A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

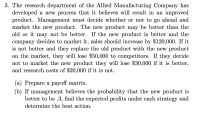

Transcribed Image Text:3. The research department of the Allied Manufacturing Company has

developed a new process that it believes will result in an improved

product. Management must decide whether or not to go ahead and

market the new product. The new product may be better than the

old or it may not be better. If the new product is better and the

company decides to market it, sales should increase by $120,000. If it

is not better and they replace the old product with the new product

on the market, they will lose $50,000 to competitors. If they decide

not to market the new product they will lose $30,000 if it is better,

and research costs of $20,000 if it is not.

(a) Prepare a payoff matrix.

(b) If management believes the probability that the new product is

better to be .3, find the expected profits under each strategy and

determine the best action.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, probability and related others by exploring similar questions and additional content below.Similar questions

- A grocery store is reevaluating the retail price of their oranges. They have a contract where they can purchase oranges for $0.52 per pound. However, this includes high quality oranges (about 40% of the time), low quality oranges (55%), and occasionally rotten fruit (5%). Suppose they sell 80% of all high quality oranges at $1.99 per pound, 65% of all low quality oranges at $1.49 per pound (they offer a sale), and they cannot sell any of the rotten fruit. What is the store's expected profit from a random shipment of 500 pounds of oranges? We do not consider personnel and other overhead costs, only the wholesale cost of the oranges. (Give your answer as a number, no dollar sign included.)arrow_forwardA real estate company, Peterson & Johnson, discusses five potential development projects.The following table shows the estimated long-term earnings (net present value) that each project would generate and the investment required to undertake it, in millions of dollars.Company owners Dave Peterson and Ron Johnson raised $20 million in investment capital for these projects. They want to choose the mix of projects that maximizesthe total estimated long-term profit (net present value) without investing more than $20 million. a) Formulate a PEB model for this problem.arrow_forwardTwo employees (Molly and Jim) must conduct a data analysis project on the success of a firm’s marketing efforts and then write a report of their findings for consideration by the firm’s board. If the first employee, Molly, worked completely alone, she could finish the data analysis component of the project with 30 hours of work and could write the report with an additional 10 hours of work. If Jim worked alone, he would take 48 hours of work to conduct the data analysis and then 12 hours to write the report. Assume that both employees need to contribute to the project, that there would be no benefits to having two people work on the same part of the project (data analysis and writing), and that working on the two parts are independent (i.e. there is no benefit to working on both parts). Which employee has the comparative advantage in conducting the data analysis? Explainarrow_forward

- Cecille Paper Company uses softwood and hardwood pulp as basic materials for producing converter-grade paper. Hardwood is 80% pulp fiber and 20% pulp binder, while softwood is 50% pulp fiber and 50% pulp binder. The cost per pound for hardwood and softwood is $.50 and $.40, respectively. The company s quality control expert specifies that in order for the product to meet quality standards, each batch must contain at least 12,000 pounds of pulp fiber and at least 6,000 pounds of pulp binder. Because of equipment limitations, the size of a batch cannot exceed 24,000 pounds. The Production Department recently received a new standard from the Cost Department, allowing $8,200 per batch. The production manager feels that this amount is too low, because such costs have never been less than $8,400. Required: Using the graphic method, determine the hardwood and softwood mix necessary to minimize the cost per batch.arrow_forwardThe Vintage Restaurant, on Captiva Island near Fort Myers, Florida, is owned and operated by Karen Payne. The restaurant just completed its third year of operation. Since opening her restaurant, Karen has sought to establish a reputation for the Vintage as a high-quality dining establishment that specializes in fresh seafood. Through the efforts of Karen and her staff, her restaurant has become one of the best and fastest growing restaurants on the island. To better plan for future growth of the restaurant, Karen needs to develop a system that will enable her to forecast food and beverage sales by month for up to one year in advance. Table 17.25 shows the value of food and beverage sales ($1000s) for the first three years of operation. Dependent variable: What is the variable: ___________________________________________ How it is measured, i.e. what units or categories are used (e.g., revenue measured in “dollars”; height measured as “short, average, tall”)…arrow_forward1.You are choosing between two texting plans. Plan A has a monthly fee of $15 with a charge of $0.08 per text. Plan B has a monthly fee of $3 with a charge of $0.12 per text. How many text messages in a month make plan A the better deal. 2. You invested $8000 in two funds paying 2% and 5% investment exceeded the interest from the 5% investment exceeded the interest from the 2% investment by $85. How much money was invested at the rate 2%?arrow_forward

