FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please do 3

Transcribed Image Text:### Investment Analysis and Sensitivity for Business Projects

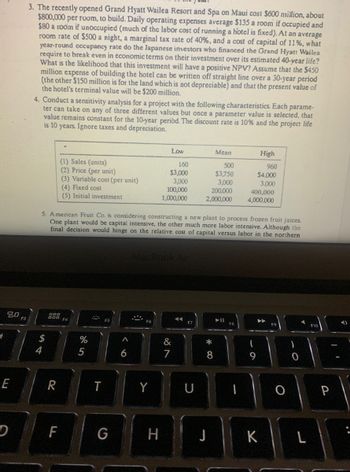

**3. Investment Analysis for Grand Hyatt Wailea Resort and Spa**

The Grand Hyatt Wailea Resort and Spa on Maui presents a significant investment case with a construction cost of $600 million, translating to $800,000 per room. The operational costs are $135 per occupied room and $80 if unoccupied. Given an average room rate of $500 per night, a 40% marginal tax rate, and an 11% cost of capital, this analysis aims to determine the necessary year-round occupancy rate for the investors to break even over a 40-year period in economic terms. The investment entails $450 million in depreciable building costs over 30 years, while the land costs $150 million. The hotel's present terminal value is $200 million. The analysis seeks to estimate the likelihood of a positive Net Present Value (NPV).

**4. Conducting a Sensitivity Analysis for Project Viability**

This section focuses on a project's sensitivity analysis with varying parameters. Each parameter reflects low, mean, and high values, consistent over a 10-year period at a 10% discount rate, ignoring taxes and depreciation.

- **Sales (units):**

- Low: 160

- Mean: 500

- High: 960

- **Price (per unit):**

- Low: $3,000

- Mean: $3,750

- High: $4,000

- **Variable cost (per unit):** Constant at $3,000

- **Fixed cost:**

- Low: 100,000

- Mean: 200,000

- High: 400,000

- **Initial investment:**

- Low: 1,000,000

- Mean: 2,000,000

- High: 4,000,000

**5. American Fruit Co.’s Plant Construction Decision**

American Fruit Co. is evaluating two potential plants for frozen fruit juice processing, differing in capital and labor intensity. The plant choice will depend on the relative costs of capital versus labor in the northern region.

This financial exploration aids in understanding investment thresholds, sensitivity to changes in critical inputs, and strategic decision-making in large capital projects.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education