of receivables allowance method, what is the estimated percentage of uncollectible accounts for each company? What is the accounts receivable turnover for each of the companies? (Round your answers to 1 decimal place.) Company Accounts Receivable Turnover Market times Supply times What is the average days to collect the receivables? (Use 365 days in a year. Do not round intermediate calculations. Round your answers to the nearest whole number.)…arrow_forwardConsidering the financial statement information below for the The C’mon Cam! Co., how long is the cash cycle? Item Beginning EndingInventory $9,338 $11,550Accounts Receivable 5,670 6,947Accounts Payable 7,689 9,625 Net Sales $82,544Cost of Goods Sold $58,638 a. 28 daysb. 39 daysc. 65 daysd. 93 daysarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education