FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

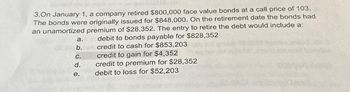

Transcribed Image Text:3.On January 1, a company retired $800,000 face value bonds at a call price of 103.

The bonds were originally issued for $848,000. On the retirement date the bonds had

an unamortized premium of $28,352. The entry to retire the debt would include a:

debit to bonds payable for $828,352

credit to cash for $853,203

credit to gain for $4,352

credit to premium for $28,352

debit to loss for $52,203

a.

36 b.

C.

d.

e.

kw

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ay 4arrow_forwardDon't upload image.arrow_forwardOn January 1, 2014, New Country issued $200,000 of ten-year 8% bonds at 98. These bonds were callable at 102 at any time after three years. Straight-line amortization was used. On January 1, 2018, a new bond issue was sold and the old bonds were called. What was the loss on bond retirement? $8,000 $2,000 $6,400 $4,400arrow_forward

- On July 1, 2018, Miniature Company has bonds with balances as shown below. Bonds Payable 65,000 Discount Payable on Bonds 3,250 If the company retires the bonds for $66,150, what will be gain or loss on the retirement?arrow_forwardDon't give solution in image format..arrow_forwardWhat is the correct choice? A $200,000 bond issue with a carrying value of $194,000 is called at 101 and retired. The entry to record the retirement of bonds is: a. Bonds Payable 200,000 Gain on Retirement of Bonds 6,000 Cash 194,000 b. Bonds Payable 200,000 Cash 200,000 c. Bonds Payable 200,000 Loss on Retirement of Bonds 8,000 Unamortised Bond Discount 6,000 Cash 202,000 d. Bonds Payable 194,000 Loss on Retirement of Bonds 8,000 Cash…arrow_forward

- Sheridan Corporation retires its $540000 face value bonds at 104 on January 1, following the payment of annual interest. The carrying value of the bonds at the redemption date is $560223. The entry to record the redemption will include a O debit of $1377 to Loss on Bond Redemption. O credit of $21627 to Premium on Bonds Payable. O debit of $21600 to Premium on Bonds Payable. O credit of $1377 to Loss on Bond Redemption.arrow_forwardA company previously issued $2,000,000, 10% bonds, receiving a $120,000 premium. On the current year's interest date, after the bond interest was paid and after 40% of the total premium had been amortized, the company calls the bonds at $1,960,000. Prepare the journal entry to record the retirement of these bonds on January 1 of the current year.arrow_forward2 pts Lahey Corporation retires its $800,000 face value bonds at 105 on January 1, following the payment of annual interest. The carrying value of the bonds at redemption date is $829,960. The entry to record the redemption will include a O credit of $10,040 to Loss on Bond Redemption O debit of $10,040 to Premium on Bonds Payable O credit of $10,040 to Premium on Bonds Payable O debit of $10,040 to Loss on Bond Redemption 79°F Rain to starrow_forward

- 7. Bower Company sold $100,000 of 20-year bonds for $95,000. The stated rate on the bonds was 7%, and interest is paid annually on December 31. What entry would be made on December 31 when the interest is paid? (Numbers are omitted.) a.Dr. Interest ExpenseCr. Bonds PayableCr. Cash b.Dr. Interest ExpenseCr. Cash c.Dr. Interest ExpenseCr. Discount on Bonds PayableCr. Cash d.Dr. Interest ExpenseDr. Discount on Bonds PayableCr. Casharrow_forwardWildhorse Corporation issued $410,000 of 10-year bonds at a discount. Prior to maturity, when the carrying value of the bonds was $379,250, the company redeemed the bonds at 94. Prepare the entry to record the redemption of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardABC Company retired bonds with a face amount of $1,000,000 paying $800,000 in cash. Prepare the journal entry to record the retirement of these bonds ABC Company retired bonds with a face amount of $1,000,000 paying $1,200,000 in cash Prepare the journal entry to record the retirement of these bonds.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education