Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

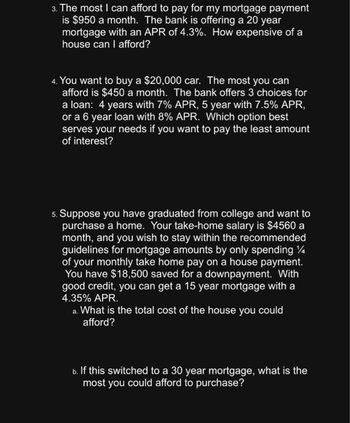

Transcribed Image Text:3. The most I can afford to pay for my mortgage payment

is $950 a month. The bank is offering a 20 year

mortgage with an APR of 4.3%. How expensive of a

house can I afford?

4. You want to buy a $20,000 car. The most you can

afford is $450 a month. The bank offers 3 choices for

a loan: 4 years with 7% APR, 5 year with 7.5% APR,

or a 6 year loan with 8% APR. Which option best

serves your needs if you want to pay the least amount

of interest?

5. Suppose you have graduated from college and want to

purchase a home. Your take-home salary is $4560 a

month, and you wish to stay within the recommended

guidelines for mortgage amounts by only spending %

of your monthly take home pay on a house payment.

You have $18,500 saved for a downpayment. With

good credit, you can get a 15 year mortgage with a

4.35% APR.

a. What is the total cost of the house you could

afford?

b. If this switched to a 30 year mortgage, what is the

most you could afford to purchase?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1. According to Zillow, the median home price in New Jersey last year was approximately $450,000. To qualify for the best mortgage rates, you will need to make a 20% down payment. How much will you need to have saved to buy a $450,000 house in New Jersey? 2. The current interest rate for a 30-year mortgage is 6.25%. Assuming you put 20% down, how much will you pay per month for a 30-year mortgage? 3. How much will you pay in interest over the life of the loan? 4. After 5 years, how much will you still owe on your mortgage?arrow_forwardYogesharrow_forwardPLEASEE THANKKK YOUUUUarrow_forward

- 3. A loan used for buying a home is called a mortgage. The Fortunato family is borrowing $430,000 to buy a home. They are taking out a 30-year mortgage at a rate of 3.55%. What is the monthly payment? 3. b. What is the total amount paid?arrow_forwardIf I purchase a home for $150,000. I do a fixed 30-year mortgage at 6%. I have to put down 10% or $15,000. What would be my annual payment? A. $6,456.72 B. $9,376.24 C. $9,712.72 D. $12,345.67arrow_forwardYogesharrow_forward

- Let’s assume that you plan to purchase a house which is selling for $350,000 today. You will make a monthly payment for the next 30 years, with an annual interest rate of 3%. What will be the amount of your monthly mortgage (i.e., home loan) payment? answer choices $1,890.37 $1,400.01 $1,475.61 $1,228.14arrow_forwardA homeowner is looking to buy a home in Marvin Gardens. The most he can afford to pay in total is $3,080 per month. Yearly property taxes will be about $12,000 (escrowed monthly) and insurance is $187 per month. There are no other costs. If mortgage rates are 5.48% for a 30-year fixed-rate mortgage, how large can his mortgage be? (Do not round intermediate calculations. Round your answer to the nearest whole number.)arrow_forwardA. what is the Monthly Payment ? what is the total interest paid ? B. time to pay off mortgage if extra $100 is added ? total interest saved ? I will rate thakn you!arrow_forward

- Answer the following question using a spreadsheet and the material in the appendix. You would like to buy a house. Assume that given your income, you can afford to pay $12,000 a year to a lender for the next 30 years. If the interest rate is 7% how much can you borrow today based on your ability to pay? What about if the interest rate is 3%? Maximum mortgage at 7%: $ Maximum mortgage at 3%: $arrow_forward17) You want to buy a house and will need to borrow $215,000. The interest rate on your loan is 5.41 percent compounded monthly and the loan is for 30 years. What are your monthly mortgage payments?arrow_forwardYou can afford a $1350 per month mortgage payment. You've found a 30 year loan at 8% interest. a) How big of a loan can you afford? $ 142,944 b) How much total money will you pay the loan company? $ 486,012. X c) How much of that money is interest? $ 343,058.82 Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education