- Store A and Store B compete for the business of the same customer base. Store A has 55% of the business and Store B has 45 %. Both companies intend to expand to increasse their market share. If both expand, or neither expand, they expect theri market share to remain the same. If Store A expands and Store B does not, the Store A"A share increases to 65%. If Store B expands and Store A doesnt, then Store A's share drops to 50%. Determine which strategy, to expand or not, each company should take.arrow_forwardXYZ Manufaturing company has hired a new VP (D.A.King) for managing capacity investment decisions. Mr. King reviews the situation after he comes on board and decides that he can invest in Batch manufacturing, Custom manufacturing or Group technology. Mr. King will not be able to forecast demand accurately till after the technology choices are made. Demand will be classified into four scenarios: poor, fair, good and excellent. The table below indicates the payoffs for each combination of technology choice and demand scenario. POOR FAIR GOOD EXCELLENT PROBABILITY 0.1 0.4 0.3 0.2 Batch - $200,000 $1,000,000 $1,200,000 $1,300,000 Custom $100,000 $300,000 $700,000 $800,000 Group Technology - $1,000,000 -$500,000 $500,000 $2,000,000 1.What is the expected monetary value of choosing the Group Technology option? 2.What is the expected monetary value of choosing the Batchoption? 3What is the BEST decision based on…arrow_forwardIf Starbright Coffee Shop could get 1 more pound of coffee, which one should it be?What would be the effect on sales of getting 1 more pound of this coffee?• If the costs associated with increasing brewing capacity from 30 gallons to 40 gallonsper day come out to roughly $15 per day, would such a change be profitable?• If the shop spent $20 per day on advertising that would increase the relative demandfor Pomona to twice that of Coastal, should it be done?arrow_forward

- Elaine Benes is considering three possible ways to invest the $200,000 she has just inherited. Some of Elaine’s friends are considering financing a combined laundromat, video-game arcade, and pizzeria, where the young singles in the area can meet and play while doing their laundry. This venture is highly risky and could result in either a major loss or a substantial gain within a year. Elaine estimates that the chances of losing all the money (i.e. loss of $200,000) are 47%, while the chances of making a $200,000 profit are 53%. Elaine can invest in some new apartments that are being built in town. Within 1 year, this fairly conservative project will produce a profit of at least $10,000, but it might yield $20,000 or even $30,000. Elaine estimates the probabilities of these yields at 20%, 50%, and 30% respectively. Elaine can invest in some private securities that have a current yield of 5%. Construct (draw) a decision tree for Elaine to determine which investment will maximize her…arrow_forwardSuppose you are the marketing manager of a firm, and you plan to introduce a new product to the market. You have to estimate the first year net profit, which depends on several variables • Sales volume (in units) • Price per unit • Unit cost . Fixed costs Your net profit is net profit = sales volume x (price per unit-unit cost) - fixed cost The fixed cost is $120, 000, but other factors have some uncertainty. Based on your market research, there are equal chance that the market will be slow, ok, or hot. • Slow market the sales volume follows Poisson distribution with mean 50,000 units product, and the average price per unit is $11.00 ● Ok market the sales volume follows Poisson distribution with mean 75,000 units product, the average price per unit is $10.00 Hot market: the sales volume follows Poisson distribution with mean 100,000 units product, but the competition is severe so you expect the average price per unit is just $8.00 No matter what the market type is, your average unit…arrow_forwardFrom the data given compute the sales price for each product T and O. From the data given compute variable cost per unit for each product T and O. Letter Co. produces and sells two products, T and O. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 50,000 units of each product. Sales and costs for each product follow.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON