Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

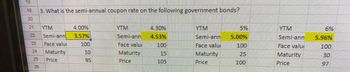

Transcribed Image Text:**Title: Calculating Semi-Annual Coupon Rates for Government Bonds**

**Introduction:**

This table helps illustrate the semi-annual coupon rates of various government bonds. It provides a comparison of semi-annual coupon rates alongside other crucial bond metrics such as Yield to Maturity (YTM), face value, maturity, and price.

**Bond Data:**

1. **Bond 1:**

- **YTM:** 4.00%

- **Semi-Annual Coupon Rate:** 3.57%

- **Face Value:** 100

- **Maturity:** 10 years

- **Price:** 95

2. **Bond 2:**

- **YTM:** 4.30%

- **Semi-Annual Coupon Rate:** 4.53%

- **Face Value:** 100

- **Maturity:** 15 years

- **Price:** 105

3. **Bond 3:**

- **YTM:** 5%

- **Semi-Annual Coupon Rate:** 5.00%

- **Face Value:** 100

- **Maturity:** 25 years

- **Price:** 100

4. **Bond 4:**

- **YTM:** 6%

- **Semi-Annual Coupon Rate:** 5.96%

- **Face Value:** 100

- **Maturity:** 30 years

- **Price:** 97

**Explanation:**

The data above includes a series of bonds with varying yields to maturity and durations. The semi-annual coupon rate is highlighted, showing the interest paid every six months. Longer maturities generally allow for assessing interest rate trends and their effects on bond pricing.

**Conclusion:**

Understanding these aspects is crucial for making informed investment decisions regarding government bonds. The semi-annual coupon rate, along with the YTM, provides insight into the bond's potential returns compared to its market price and duration.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- esc If 1 2 3 4 5 6 7 8 10 11 13 14 16 19 1. Find the Yield to Maturity (YTM) for the following government bonds Price Semi-ann Face valu Maturity YTM YTM Semi-ann Face valu Maturity Price YTM Semi-ann Face valu Maturity E 99.83 2.25% 100 3 2.31% ? 2.64% 2.38% 100 4 Q 2. Based on the following YTM for the various maturities, what price are these government bonds trading at? -$99.02 4.00% 3.57% 100 Type here to search Sheet1 f2 Price Semi-ann Face valu Maturity YTM a 3. What is the semi-annual coupon rate on the following government bonds? 2 YTM Semi-ann Face valu Maturity Price YTM Semi-ann Face valu Maturity W f3 # 98.45 2.50% 100 * 2.61% 3 2.17% 2% 100 2 4.30% 100 15 f4 Price Semi-ann Face valu Maturity YTM $ T YTM Semi-ann Face valu Maturity Price YTM Semi-ann Face valu Maturity 99.25 2.75% 100 10 2.84% f5 3% 5.50% 100 20 -$137.39 olo 5% 100 LO 5 TE Price Semi-ann Face valu Maturity YTM f6 YTM Semi-ann Face valu Maturity 97.59 3% 100 30 3.12% 17 6% 5.96% 100 30 hp &arrow_forwardWhat is the coupon rate of a ten-year, $10,000 bond with semiannual coupons and a price of $9,558.57, if it has a yield to maturity of 6.6%? OA. 7.188% OB. 5.99% OC. 4.792% OD. 8.386%arrow_forwardSunnyfax Publishing pays out all its earnings and has a share price of $37.00. In order to expand, Sunnyfax Publishing decides to cut its dividend from $3.00 to $2.00 per share and reinvest the retained funds. Once the funds are reinvested, they are expected to grow at a rate of 14%. If the reinvestment does not affect Sunnyfax's equity cost of capital, what is the expected share price as a consequence of this decision? O$45.87 $40.14 $68.81 $57.34arrow_forward

- 4. Compute the four-year spot rate using the information below about two 4-year annual coupon bonds: Face value Face value Price Bond I Bond II $800 5% $575 $1,000 6% $723arrow_forwardWhat is the coupon rate if a two-year $10,000 bond with semiannual coupons and a price $9636.67 if it has a yield to maturity of 6.9%? a. 5.909% b. 6.894% c. 4.924% d. 3.939%arrow_forwardWhich of the following bonds will have the larger price change (dollar value) for a 75- basis point change in yield? A. A $120 dollar bond with duration 2.25 B. A $70 dollar bond with duration 3.25 C. A $160 dollar bond with duration 1.75 D. A $200 dollar bond with duration 1.25 E. A $300 dollar bond with duration 0.75arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education