FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

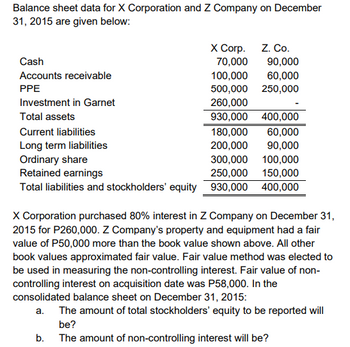

Transcribed Image Text:Balance sheet data for X Corporation and Z Company on December

31, 2015 are given below:

Cash

Accounts receivable

PPE

Investment in Garnet

Total assets

Current liabilities

Long term liabilities

Ordinary share

Retained earnings

Total liabilities and stockholders' equity

X Corp. Z. Co.

70,000

90,000

100,000

60,000

500,000 250,000

260,000

930,000 400,000

180,000 60,000

200,000 90,000

300,000 100,000

250,000

150,000

930,000 400,000

X Corporation purchased 80% interest in Z Company on December 31,

2015 for P260,000. Z Company's property and equipment had a fair

value of P50,000 more than the book value shown above. All other

book values approximated fair value. Fair value method was elected to

be used in measuring the non-controlling interest. Fair value of non-

controlling interest on acquisition date was P58,000. In the

consolidated balance sheet on December 31, 2015:

a. The amount of total stockholders' equity to be reported will

be?

b. The amount of non-controlling interest will be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Select information from BUI Balance Sheets as of December 31 Current Assets Net Plant and Equipment Total Assets Accounts Payable Notes Payable Accruals Long-Term Bonds Total Common Equity Total Liabilities & Equity Income Statement Earnings before interest and taxes Depreciation and Amortization Interest Taxes 40% Net Income Other Information WACC Number of shares outstanding Price per share What was 2014 EVA? $0 $197,600 $140,000 $57,600 2013 1,200,000 900,000 2,800,000 2,700,000 4,000,000 3,600,000 2014 200,000 216,000 280,000 108,000 120,000 252,000 1,040,000 864,000 2,360,000 2,160,000 4,000,000 3,600,000 2014 1,200,000.0 140,000.0 104,000.0 438,400.0 657,600.0 2014 18.00% 80,000 $22.13arrow_forwardGiven the following data for the King Company: How would common stock appear on a common size balance sheet? Curment labites $ 400 Long term debt 480 Common stack 700 Retained eanings Total iabities & sochdders equty $2,500 920 Enlarged View 20% 70% 28% 30%arrow_forwardFINANCIAL STATEMENT ANALYSIS DATA INFORMATION Statement of Financial Position of cf company 2015 2016 Cash and Cash Equivalents $ 990,000.00 $ 950,000.00 Short Term Marketable Securities $ 10,000.00 $ 15,000.00 Accounts Receivable $ 1,020,000.00 $ 1,550,000.00 Inventory $ 1,005,000.00 $ 1,360,000.00 Other Current Assets $ 870,000.00 $ 1,150,000.00 Total Current Assets $ 3,895,000.00 $ 5,025,000.00 Fixed Assets $ 14,006,000.00 $ 17,605,000.00 Accumulated Depreciation $ -1,280,000.00 $ -1,700,000.00 Net Fixed Assets $ 12,726,000.00 $ 15,905,000.00 Longterm Investments $ 360,000.00 $ 320,000.00 Investments in Other Companies $ 65,000.00 $ - Intangibles and Other Assets $ 100,000.00 $ 110,000.00 Total Non Current Assets $…arrow_forward

- prepare cash flow statementarrow_forwardPrepare the Cash Flow Statement for the year ended 31 December 2022 using info below The information given below was extracted from the accounting records of Excellence Limited Information from the Statement of Financial Position as at 2022 R 2021 R Ordinary share capital 750 000 580 000 Retained earnings 145 000 60 000 Property, plant and equipment (see note) 475 000 410 000 Investments 248 000 220 000 12.5% Debentures 125 000 120 000 Inventory 320 000 260 000 Trade debtors 57 000 67 500 Bank ? Prepaid expenses 15 500 2 500 Trade creditors 60 000 85 000 Bank overdraft 50 000 South African Revenue Services 25 000 40 000 Extract from the Statement of Comprehensive Income for the year ended 31 December 2022 Profit before interest and tax 342 000 Depreciation on equipment 25 000 Dividends received on investment 30 000 Interest on debentures 22 500…arrow_forwardCan you please help me prepare the Cash Flow Statement of Harmony Limited for the year ended 31 December 2020.arrow_forward

