FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please make your answer is correct tutor. Out of my questions in Bartleby, 90% are wrong all the time. Which is resulting also to my low grades.

Don't get it if you don't know the answer. Please use TEXT. not snip or handwriting. Thank you

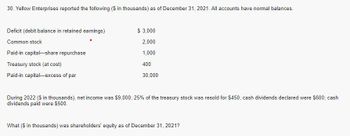

Transcribed Image Text:30. Yellow Enterprises reported the following ($ in thousands) as of December 31, 2021. All accounts have normal balances.

Deficit (debit balance in retained earnings)

Common stock

Paid-in capital-share repurchase

Treasury stock (at cost)

Paid-in capital-excess of par

$ 3,000

2,000

1,000

400

30,000

During 2022 ($ in thousands), net income was $9,000; 25% of the treasury stock was resold for $450; cash dividends declared were $600; cash

dividends paid were $500.

What (S in thousands) was shareholders' equity as of December 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardConsider a study to evaluate the effect on college student grades of dorm room Internet connections. In a large dorm, half the rooms are randomly wired for high-speed Internet connections (the treatment group), and final course grades are collected for all residents. Which of the following pose threats to internal validity? (i.) Midway through the year, all the male athletes move into a fraternity and drop out of the study. (Their final grades are not observed.) (ii.) Engineering students assigned to the control group put together a local area network so that they can share a private wireless Internet connection that they pay for jointly. (iii.) The art majors in the treatment group never learn how to access their Internet accounts. (iv.) The economics majors in the treatment group provide access to their Internet connection to those in the control group, for a fee. A. Only (i) due to attrition and (iii) due to failure to follow protocol. B. Only (ii) and (iv) due to partial…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Claudia is learning about differential analysis in Chapter 25 this week. She made a goal to try and go one chapter without getting mad. However, there is something that is driving her crazy: She can’t figure out what the purpose of the “differential” column is. She points out the “Lease or Sell” example in the book with total income calculated for each alternative. “Clearly, leasing would provide a higher income than selling, so why do we need that stupid third column?” Claudia asks aloud. “I bet it’s just those dumb old accountants that have nothing better to do than waste our time with extra work.” Please summarize what differential analysis is and explain to Claudia why you think that “third column” might be important. Alternatively, if you totally agree with Claudia on this issue, please support your position.arrow_forwardIf you find a source online, there are many red flags that might suggest the source is not reliable. Which of these is NOT one of those potential red flags. it is a .org site it is 10 years old the site has grammatical errors and poor formatting all of these are potential red flags the site receives corporate sponsorship it is produced by an expert, but gives no sourcesarrow_forwardRecapture of CCA occurs when there is a negative balance in the class at the end of the year. True or Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education