FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

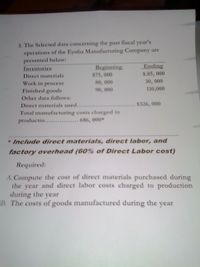

Transcribed Image Text:fiscal year's

3. The Selected data concerning the past

operations of the Eyoha Manufacturing Company are

presented below:

Inventories

Beginning

Ending

Direct materials

$75, 000

$.85, 000

80, 000

90, 000

30, 000

110,000

Work in process

Finished goods

Other data follows:

Direct materials used......

Total manufacturing costs charged to

productio..... 686, 000*

$326, 000

* Include direct materials, direct labor, and

factory overhead (60% of Direct Labor cost)

Required:

A. Compute the cost of direct materials purchased during

the year and direct labor costs charged to production

during the year

B. The costs of goods manufactured during the year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mason Company provided the following data for this year: Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Raw materials Work in process Finished goods Beginning $ 8,600 $ 5,800 $ 71,000 Ending $ 10,800 $ 20,000 $ 25,400 $ 653,000 $ 82,000 $ 133,000 $ 106,000 $ 45,000 $ 223,000 $ 201,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement.arrow_forwardSelected data concerning the past year’s operations of the Altek Manufacturing Company are as follows:Inventories ($) Beginning EndingRaw materials 71,000 81,000Work in Process 80,000 30,000Finished Goods 90,000 110,000Other Data:Direct Materials Used ---------------------------------------------- $ 326,000Total Manufacturing Costs Charged to productionduring the year (includes direct material, direct labour,and manufacturing overhead applied at arate of 60% of direct-labour cost) ----------------------------------$ 686,000Cost of Goods Available for Sale ----------------------------------$ 826,000Selling and Administration Expenses ----------------------------- $ 31,500 Required:a) What was the cost of raw materials purchased during the…arrow_forwardMunabhaiarrow_forward

- The following data from the just completed year are taken from the accounting records of Mason Company: $ 653,000 $ 88,000 $ 130,000 $ 100,000 $ 40,000 $ 225,000 $ 202,000 Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Raw materials Work in process Finished goods Beginning $ 8,900 $ 5,500 $ 73,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. Complete this question by entering your answers in the tabs below. Ending $ 10,600 $ 20,100 $ 25,800 Required 1 Required 2 Required 3 Direct materials: Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct…arrow_forwardPROVIDE Answer with calculationarrow_forwardCalculate the cost of goods sold for the year.arrow_forward

- ints) The following data have been taken from the accounting records of Larder Corporation for the just completed year. Sales. $2,100,000 $350,000 $385,000 $390,000 $225,000 $210,000 $210,000 $190,000 $135,000 $120,000 $195,000 $140,000 Purchases of raw materials Direct labor. Applied Manufacturing overhead Administrative expenses. Selling expenses. Raw materials inventory, beginning. Raw materials inventory, ending Work in process inventory, beginning. Work in process inventory, ending. Finished goods inventory, beginning.. Finished goods inventory, ending.. Required: a. Prepare a Schedule of Cost of Goods Manufactured in good form. b. Compute the Cost of Goods Sold. c. Using data from your answers above, prepare an Income Statement (using the traditional format).arrow_forwardThe following data (in thousands of dollars) have been taken from the accounting records of Karlana Corporation for the just completed year. Sales ........... Raw materials inventory, beginning........... Raw materials inventory, ending. $910 $80 $20 $100 $130 $200 $160 Selling expenses.......... $140 Work in process inventory, beginning....... $40 Work in process inventory, ending....... $10 Finished goods inventory, beginning......... $130 Finished goods inventory, ending.... $150 The cost of goods sold for the year (in thousands of dollars) was: Purchases of raw materials.... Direct labor........... Manufacturing overhead. Administrative expenses........ O $670 O $500 $540 O $650arrow_forwardHere are selected data for Ramalingagowda Company: Cost of goods manufactured $320,000 Work in process inventory, beginning 109,000 Work in process inventory, ending 104,000 Direct materials used 73,000 Manufacturing overhead is allocated at 50% of direct labor cost. What was the approximate amount of manufacturing overhead costs? Select one: a. $161,333 b. $80,667 c. $242,000 d. $78,000 e. $151,250arrow_forward

- Selected data concerning the past year’s operations of the Altek Manufacturing Company are as follows:Inventories ($) Beginning EndingRaw materials 71,000 81,000Work in Process 80,000 30,000Finished Goods 90,000 110,000Other Data:Direct Materials Used ---------------------------------------------- $ 326,000Total Manufacturing Costs Charged to productionduring the year (includes direct material, direct labour,and manufacturing overhead applied at arate of 60% of direct-labour cost) ----------------------------------$ 686,000Cost of Goods Available for Sale ----------------------------------$ 826,000Selling and Administration Expenses ----------------------------- $ 31,500 Required: What was the cost of goods sold during the year?arrow_forwardCornet Products, Inc., summarizes the following data for the first year of operations Sales (# of units sold: 100,000 units) ........................................ $7,000,000 Production costs (# of units produced: 102,250 units): Direct materials............................................................................. 1,100,000 Direct labor .................................................................................... 707,500 Manufacturing overhead: Variable............................................................................................. 1,260,000 Fixed.................................................................................................. 1,022,500 Operating expenses: Variable.............................................................................................. 560,000 Fixed................................................................................................... 640,000 Under variable costing, what is Cost…arrow_forwardSelected data from Design Corporation for 20X6 is as follows: Inventories Materials Work in process Finished goods Beginning $34,000 135,000 110,000 Costs incurred during 20x6 are as follows: Direct materials purchased Manufacturing overhead Direct manufacturing wages Cost of goods sold is Select one: O a. $252,000 O b. $259,000 O c. $244,000 O d. $236,000 Ending $40,000 150,000 102,000 $41,000 $80,000 180% of manufacturing overheadarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education