- Sunland Co. reports the following information: Net cash provided by operating activities Average current liabilities Average long-term liabilities Dividends paid Capital expenditures Purchase of treasury stock Payments of debt Sunland's free cash flow is $192000. $292000. $62000. O $16000. $422000 314000 214000 130000 230000 23000 72000arrow_forwardSW Company provides the Equity & Liability information below for analysis. SW Company had net income of $365,700 in 2023 and $335,800 in 2022 Equity and Liabilities share capital-connen (137, 700 shares issued) Retained earnings (ote 1) Accrued liabilities sotes payable (current) Accounts payable Total egrity and liabilities Return on equity Note 1 Cash dividends were paid at the rate of $1 per share in 2022 and 52 per shore in 2023 Required: 1. Calculate the return on common there equity for 2022 and 2023. (Assurne total equity was $1,454,000 at December 31, 2021) (Round your answers to 1 decimal piace) 2022 23.4 $1,417,500 $1,417,500 417,700 10,300 22,700 59,500 2023 225 111,300 6,500 65,500 179,000 $1,937,700 $1,979,200 2. Calculate the book value per shares for 2022 and 2023 (Round your answers to 2 decimal places) 2022 XX S1254 S 13.31arrow_forwardSTATEMENT OF CASH FLOW EXAMPLE Kerby Company has prepared the following Balance Sheets for 2023 and 2022. Cash 12/31/23 $ 56 12/31/22 $ 40 Accounts receivable 41 42 Fixed assets 579 465 Accumulated depreciation (170) (140) $506 $407 Accounts payable Mortgage payable Preferred stock $ 74 $ 60 20 181 Additional Paid-In Capital - preferred 70 Common stock Retained earnings 100 61 ២៩៩៩88 100 100 $506 $407 1. On 8/1/23, Kerby sold a fixed asset with a cost of $91 and book value of $66 for $67. 2. Retained Earnings was adjusted by dividends and net income only. 3. Net Income in 2023 was $80. a. Net Cash Provided by Operations is $ b. Net Cash Used by Investments is $ c. Net Cash Provided by Financing is $arrow_forward

- Cash Accounts receivable (net) Other current assets Investments Property, plant, and equipment (net) Current liabilities Long-term debt Common stock, $10 par Retained earnings Blue Corporation Balance Sheets December 31 Net income 2025 $31,000 $21,000 51,000 95,000 60,000 500,000 $86,000 150,000 370,000 $737,000 $612,000 $81,000 325,000 176,000 $737,000 Blue Corporation Income Statements For the Years Ended December 31 Sales revenue Less: Sales returns and allowances Net sales Cost of goods sold Gross profit Operating expenses (including income taxes) 2024 46,000 100.000 2025 75,000 90,000 315,000 $745,000 41,000 704,000 430,000 2023 $19,000 49,000 126,000 114,000 $612,000 $545,000 69,000 2024 50,000 358,000 $545,000 $71,000 55,000 305,000 $605,000 31,000 574,000 355,000 219,000 151,000 274,000 181,000 $93,000 $68,000arrow_forwardConsider the following partial income statements and balance sheets for Lillard Corp. For the year ended December 31, Net income Less income attributable to noncontrolling 5,700 interests Net income attributable to Lillard Corp. 100,400 107,300 Lillard Corp. shareholders' equity Noncontrolling interests Total equity What is Lillard's return on equity for 2024? 11.7% O 11.5% 12.3% 11.9% 2024 2023 108,000 113,000 11.1% 7,600 Dec. 31, 2024 Dec. 31, 2023 861,000 888,000 32,400 30,600 893,400 918,600arrow_forwardComparative balance sheets for Hamilton Company are presented below. Hamilton Company Comparative Balance Sheet Decemebr 31 Assets 2017 2016 Cash 78000 12000 Accoutns Receivable 93000 76000 Inventory 180000 189000 Land 75000 100000 Equipemnt 250000 210000 Accu Dep - Equipment (66,000) (42,000) Total 610000 545000 Liability and Equity Accounts Payable 34000 47000 Bonds Payable 150000 200000 Common Stock ($1 Par ) 214000 164000 Retained Earnings 212000 134000 Total 610000 545000 Additional information: 1. Net income for 2017 was $134000 2. Cash dividends of $65,000 were declared and paid. 3. Bonds payable amounting to $50,000 were redeemed for cash $50,000.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education